After years of strong double-digit growth, the global medical dispensing skin care market is entering a phase of stabilization. According to Kline + Company’s recently published data on Medical Dispensing Skin Care Global Screening Assessment , the market recorded low single-digit growth of 4% in 2024, signaling a slowdown after years of impressive expansion. Some of the main factors behind this are economic instability, pricing pressures, consumers’ shift to online shopping preference, and more cautious spending behavior of consumers.

Regional Performance of the Medical Dispensing Skin Care Market

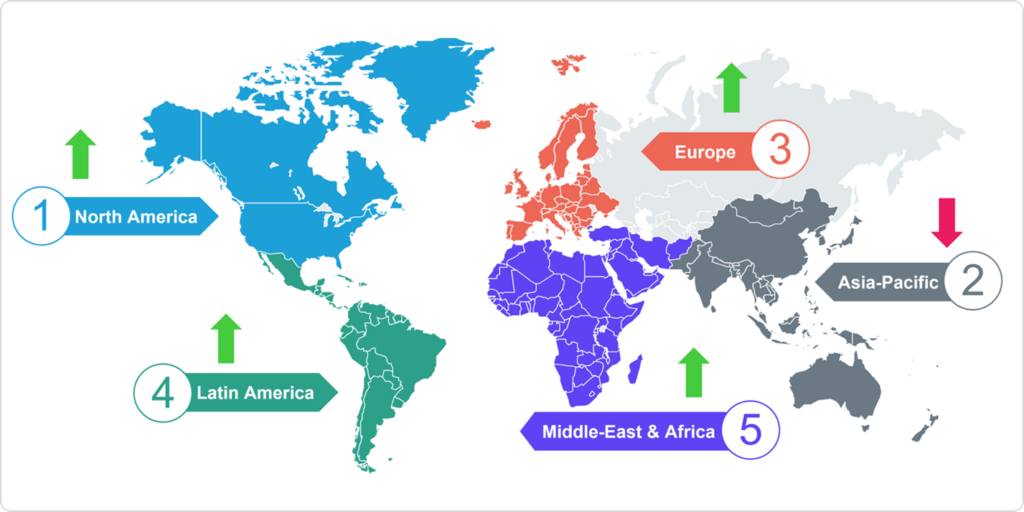

North America maintains its position as the largest market, driven by well-established distribution networks and a strong consumer base. Europe, on the other hand, has demonstrated the most robust growth, suggesting a rising appetite for innovative skin care solutions within the region. Asia-Pacific is the only region to register a decline, largely attributed to the slowdown in China—responsible for over 55% of its sales.

Data source: Kline+Company’s Medical Dispensing Skin Care Global Screening Assessment

New Entrants and Evolving Competitive Dynamics

An influx of new brands are entering the medical dispensing channel. Emerging players such as Pavise, Gigaderma, and Sensilis are positioning themselves to capture market share by differentiating themselves through innovative formulations, patient-centric solutions, and strategic partnerships with healthcare providers.

Established market leaders—SkinCeuticals, ZO Skin Health, Obagi, and Alastin—continue to dominate the professional skin care market through relentless innovation and strategic partnerships. These brands are expanding their reach by collaborating with device companies and venturing into new geographic territories. In 2024, SkinCeuticals entered the Japan market, while Obagi expanded its distribution in Southeast Asian markets.

Key New Product Launches

Diversification of Channels: Retail and Digital Strategies

Medical-dispensed skin care brands are expanding beyond traditional physician-exclusive channels, finding growth through alternative strategies. Alastin made headlines by entering the Amazon marketplace, while Colorescience has gained traction through their website and third-party e-tailers. SkinMedica and BABOR have also ramped up their digital marketing efforts by leveraging social media platforms, such as TikTok, and influencers.

Simultaneously, some brands are enhancing their traditional retail presence including, ISDIN’s launch at Sephora, BABOR’s expansion into Nordstrom, and Biologique Recherche’s launch at Bergdorf Goodman. Meanwhile, Bluemercury continues to shape the professional skin care market as a key specialty retailer.

Looking Ahead: Stability and Opportunity

As the market stabilizes, the focus for brands is shifting from rapid expansion to sustainable growth. The current phase offers a unique opportunity for companies to recalibrate their strategies, emphasizing innovation, sustainability, and customer-centric solutions. The brands that succeed will be those that can adapt to evolving consumer preferences, navigate complex regulatory landscapes, and leverage technological advancements.

For professional skin care brands and investment firms seeking in-depth insights into the dynamic medical-dispensing skin care market, a detailed analysis of the competitive landscape and emerging opportunities in 65 countries is available. To learn more, please refer to Kline + Company’s Medical Dispensing Skin Care Global Screening Assessment.