The finished lubricant markets of Africa and the Middle East are traditionally overshadowed by other markets, more notable for their large size, rapid growth or high quality levels. However, the AME region boasts attractive country markets of its own, with high growth potential and quality lubricant output.

While much of the high quality production gets exported out of the region, there are drivers present that are also likely to improve the quality of products consumed locally. Estimated on the basis of the volume of lubricants blended the African and the Middle Eastern finished lubricant market stands at about 3.5 million tones. The degree of export activity is evidenced by the fact that about 0.5 million tones of lubricant production is exported by the UAE alone. The UAE is among the top five country markets in the region, ranking second behind Iran, which captures approximately 20% of the region’s market. Egypt, South Arabia and South Africa follow.

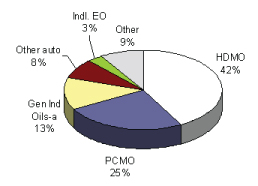

As revealed by recent study Lubricant basestocks in Africa and the Middle East 2010: Market Analysis and Opportunities, the region is predominantly an automotive market, with automotive products accounting for close to 75% of total lubricant demand. This situation is in sharp contrast to what we see in other markets around the world. Globally, industrial lubricants take the forefront, accounting for 45-50% of total demand. In comparison, they command a mere 25% of total demand in the AME region. The reason behind this is the relatively lower level of industrialization in the region. As a result, HDMO consumption for the transport and logistic sector, and PCMO consumption for passenger cars and light duty vehicles are the two largest product categories.

Finished lubricant demand in AME by product category (2009)

The region’s 3.5 million tone blending volume has created a basestock market of around 63 thousand barrels per day. For a breakdown of lubricant basestocks demand in the region by quality, see next week’s post on our blog.

Related Articles: