The Middle East accounts for approximately 5% of the global consumption of synthetic latex polymers, with a market value of about USD 1.3 billion in 2016. This region represents an interesting mix of diverse economies, displaying a combination of varying market characteristics, ranging from the advanced Turkish market, which closely follows European trends, to the highly price-sensitive Egyptian market.

Like in most regions, except Southeast Asia, paints and coatings and adhesives and sealants are the largest application sectors in the Middle East. However, the region exhibits some striking differences in the application mix. Compared to other geographies, the share of carpets is much higher in the Middle East, with this region housing the largest carpet manufacturing industry in the world. Contrary, the paper industry’s share as a consumer of latex emulsions is very small.

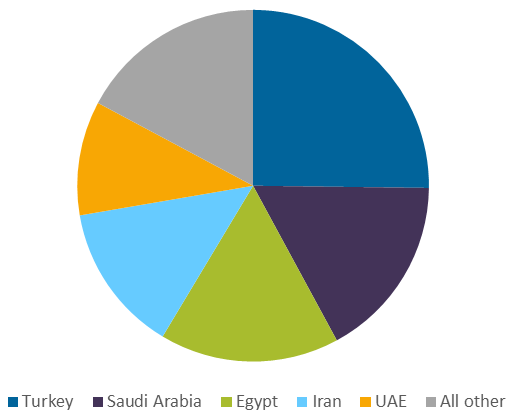

Turkey is the overall largest consumer of synthetic latex polymers due to its well-developed construction, paints and coatings, and adhesives and sealants industries, followed by Saudi Arabia and Egypt. However, each country market has a unique application split for the consumption of emulsion polymers. While Saudi Arabia has a very large paints and coatings market, Egypt has the highest consumption of latex polymers within the carpet industry, and construction is the largest end-use application in Iran.

Middle East Breakdown of Synthetic Latex Polymers by Volume Consumption, 2016

Similar to the developing markets of India and Brazil, styrene acrylics is the most consumed latex polymer in the Middle East. Turkey is the largest consumer of acrylic-based emulsion polymers, Iran is the largest consumer of PVAc emulsions, and Egypt is the largest consumer of styrene-butadiene latex driven by a demand from the carpet industry.

The supplier landscape is quite fragmented with many multinational companies, as well as several important local suppliers. The top two companies, Dow Chemical and Synthomer, are followed by the Turkish Organik Kimya. These three companies account for about 30% of the market. Other global suppliers present in the region are BASF, Wacker, and Trinseo. Iran based Simab Resins, Turkish company Argon, Egypt-based Eagle Chemicals, and Saudi Arabia-based Arabian Chemical Company are among the leading regional producers of synthetic latex polymers in the Middle East.

Despite the challenges posed by political instability in some of the countries, the region represents robust growth potential. Iran is expected to show the highest growth, triggered by increased investments into the economy after the lifting of sanctions in 2016, which makes the country’s market open for regional and multinational suppliers. Qatar will outperform the region’s average growth driven by heavy infrastructure investments associated with FIFA 2022 World Cup.

Turkey will also present strong growth, particularly the paints and coatings and adhesives and sealants sectors, followed by UAE and Israel. Overall, growth in the Middle East is marked by strong developments in public and industrial infrastructure. Relatively higher-specialty latex polymers, such as polyurethane emulsions, redispersible powders, and high solids-styrene butadiene, will exhibit higher growth compared to more conventional latex polymers.

In addition to the growth factors and trends, it is also important to understand the challenges within the market of each application in the different countries of the region. Kline offers a comprehensive study on more than 10 application industries of synthetic latex polymers in the 14 countries of the Middle East with a complete assessment of various polymer emulsion markets in our recently published Middle East report from the Synthetic Latex Polymers: Business Market Analysis and Opportunities series.