Trade tensions, geopolitical events, and slowing economies caused by the COVID-19 pandemic have had little effect on merger and acquisition (M&A) activities in the chemicals industry this year. The industry experienced a slowdown in organic sales growth across most segments in all regions, yet many companies have taken this time to consider transactions for business transformation. This includes acquisitions to secure growth, generate cash resources, maintain market competitivity, build IP, or restructure their business. This year alone has witnessed divestment announcements such as Lonza’s Specialty Ingredients business and deals closing across the specialty chemicals sector, particularly in the ingredients value chain. Deals have ranged from EQT Partners acquisition of Schuelke and IFF’s acquisition of DuPont’s Nutrition and Biosciences to Cargill’s acquisition of Floratech. Deal multipliers continue to rise, showing no indication of a decline. The current situation has had a mixed impact on the global biocides market. Many markets for biocides such as household, industrial and institutional hygiene (HI&I), personal care, and agriculture are either positively or less impacted, whereas industrial markets such as paints and coatings, marine antifoulant coatings, plastics, and oilfield applications experienced the strongest decline in demand.

Trade tensions, geopolitical events, and slowing economies caused by the COVID-19 pandemic have had little effect on merger and acquisition (M&A) activities in the chemicals industry this year. The industry experienced a slowdown in organic sales growth across most segments in all regions, yet many companies have taken this time to consider transactions for business transformation. This includes acquisitions to secure growth, generate cash resources, maintain market competitivity, build IP, or restructure their business. This year alone has witnessed divestment announcements such as Lonza’s Specialty Ingredients business and deals closing across the specialty chemicals sector, particularly in the ingredients value chain. Deals have ranged from EQT Partners acquisition of Schuelke and IFF’s acquisition of DuPont’s Nutrition and Biosciences to Cargill’s acquisition of Floratech. Deal multipliers continue to rise, showing no indication of a decline. The current situation has had a mixed impact on the global biocides market. Many markets for biocides such as household, industrial and institutional hygiene (HI&I), personal care, and agriculture are either positively or less impacted, whereas industrial markets such as paints and coatings, marine antifoulant coatings, plastics, and oilfield applications experienced the strongest decline in demand.

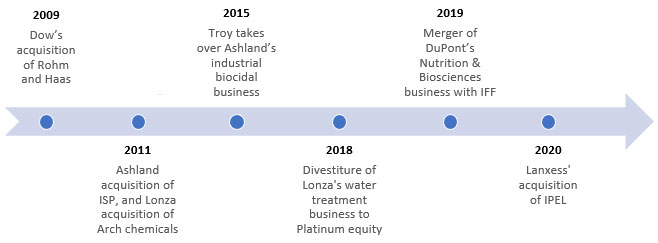

Over the last decade, the global biocides industry underwent several M&A activities, including some major ones shown below.

This month, Lonza is set to start the sale process of its specialty ingredients business (LSI) unit. With a reported EBITDA of CHF 300 million (US 323 million) in 2019, LSI is comprised of two business units: Microbial Control Solutions (MCS) and Specialty Chemicals Services (SCS). MCS serves end-use markets including paints and coatings, HI&I, personal care, and wood treatment. SCS mostly offers agricultural and pharmaceutical contract manufacturing, nutritional supplements, and composites.

Lonza decided to divest its LSI division to focus more on its Pharma, Biotech & Nutrition business. UBS investment bank is leading the sale and claims to have issued information packages on LSI to peers such as LANXESS and Clariant, plus private equity groups. LANXESS and Clariant have been working on strengthening their businesses, having divested Arlanxeo, chrome chemicals, and masterbatches. LANXESS CEO Matthias Zachert stated on an investor call that the firm’s M&A firepower is somewhere between 1 to 2 billion Euros, while a big 4 strategy consultancy claimed it has been approached by 25 private equity firms interested in this deal.

Lonza has a wide portfolio of active biocidal ingredients encompassing several key chemistries across most applications. A market leader in wood preservation, antidandruff agents, biocides for soft foulants in marine coatings, crop protection molluscicides, and HI&I markets, it maintains a strong presence in paints and coatings, metalworking fluids, and oil & gas application segments.

Changes in regulatory frameworks in key regions have been the main driver for the shift in the global biocides market. A rich portfolio of products makes larger players, such as Lonza, more resilient to regulatory changes. Lonza has distinct competitive advantages in a world of increasing requirements for biocides registration, labeling, and packaging.

As biocides is a regulation-dependent business, some of the key actives in LSI’s portfolio are currently under regulatory scrutiny. High exposure to mature markets, along with expiration of key patents such as ZnPT (zinc pyrithione), could pose potential risks for LSI’s business. Wood protection is gradually shifting toward new, alternative, less toxic, more environmentally friendly wood preservatives. This shift has implications on existing products from large players including Lonza, Viance, and Koppers. These products are banned in Europe and being phased out in North American residential applications. ZnPT is an effective and durable fungicide and algicide for many different applications. It is also the most common antidandruff agent worldwide. ZnPT remains under regulatory review for various applications and faces a high risk of a ban in Europe. A complete ban on ZnPT could have repercussions along the entire value chain, starting from raw material guar supply from Solvay to its key end use in antidandruff shampoos for the personal care majors such as P&G and Unilever. Nevertheless, Lonza’s extensive portfolio, as well as actives under development, mitigates against many regulatory concerns.

Kline believes LSI could take advantage of the robust growth expected from industrial applications in the longer term, leveraging preservation know-how, knowledge of formulated biocidal products, and its strong position in HI&I, especially with the increased demand for disinfection due to COVID-19.

Potential strategics interested in LSI

Reuters speculated that the LSI deal could be worth CHF 3.3 to 3.5 billion, which implies that private equity firms are most likely to secure this deal unless a partnership between a sponsor and strategic is struck—or unless LANXESS considers this portfolio of products a transformational acquisition.

UBS, the sell-side bank, suggested that Clariant, LANXESS, BASF, and Nouryon have synergies with this opportunity. It is of Kline’s opinion that, based on the recent multipliers of specialty chemicals and ingredients, deals may cause strategics to miss out on this opportunity). The LSI acquisition offers a route to a synergistic product/market/capability addition to their existing business portfolio industrial buyers purchase with the goal of ongoing or maintained ownership. Hence, the acquisition decision is based on the fit with their industrial logic and corporate renewal strategy.

Private equity owners are short- to medium-term business developers and transformers, enhancing firm’s value over a given timeframe in order to secure a financially sound exit. Bloomberg reported that several private equity partners active in the chemical industry, such as Bain Capital, Cinven, Advent International, Lonestar, Carlyle, EQT, Blackstone Group, KKR & Co., and Partners Group, could participate in the bidding process.

Given the centrality of the right investment decisions, pre-deal due diligence analyses are to be performed meticulously.

LSI business attractiveness and outlook

Overall, Kline sees Lonza’s HI&I, personal care, and industrial biocide business as a differentiator in the deal due to its value and potential. A handful of products in the LSI portfolio represents a large part of Lonza’s sales, despite its dense portfolio.

Unsurprisingly, hygiene and disinfection products have become a key driver of the biocidal industry during COVID-19. This has significantly increased the demand for biocides in HI&I and personal care applications, where end products include hand sanitizers, surface disinfectants, and antimicrobial soaps. Lonza is a key player in HI&I and other hygiene applications and will take advantage of the opportunities created in this area.

Further growth of LSI could be positively shaped with solution-driven innovations, open innovation programs, and licensing or acquisition of chemistries and technologies.

Kline has been reporting on specialty biocides market activities for more than 50 years. Our experienced international consultants closely follow the ever-evolving market landscape. We are well-positioned to provide comprehensive assessments in the areas of strategy and business development, manufacturing and supply chain, technology and innovation, customer relationships, and M&A support, among others. Our unrivaled market intelligence and competitive intelligence across the chemicals and materials industry was developed over 60 years and helped our customers better position their business growth.

[pardot-form id="15031" title="ACTION REQUIRED Energy COVID-19 Impact on Lube Markets INQUIRY"]