The sourcing of professional hair care products has undergone significant changes in recent years. Salons and independent stylists are expanding beyond traditional manufacturers and distributors to purchase through a wider range of retail outlets, including brick-and-mortar stores and e-commerce platforms. Notably, in the United States, the importance of e-commerce for salons surged from 19% in 2023 to 26% in 2024.

Understanding these evolving behaviors is essential for brands looking to meet their clients where they are, and how they buy.

Kline + Company’s latest multi-country survey with thousands of salons and independent stylists reveals some interesting findings into what’s shaping professional hair care sourcing today, some of which may surprise you.

- Independent Stylists Are the Majority in Some Markets

In countries such as the United Kingdom, Italy, and the United States, independent stylists now make up the majority of hairdressing professionals in the industry. As the significance of this group continues to grow, it is important to understand how their purchasing behavior differs from that of salons.

- Most Salons Source Products Through Manufacturers, Distributors, and Wholesalers

While salons in most European markets still source primarily through manufacturers, wholesalers, and distributors, in the United States and United Kingdom, salons are shifting toward retail stores and e-commerce platforms.

- Most Independent Stylists Source Products Through Retail and Online

Unlike salons, independent stylists are far more likely to source products from physical stores and online platforms. Only in Spain and Italy does traditional sourcing remain dominant.

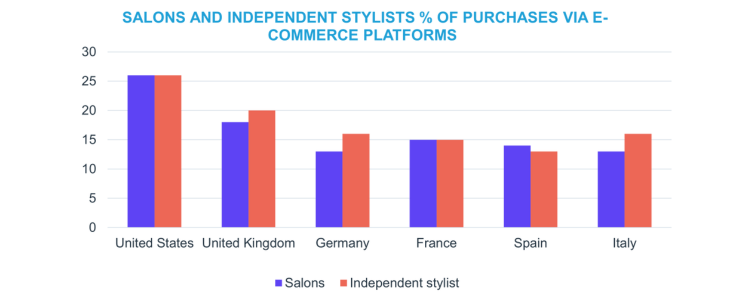

- E-commerce Continues to Grow, Especially in the United States

Salons and independent stylists in the United States lead the way in online purchases, with over a quarter of their purchases made through general and specialty websites. Europe still lags, with digital channels playing a smaller but growing role.

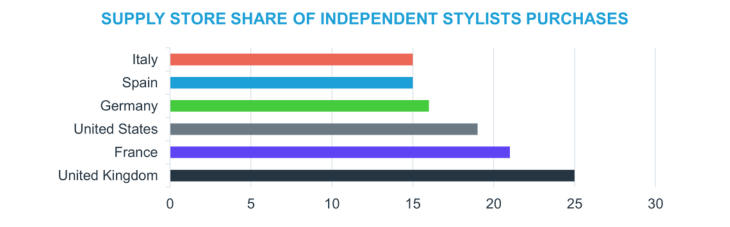

- Beauty Supply Stores Are Important for Independent Stylists

In the United Kingdom, beauty supply stores represent a quarter of the value of professional hair care product purchases. This is followed by the United States and France, where these stores account for around 20% of the channel’s value importance.

Notable stores such as Sally Beauty and Salon Services in the United Kingdom, Sally Beauty and CosmoProf in the United States, and Bleu Libellule and La Boutique du Coiffeur in France are particularly popular among independent stylists. These stores are favored for their wide selection of products, convenience, accessibility, competitive pricing, and value for money.

Among others, the survey also revealed strategies that salons and independent stylists use to attract and retain clients:

- Social media platforms, particularly Instagram and Facebook, are the top channel for visibility and client engagement.

- A strong online presence—including a website, an online booking system, and a social profile—helps increase discoverability and ease of booking.

- Loyalty programs offering discounts, gift cards, point redemption for free products, and support materials enhance customer retention and can drive repeat business.

Explore Kline + Company’s full Salon and Stylists Purchase Channels survey for deeper insights into where, what, and how salons and independent stylists purchase professional hair care products across key professional hair care markets—France, Germany, Italy, Spain, the United Kingdom, and the United States. In addition to this study, Kline + Company offers custom surveys with a wide range of end users, tailored to your brand’s specific needs.