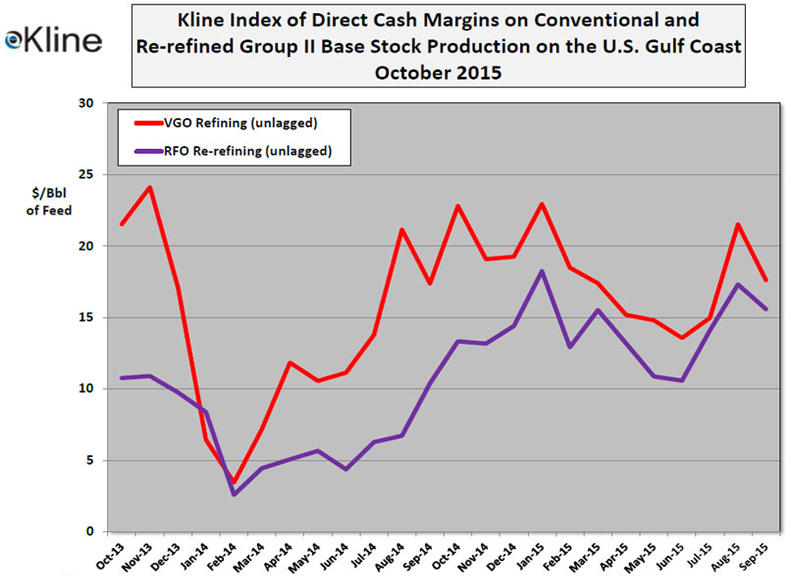

Kline’s October Index of Base Stock Production and Re-refining Cash Margins Shows Declines Due to Lower Postings

In January, Kline & Company, a worldwide consulting and research firm serving needs of organizations in the lubricants and base stocks industry, introduced its monthly Base Stock Margin Index, a characterization of recent cash margin contributions in the U.S. base oil market over the past 24 months.

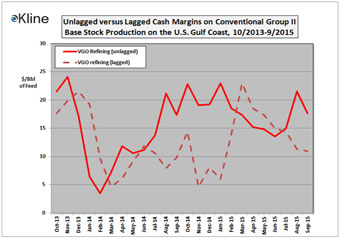

The Index estimates cash margin contributions associated with U.S. Group II base stock production. It simulates EBITDA before the deduction of corporate SG&A expenses for typical VGO-based virgin base stock plants and RFO-based re-refineries. A more detailed description of the Margin Index can be found in the January 2014 release.

“The decline in Group II 100N and 200N postings, which occurred at the beginning of August, was followed by a second round of downward adjustments during the second week of September,” noted Ian Moncrieff, Vice President of Kline’s Energy Practice. “The viscosity-weighted drop in U.S. Group II prices from August to September amounted to $3/Bbl. Combined with a modest uptick in VGO pricing, the net result was a drop in conventional Group II cash margins of some $4/Bbl. Turning to base oil domestic demand, the EIA reports that U.S. ‘lubricant’ consumption in July, 2015 was nearly 15% above the same month in 2014, continuing the growth trend discussed in last month’s release. Even though U.S. base oil consumption in 2015 appears to be growing, other major economies are not following the U.S. market’s lead, with static or declining indicators in the other major markets.”

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff, Vice President (Ian.Moncrieff@klinegroup.com) at (973)-615-3680 in Kline’s Energy Consulting Practice.

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff, Vice President (Ian.Moncrieff@klinegroup.com) at (973)-615-3680 in Kline’s Energy Consulting Practice.