Changing industry regulations and continuous developments across end-use applications are the key factors affecting the USD 4.5 billion market for specialty biocides in China, Europe, India, and the United States, according to Kline’s recently published chapters of its Specialty Biocides: Regional Market Analysis study.

Due to their nature and the variety of applications they are used in, biocides are often a key component in chemical formulations. The fact that some chemistries are under scrutiny in many countries makes this sizeable and rather mature market an unexpectedly dynamic industry, where regional markets are characterized by sets of completely different trends.

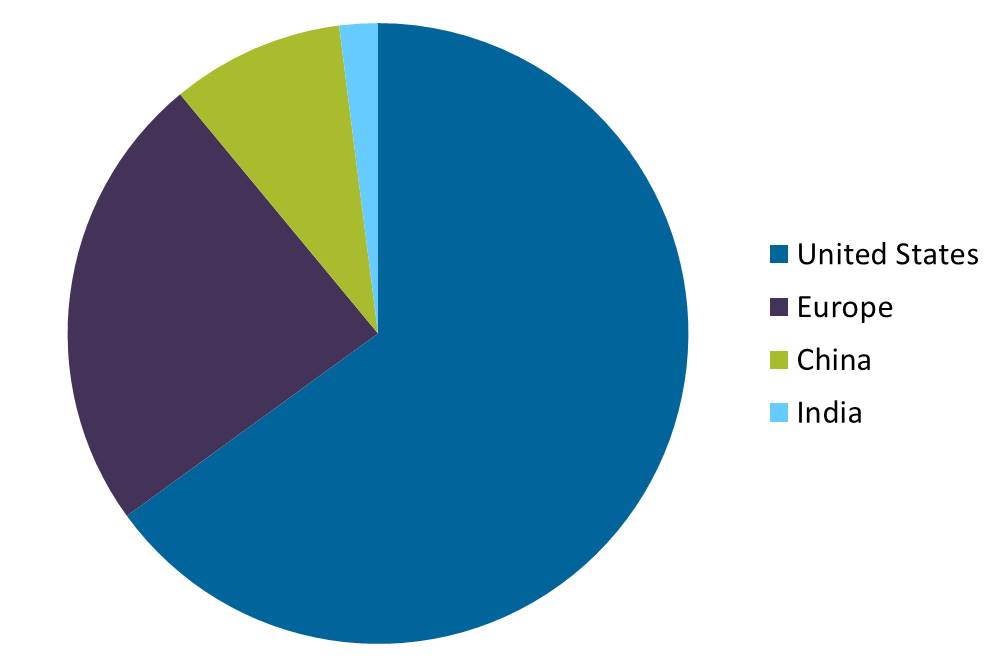

Consumption of Specialty Biocides by Country in Value Terms, 2016

Total: USD 4.5 Billion

United States

The United States remains the largest global market for specialty biocides with USD 2.9 billion in revenues, notably due to an unmatched market for wood preservation. The wide use of wood as a construction material in both the commercial and residential sectors makes wood preservation a key outlet for biocides. As a result, the key chemistries used in wood preservation, such as creosote or copper chrome arsenate (CCA), are the leading biocides in the U.S. market, larger than products like IBPC or quats, which are used in a wider application range. However, the large wood preservation segment is undergoing major changes because the use of some biocidal products falls under new regulations introduced by the Environmental Protection Agency (EPA). The regulations will adversely affect wood treatment with CCA for all residential uses. It is expected that in five years no wood treater or manufacturer will use CCA to treat wood in residential sectors. Due to the risks associated with occupational exposure, the wood preservation industry is gradually moving away from arsenic-containing preservatives towards new alternative wood preservatives, such as copper naphthenate, which are safer and environmentally friendly according to the EPA’s risk assessment.

Other applications are also susceptible to change due to concerns over health effects and environmental damage. In adhesive and sealant applications, formaldehyde-releasing biocides are slowly being replaced by other chemistries, such as isothiazolinones. Triazines, even if the maximum concentration in some applications has been limited, are keeping pace in the United States, notably due to their favorable price, but are increasingly dealing with competition from other chemistries. Oil and gas applications have also been on a roller-coaster lately, notably due to changing oil prices, but also because of the switch from some chemistries, such as acrolein, to more environmentally friendly options.

Europe

Europe, the second largest biocides market globally, has also been strongly affected by the regulatory pressures coming from the enforcement of the Biocidal Product Regulations (BPR). High registration costs have stimulated an intense industry consolidation, and the complete exit from the EU market of some suppliers, including BWA Water Treatment. Moreover, some chemistries were not registered at all, as their market potential was considered to be not large enough to support the costs. Even products properly registered as a biocidal substance face tight regulations due to the allowed levels of certain actives. The introduction of concentration level of MIT at 1,500 ppm resulted in a considerable drop in the product consumption since 2016. The ongoing regulations create uncertain expectations in suppliers regarding the market’s future. As a result, suppliers tend to focus on the actives that are less likely to be restricted, such as IPBC among the fungicides and glutaraldehyde in oil and gas uses, or cut down products, such as triazines, as they are more likely to fall under new restrictions. Nevertheless, with biocides being essential in a number of applications, they still represent a growing market potential in a number of end-use applications, notably in hygiene, driven by the increasing awareness of health and safety and non-cyclical nature.

China

The consumption of specialty biocides in China is influenced by a large use of commodities, notably sodium hypochlorite, which hindered growth of specialties’ consumption in some applications, such as aquaculture. With China being the largest freshwater fish producer globally, this application is an important market segment for the country’s economy. Historically, in China, industrial preservation applications used to represent a larger growth potential compared to Western markets. However, changes in macroeconomics, in applications such as paper and marine antifoulants, result in rather stagnant consumption of biocides in the region. While the regulatory constraints are less stringent in China compared to Europe and the United States, new practices are being introduced in the region, opening up new opportunities for “greener” chemistries, such as BIT or peracetic acid, which are expected to show a growth rate way over the market average.

India

Unlike China, growth in India is not showing signs of weakening. India shows a double-digit growth rate due to the rapid extension of strategic applications, such as paints and coatings, leather, antifoulant marine coatings, and metalworking fluids, approaching USD 93 million in revenues.

Industrial preservation applications are leading the market demand by volume and value. Paints and coatings is the most consuming sub-application in volume terms, primarily due to the rapidly growing construction sector. In terms of volume, nitrogen-based biocides is the leading category due to the significant use of quaternary ammonium compounds across most end-use applications. Consumption of specialty biocides in hygiene applications will benefit from the increasing awareness among consumers about the importance of sanitizers and disinfectants.

Market outlook

The European, Chinese, and U.S. markets are projected to show a low but stable growth of 1.8% from 2016 to 2021. In the United States, MCA and dissolved copper azole are expected to be the fastest growing biocidal actives, as they will take over the share from phased-out products, such as CCA. Europe’s growth is affected by a slow recovery from financial crisis in several important market sectors, notably related to the construction sector, such as paints and coatings or plastics and resins. Halogenated and phenolics biocides are expected to be the fastest growing products in the region. India is projected to show double-digit growth through 2021, with nitrogen-based, organosulfur, and halogenated biocides being the most rapidly growing categories. In China, the market will be negatively affected by the slow growth of a few key consuming applications, namely water treatment and paper applications. In the meantime, industrial preservation applications and other hygiene applications are expected to enjoy solid growth figures by 2021.