Mexico is expected to resume growth in 2020 after last year’s economic stagnation, which was caused by a combination of negative factors including policy uncertainty and slower global and U.S. production. The economic recovery will be contingent on the successful implementation of prudent fiscal policies and the ratification of the U.S., Canada, Mexico (USMCA) trade agreements, which is basically replacing NAFTA.

Mexico—the economy of which is one of the most industrialized in Latin America, having a large, sophisticated manufacturing industry that benefited from the North America Free-Trade Agreement (NAFTA) in 1994—has received substantial foreign investment over the last decade, attracted by economic reforms pursuing greater economic openness and international trade liberalization. Key economic areas have benefited from the inflow of investment, notably the automotive industry, but also the investments are being injected into the machinery and equipment industry for the transformation of steel and aluminum products.

The automotive industry remains a cornerstone for the Mexican economy—passenger and commercial vehicles are important export items that contribute to the country’s trade balance. With about 38 million vehicles on the roads, Mexico has the second-largest vehicle population in the Latin American region, after Brazil. As investment flows continue, the country has strengthened its position as the world’s seventh-largest light-vehicle manufacturer and the third-largest light-vehicle exporter.

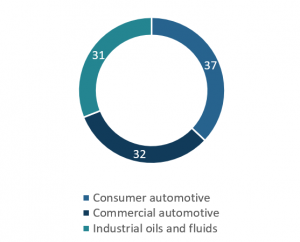

The total lubricant demand in Mexico is estimated at slightly over 800 kilotonnes in 2019. The market size and demand are led by the consumer automotive lubricant sector, followed by the commercial and industrial sectors. However, the demand split is fairly equal among the segments.

Estimated Demand for Finished lubricants in Mexico, 2019

The two growth drivers for consumer lubricants are passenger vehicles and motorcycles. Hybrid passenger vehicles increased by 48% between 2018 and 2019. However, growth of battery electric vehicles (BEV) is limited due to a lack of recharging infrastructure. Consumption of consumer lubricants is led by passenger car motor oil (PCMO), which accounts for 75% of the total volume, followed by gear oils used in passenger vehicles. The demand for multigrade PCMO is led by SAE 25W-50 and 20W-50. Vehicle design improvements drive demand for synthetic products in factory-fill applications. Moreover, OEMs established in the country must comply with U.S. standards, such as improved low-temperature performance and tightening corporate average fuel economy (CAFE) requirements. Total demand in the consumer lubricants sector is expected to show a CAGR of 1.8% over the next five years.

The consumer segment is one of the most competitive in the country, with more than 50 brands competing in the marketplace. Shell is the leading supplier, representing 20% of the market. ExxonMobil follows, with most of its sales coming from workshops and oil change stations. Roshfrans is the third supplier, given its strong presence in the refaccionaria channel (auto parts stores) and its low-price strategy.

The commercial lubricants market, meanwhile, is the second most-demanded lubricants market and is expected to grow at an annual rate of 1.8% from 2019 to 2029. Commercial automotive lubricants consumed in Mexico include heavy-duty motor oil (HDMO), gear oil, hydraulic and transmission fluid, and grease. HDMO represents 48% of all commercial lubricants sold in the country. HDMO users consume a significant amount of monograde oils, with SAE 40 and 50 viscosity grades being the most popular. This is mainly due to the old age of trucks and buses. As per the multigrades, the most-used viscosity grade is SAE 15W-40. Synthetic lubricants have a limited presence in the commercial segment as a result of the old vehicle parc and lack of widespread knowledge of their advantages. The share of synthetics in the market for HDMO is 17%. ExxonMobil is the leading supplier in the commercial segment, with an estimated 18% market share, followed by Shell and Mexlub.

The industrial lubricants sector in Mexico is driven by process oils, along with metalworking and hydraulic fluids, accounting for 70% of consumption. The industry estimates annual growth between 1% and 2% for the next five years. The industrial segment is largely supplied by multinational players, where ExxonMobil is yet again the market leader, accounting for a 27% market share.

The manufacturing industry is considered the engine of growth over the last two decades in Mexico thanks to the country’s diversified labor pool, low wage costs, and proximity to the United States. Mexico has planned its economic strategy around these advantages, which has spurred investment in the industrial sector, with the United States as the leading investor for decades. The subsectors driving the manufacturing industry are most notably the automotive, plastics, and aerospace industries.

Going forward, the overall lubricants market is forecast to show a 2% growth over the next five years due to Mexico’s infrastructure projects and manufacturing industry.

Kline’s recently published: Opportunities in Lubricants: LATAM and Caribbean market analysis report provides detailed and invaluable information and analysis of the market, its trends, key players, and performance of the overall lubricant market. Please send us your feedback on which country from the LATAM region you would like us to preview next.