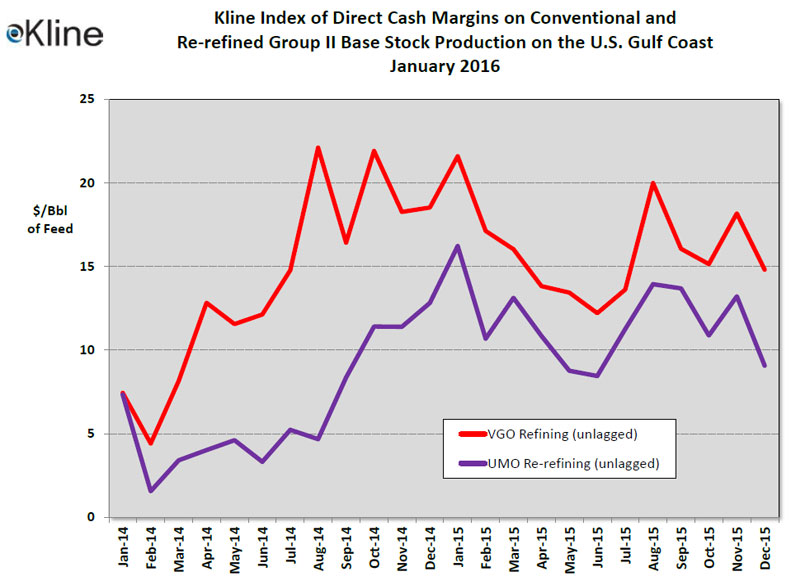

Kline’s Index of Base Stock Production and Re-refining Cash Margins Indicates a Downward Turn for Profitability

In January, Kline & Company, a worldwide consulting and research firm serving the needs of organizations in the lubricants and base stocks industry, introduced its monthly Base Stock Margin Index, a characterization of recent cash margin contributions in the U.S. base oil market over the past 24 months.

The Index estimates cash margin contributions associated with U.S. Group II base stock production. It simulates EBITDA before the deduction of corporate SG&A expenses for typical VGO-based virgin base stock plants and RFO-based re-refineries. A more detailed description of the Margin Index can be found in the January 2014 release.

“Since the last Margin Index update in November, crude oil prices have continued to fall, with Brent averaging $38/Bbl in December,” noted Ian Moncrieff, Vice President of Kline’s Energy Practice. “Crude prices have continued downwards in January, with Brent hitting a low of $27.40/Bbl on January 19. This seemingly inexorable decline in raw material prices has affected refined products and specialties markets, with the structural weakness in base oils markets being temporarily overshadowed by the near-term positives of improvements in instantaneous base oil margins as producers delay the inevitability of downwards adjustments in base oil pricing. Only when there is more stability in the crude oil market, with feedstocks prices remaining within a narrower price band for a sustainable period, will the underlying supply/demand and capacity utilization fundamentals begin once again to illuminate the structural profitability (or lack thereof) of the base oil market.”

Moncrieff added, “Instantaneous cash margins for both conventional base oil refiners and re-refiners increased in November, since downward adjustments in contract base oil prices did not happen until early December. In December, after the latest round of downward adjustments in contract base oil prices, profitability for re-refiners of both VGO and used oil naturally declined. Furthermore, conventional Group II producers were affected by a weak middle distillate market due to the unseasonably warm temperatures in December, which resulted in ULSD prices marginally below VGO, a rare occurrence. Considering that a conventional Group II plant has a diesel yield specificity of at least 30%, VGO refiners were significantly hindered by this temporary collapse in the diesel/VGO crack. Overall, Group II cash margins in 2015 improved nominally over 2014, though they are well below reinvestment levels. One potential factor which may account for this uptick in margins is that 2015 U.S. ‘lubricant’ consumption (as reported by EIA) YTD through October is up 9% versus the same period of 2014. This surprising statistic bears closer examination. Looking forward, there is still weakness at the low-viscosity end of the market, which will continue to depress its margin contribution to base oil plant profitability.”

On a final note, Moncrieff added, “We’d like to take this early opportunity to bring to the industry’s attention a major new initiative being launched by Kline next month, which is designed to provide confidential analysis and insights into the past and likely future profitability of each client’s own base oil plant(s), as well as identifying opportunities for enhancing their competitiveness with industry peers. This service, which we call the Base Oil Plant Health Check, is a joint venture between Kline and SBA Consulting, which will combine the industry-leading market, commercial, and technical insights of Kline’s Energy practice working in close association with Steve Ames.”

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff, Vice President (Ian.Moncrieff@klinegroup.com) at (973)-615-3680 in Kline’s Energy Consulting Practice.