Anuj Kumar

Industry Manager, Energy

The Thick End of the Market

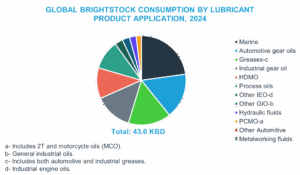

Brightstocks have long been recognized as the backbone of heavy-duty lubricant formulations. These ultra, heavy base oils have powered some of the toughest industrial and automotive applications for decades. However, the market landscape is shifting. Declining demand in automotive sectors, shrinking Group I refinery capacities, and rising costs are reshaping the future of brightstocks. At the same time, new Group II brightstock production offers both relief and new challenges. This article draws on insights from Kline’s recent Global Business Outlook For Brightstocks study to examine the current state of the brightstocks market, with a particular focus on automotive and industrial applications.

What Are Brightstocks and Why Do They Matter?

Brightstocks are very high-viscosity base oils, typically produced at Group I refineries through solvent refining and dewaxing processes. Their kinematic viscosity at 100°C ranges between 32-40 cSt, making them essential for lubricants that require robust film strength and protection under extreme load and temperature conditions. While a handful of naphthenic base oil refineries produce high, viscosity equivalents; brightstocks are largely absent in Group II and III plants due to differences in refining technology.

Synthetic alternatives, such as high, viscosity polyalphaolefins (PAOs), are available but come at a significantly higher cost, limiting their use to critical performance niches. The absence of brightstocks would make it difficult for key applications, such as marine lubricants, gear oils, greases, and heavier industrial oils, to maintain viscosity and performance under stress. In short, brightstocks are indispensable in applications where maintaining viscosity and durability is non-negotiable.

Application Trends: Automotive vs. Industrial

Automotive:

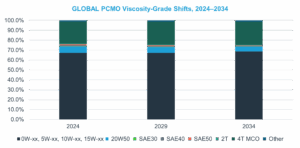

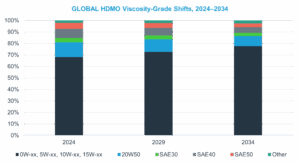

Brightstocks were historically vital for monograde engine oils and heavy-duty gear oils. However, the automotive sector is undergoing a significant transformation. The shift toward lighter, more efficient oils, driven by fuel economy and emissions regulations, has led to a steady decrease in brightstock demand. Multigrade oils (such as SAE 5W-30 and 0W-20) have become the global standard, and the brightstock, heavy monograde oils are fading into history. Even in regions where monogrades were once prevalent, such as Africa, South Asia, and the Middle East, the transition toward lighter grades is accelerating.

Industrial:

In contrast, industrial applications remain a stronghold for brightstocks. Marine cylinder oils, heavy-duty greases, process oils, and gear oils continue to rely on their thickening properties. Specialty sectors, like rubber compounding, adhesives, and sealants, also benefit from brightstocks’ unique characteristics. While automotive usage is falling, the industrial backbone still depends on brightstocks for reliable performance in demanding environments.

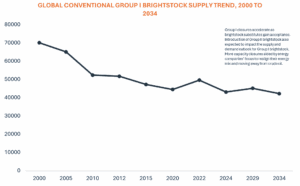

Supply Dynamics: Group I Rationalization

The lubricant base oil landscape is increasingly dominated by Group II and III refineries, which offer higher quality, lower sulfur content, and higher yields of lighter fractions. However, these facilities cannot produce brightstocks (barring a few exceptions) due to differences in refining processes. Over the past two decades, numerous Group I refineries have shut down, leading to a sharp decline in global brightstock production capacity.

This supply squeeze has resulted in persistent shortages and frequent price spikes, especially during refinery outages or turnarounds. Every Group I closure doesn’t just reduce base oil output; it potentially cuts brightstock supply, tightening a market already running thin. The result is a market where supply disruptions can have outsized impacts on pricing and availability.

Demand Shifts and Market Impact

Automotive demand for brightstocks is structurally declining and unlikely to recover. The shift to lower viscosities, driven by OEM requirements for fuel economy and emissions, has left little room for high viscosity brightstocks in modern automotive lubricants. Even in markets where monogrades were once strong, the transition toward lighter grades is accelerating.

Meanwhile, industrial demand remains stable but is not sufficient to offset the losses from the automotive sector. Marine oils, greases, and process industries continue to rely on brightstocks, but may not be able to offset the losses incurred due to automotive decline.

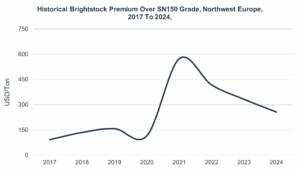

Pricing: Supply Scarcity Drives Premiums but is a risk

Brightstocks often trade at a premium compared to lighter base oils, reflecting their scarcity and essential role in niche applications. The pricing of brightstocks follows the classical law of supply and demand: supply scarcity combined with stable niche demand results in premium pricing. Supply disruptions, such as refinery turnarounds or unplanned outages, can lead to rapid price increases, prompting some blenders to consider synthetic alternatives.

However, these substitutes are typically two to three times more expensive, limiting their use to critical performance niches. Brightstock pricing has historically been volatile and prone to sudden spikes, making it one of the most closely watched molecules in the base oil trade. If prices increase too much, blenders may be tempted to switch permanently to alternatives, which could further erode demand.

Transition and Adaptation

Looking ahead, the brightstocks market is expected to continue its gradual decline but not disappear entirely. Automotive demand will keep falling as lighter grades dominate, while industrial demand is likely to remain stable but flat. The ongoing rationalization of Group I refineries will further shrink supply, although new projects, such as ExxonMobil’s Singapore Group II brightstock unit and Grupa Lotos’ facility in Poland, will provide some relief.

The introduction of Group II brightstocks is a notable development, but it comes with challenges. Group II molecules have lower solvency power, which can cause compatibility challenges in applications where additives need high solubility. To use Group II brightstocks in traditional Group I applications, blenders may need new additive packages or blending techniques. Market acceptance, particularly in marine and grease sectors, will depend on demonstrated performance equivalence.

Discover the Value of Brightstocks for Your Specific Needs

Looking for reliable, high-viscosity base oils to enhance the performance of your heavier lubricants? Brightstocks remain the trusted choice for marine oils, greases, process industries, and specialized applications where durability and film strength are essential.

Our latest report – Global Business Outlook for Brightstocks – provides in-depth market analysis and insights to help you navigate supply challenges and optimize your formulations. Whether you’re adapting to new Group II brightstock streams or seeking solutions for industrial resilience, this report is your essential resource.

Unlock the full potential of brightstocks. Contact us today to learn more or request your copy of the Global Business Outlook for Brightstocks report.