It isn’t just a typical year for the beauty devices market in China, which has wavered between single-digit to low double-digit growth over the past few years. There are several factors driving this incredible growth of approximately 71% in 2017, but, undeniably, the Foreo brand plays the strongest role.

Other factors playing a role in this booming market include an influx of low-priced silicone devices, strong sales of multi-functional devices, and personalized devices based on artificial intelligence.

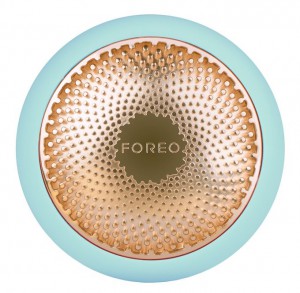

Relative newcomer Foreo has gone from being an unknown brand to the leading brand in the market with sales registering an incredible growth of over 300% to reach an estimated $85 million in 2017. This is in stark contrast to sales in the United States of $17 million. The reasons for growth are an expanding distribution network primarily through the direct channel, an increasing focus on marketing initiatives, and the launch of Luna Play Plus and Espada Acne Clearing Blue Light Pen. Price points also play a major role in the brand’s popularity. The brand is expected to enjoy another year of successive growth in 2018 driven by the launch of UFO (Your Future Obsession), a puck-shaped device that allows for better absorption of the ingredients in a sheet mask, all in 90 seconds.

On the other hand, former leading marketer NuSkin loses market share due to the poor performance of its Galvanic Facial Spa and Galvanic Body Spa devices in the absence of any major breakthrough innovations in the recent past and their expensive positioning in the price-competitive market. However, the introduction of the AgeLoc LumiSpa in late 2017 is a saving grace that manages to generate $12.5 million for the marketer in its first quarter of sales in 2017.

NuSkin AgeLoc LumiSpa

The Chinese at-home beauty devices market continues to be dominated by the cleansing and anti-aging categories, which collectively represent approximately the lion’s share of the market’s sales in 2017. However, the three key categories of hair regrowth, hair removal, and cleansing categories are driving the market’s growth.

For more insights into the at-home beauty devices market in Asia, please refer to our Beauty Devices: Global Market Analysis and Opportunities report to be published this summer. This report assesses the size and growth, key changes in distribution, the competitive landscape, and notable new launches and product trends in key markets, such as China, Europe, Japan, South Korea, and the United States. It also includes an online interactive database with breakdowns for 2013 through 2017 by market, company, brand, distribution channel, skin care concern, and technology, as well as a quick review of the key at-home beauty devices that pair with mobile apps.

Attending Cosmoprof in Las Vegas?

Don’t miss our exclusive presentation on the beauty brands and products that are winning in the digital space. Register here»