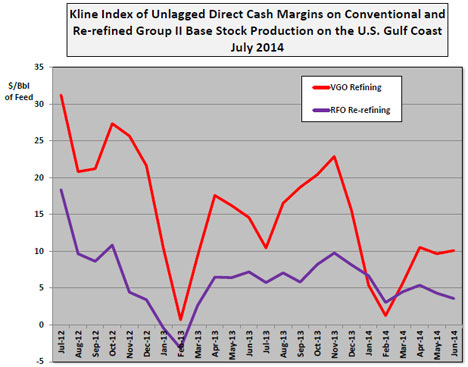

Kline’s July Index of Base Stock Production and Re-refining Cash Margins Shows Steady Returns for VGO Refiners and Decreasing Returns for Re-refiners

In January, Kline & Company, a worldwide consulting and research firm serving needs of organizations in the lubricants and base stocks industry, introduced its monthly Base Stock Margin Index, a characterization of recent cash margin contributions in the U.S. base oil market over the past 24 months.

The Index estimates cash margin contributions associated with U.S. Group II base stock production. It simulates EBITDA before the deduction of corporate SG&A expenses for typical VGO-based virgin base stock plants and RFO-based re-refineries. A more detailed description of the Margin Index can be found in the January release.

“As base oil prices held steady during June, a $2.00/Bbl drop in low sulfur VGO cracks served as the primary driver for the improved Group II margins for conventional refiners,” said Ian Moncrieff, who manages Kline’s price forecasting activities. “Conventional base oil plant cash margins have remained steady, in the $10.00/Bbl range, while re-refiners have seen slight decreases on their already tight margins during the second quarter of 2014. Though overall base oil fundamentals remain weak, due to the market’s expectation that more production from Chevron’s Pascagoula plant will find its way into domestic markets, current supply is tight as the industry experiences staggered summer maintenance turnarounds.”

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff, Vice President (Ian.Moncrieff@klinegroup.com) at (973)-615-3680 in Kline’s Energy Practice.