Seed Treatment Showing Stable Signs of Growth for Italy’s Major Crops, According to Kline

PARSIPPANY, NJ – July 30, 2014 - The sales value of the seed treatment market in Italy based on corn and potatoes is estimated at EUR 4.0 million in 2013 finds a chapter in recently published Global Seed Treatment: Market Analysis and Opportunities by worldwide consulting and research firm Kline & Company. Potatoes have a much smaller area treated, but a significantly larger amount per hectare value, resulting in a larger sales value.

PARSIPPANY, NJ – July 30, 2014 - The sales value of the seed treatment market in Italy based on corn and potatoes is estimated at EUR 4.0 million in 2013 finds a chapter in recently published Global Seed Treatment: Market Analysis and Opportunities by worldwide consulting and research firm Kline & Company. Potatoes have a much smaller area treated, but a significantly larger amount per hectare value, resulting in a larger sales value.

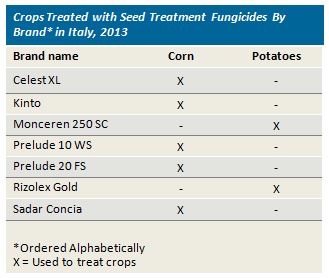

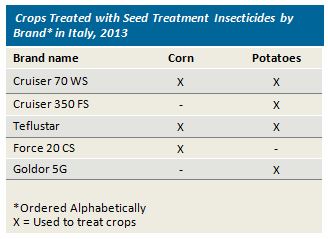

Corn and potatoes have the largest amount of hectares treated in Italy in 2013, with approximately 90% of the corn and about 80% planted potatoes receiving a seed treatment application. These seed treatments can be fungicide only, followed by an insecticide seed treatment application, or the two can be applied in a combination treatment.

The most used seed treatment fungicide on a hectare treated basis is Syngenta’s Celest XL, used mainly on corn, accounting for over 90% of the seed treatment fungicide market in Italy.

Cruiser is no longer the only insecticide seed treatment product used in Italy, although it remains the most used, especially in potatoes. Cruiser 70 WS is used to treat 16,900 hectares of potatoes in 2013.

Syngenta remains the leading supplier in Italy for seed treatment, followed by Bayer Crop Science. These two suppliers have nearly the entire market, or over 90% of total sales, with Makhteshim, BASF, Diachem, and Sumitomo also participating, but at a very minor level.

Kline’s chapter on Italy of the global seed treatment market research is a detailed analysis of the Italian seed treatment market in 2013, covering the following topics:

- Crop background and planted acres

- Crop end use by acres or volume

- Production and crop protection methods

- Key seed suppliers and their product capability with treatment

- Role of seed treatment as crop protection method

- Key diseases, insects, nematodes, and other reasons seeds are treated; regional differences within countries when appropriate

- Chemical treatment methods for target diseases and insects and non-chemical alternatives

- Product sales and market share for seed treatment products

- Active ingredient use for seed treatment products

- Sales by company for seed treatment products

- Seed treatment outlook and assumptions by crop background

About Kline & Company

Kline is a worldwide consulting and research firm dedicated to providing the kind of insight and knowledge that helps companies find a clear path to success. The firm has served the management consulting and market research needs of organizations in the chemicals, materials, energy, life sciences, and consumer products industries for over 50 years. For more information, visit www.KlineGroup.com.