The overall electric two-wheeler parc may be minuscule, at 1% of the parc in Asia-Pacific, Europe, and the Americas, but it’s expected to grow exponentially and reach a share of 4% by 2026. The reason: COVID-19.

“The pandemic has caused people to focus not only on their health and safety but also the environment,” says Sushmita Dutta, Project Manager in our Energy sector. “This has played an important role in making people consciously choose products that are less harmful to the environment— and that includes vehicles. The trend started in the automotive industry, but now the two-wheeler market is following the same path.”

According to Dutta interest in electric two-wheelers is increasing in Asian and European countries after the European Union decided to go climate-neutral by 2050; this further intensified public interest in options that will mitigate the impact of human activities on the environment. In addition, improvement in technology, increasing OEM investments, and growing acceptance globally are driving the industry’s growth.

The top two markets

Growth in sales of electric two-wheelers has witnessed a strong escalation globally over the past few years — especially in China, the largest electric two-wheeler market with a population of 5.9 million units. Vietnam takes the next spot, with electric two-wheelers having 10% of total two-wheeler sales in the country.

India could become the second-largest electric two-wheeler market, surpassing Vietnam by 2026, given the country’s ambitious plans for the market. According to Minister for Road Transport & Highways, the government aims to achieve 80% penetration of electric two-wheelers in terms of sales by 2030; however, OEMs believe lower penetration levels would be achieved.

The short-term effects

Electric vehicles, unlike internal combustion vehicles, do not have engines that require lubrication. Per Kline’s research, engine oils (2T+4T) accounted for 95% of motorcycle oils demand (includes 2T, 4T, fork/suspension oil, gear oil and greases) in globally in 2021.

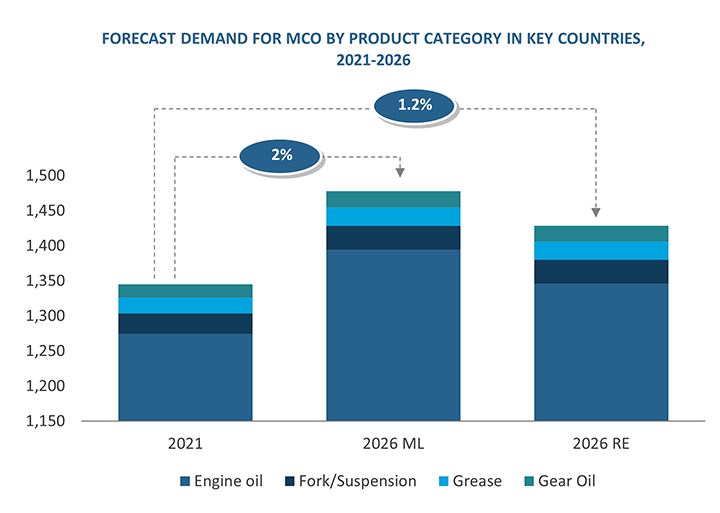

The market is now getting disrupted by the electrification trend, but there’s good news: Electric two-wheelers will not incur a significant negative impact on demand in the short term by 2026, as evident from the chart below (extracted from our upcoming Lubricants for Motorcycles, Scooters, and Mopeds: Global Market Analysis and Opportunities report).

Source: Kline’s Lubricants for Motorcycles, Scooters, and Mopeds: Global Market Analysis and Opportunities

Future MCO demand has been analyzed under two scenarios: most likely (ML) and rapid electrification (RE). The RE considers the latest commitments formally announced by key stakeholders such as governments, regulators, and OEMs related to increasing sales of electric two-wheelers will be met, whereas the ML scenario assumes that there will be some challenges related to the implementation of these commitments.

Electrification, however, will bring down the overall engine oil growth rate, and post-2030, demand in the 15 countries profiled in our study will begin to shrink. It should be noted that a part of this decline will be driven by the gradual extinction of two-stroke vehicles.

The impact of e-commerce, last-mile delivery, and bike-taxis

Mobility and business restrictions caused by the pandemic led apprehensive people to adopt e-commerce platforms for food, pharmaceuticals, clothing, and other fast-moving consumer products. Consequently, the number of two-wheelers used to carry out deliveries of purchases made online has increased, especially in Asian and South American countries. Another interesting commercial use of two-wheelers is bike-taxis/bike-rentals that can be booked instantly using a mobile application.

E-commerce and last-mile delivery firms find two-wheelers to be the best vehicle to perform deliveries at a low cost. Owners of two-wheeler also benefit: They can attain a primary or a secondary income and work for such companies at their convenience.

Two-wheelers used for commercial purposes traverse more distance over a fixed period than those used for personal purposes. This translates into a greater frequency of oil changes and top-ups.

Convergence of the two trends

The growing e-commerce industry and increasing electric vehicle sales are the two most significant trends in the two-wheeler market that have an opposing impact on lubricant usage. Since electric mobility is the future, it makes sense for e-commerce and last-mile delivery companies to have electric two-wheelers in their fleets.

In December 2020, Ola, a ride-hailing firm in India, announced that it signed a memorandum of understanding with the government of Tamil Nadu state to set up an electric scooter manufacturing facility. Even in Indonesia, major bike-taxi brands such as Grab and Gojek have planned to transform their fleets into EVs. In China, electric two-wheelers are already meeting the demand for delivery services, as they can provide good performance at maximum speed, plus they have improved endurance and power.

Further penetration of electric two-wheelers in the business segment can happen with viable battery-swapping options. This has caught the attention of not only vehicle manufacturers but also ride-hailing companies, along with the likes of Gogoro. These companies are likely to test their services by tie-ups with business segment users first. Battery swapping could be more successful in the case of business-use vehicles, as companies like Uber or Ola can have their own battery-swapping stations.

The future of the MCO market

The growing electric two-wheeler market will inevitably hamper MCO growth in the long term, but there is hope for expansion over the next five years. Opportunities lie with better-quality, high-performance lubricants, as their demand has increased driven by OEMs’ recommendations in view of increasing stringency in emission norms; there is also growing awareness of the benefits of using more fuel-efficient lubricants. In addition, e-commerce growth is opening opportunities for lubricants suppliers to partner with last-mile delivery firms.

For more information on the subject, be on the lookout for Lubricants for Motorcycles, Scooters, and Mopeds: Global Market Analysis and Opportunities, which will be published this week. The report will present a comprehensive analysis of the global two-wheeler lubricants market, along with an appraisal of government policies, market trends, and supply and demand drivers, plus an assessment of key market segments in terms of unique requirements, purchasing criteria, distribution networks, challenges in doing business, and opportunities.