By Pooja Sharma

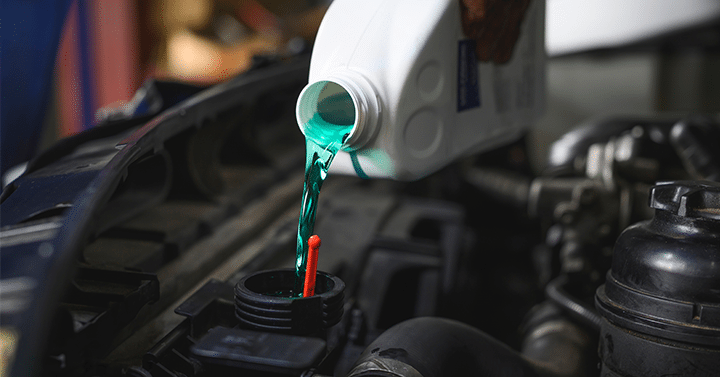

The market for automotive cooling fluids is evolving, driven by advancements in automotive design technology and the need for longer fluid service life and better performance. Modern vehicles have downsized engines with higher power density, making them compact and faster. These engines operate at higher temperatures and require cooling fluids that offer excellent heat removal and robust corrosion protection.

Evolving Coolant Technology

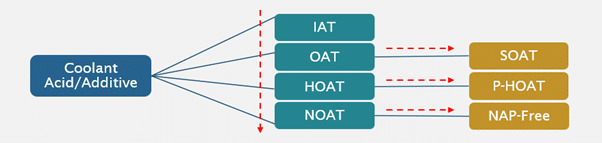

To meet these new demands, automotive coolant technology is continuously adapting. The trend is moving towards cooling fluids enhanced with additives and inhibitors for better corrosion protection and longer service life. Conventional green coolants, based on inorganic additive technology (IAT), are being phased out in favor of organic and hybrid organic acid technology-based fluids.

Geographical Variations in Coolant Technology

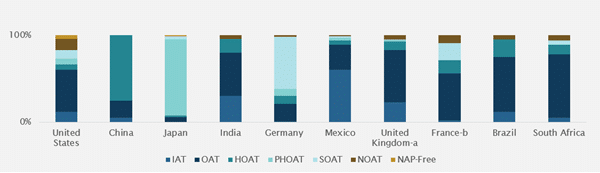

The transition in coolant technology varies across different regions, influenced by economic factors, vehicle age, user behavior, and maintenance practices. For instance, traditional IAT-based coolants are still popular in developing countries like Mexico and India due to their lower cost. In contrast, organic acid technology (OAT) and hybrid organic acid technology (HOAT) coolants are prevalent in developed markets like the United States and the United Kingdom.

Adoption of Advanced Coolants

Newer cooling fluids formulated with organic acid technology (OAT) and hybrid organic acid technologies (HOAT) are now prevalent in most developed country markets, such as the United States and the United Kingdom. These types of fluids work better in modern vehicles that have more aluminum parts. In fact, leading automotive original equipment manufacturers (OEM) in the United States, such as General Motors and Ford, currently recommend OAT-based coolants for their existing vehicle models. The OAT-based extended-life coolants contain organic acids, such as sebacate and 2-ethyl hexanoic acid (2-EHA), and usually do not contain silicates or phosphates as in conventional IAT coolants. Extended-life OAT coolants typically have a recommended service life of 150,000 miles or five years (whichever comes first) in light-duty applications and up to three years or 500,000km (whichever comes first) in heavy-duty applications. These coolants provide long-term protection to aluminum and cast-iron parts.

Shift in Coolant Product Technology

Asian OEMs are more inclined to use HOAT-based coolants that contain both organic acids as well as compounds but have lower concentrations of silicate compared to traditional IAT coolants. HOAT coolants also have a life of 150,000 miles or five years (whichever comes first) in light-duty applications and up to three years or 500,000km (whichever comes first) in heavy-duty applications with the help of SCAs. Most of the leading coolant suppliers in China, such as China Petrochemical Corporation (Sinopec Group) and China National Petroleum Corporation (CNPC), are currently supplying HOAT-based coolant products.

In fact, going one step further are highly economically advanced country markets, such as Germany and Japan, that are pioneering the use of silicated OAT (Si-OAT) and phosphate HOAT (PHOAT) coolants. Si-OAT coolants, which are formulated with organic acid technology and further inhibited with silicate additives, are particularly recommended for high-pressure aluminum engines, where protection is of utmost importance. PHOAT coolant formulation is similar to HOAT type of formulation, except for the additive component which is phosphate in place of silicate used in HOAT products. Some examples of the leading German OEMs using Si-OAT formulations are Volkswagen, Mercedes-Benz, and Volvo; leading Japanese OEMs using PHOAT formulations are Honda, Toyota, and Subaru.

Challenges in Developing Nations

While advanced nations have largely moved away from IAT-based coolants, the shift to organic formulations is slower in developing countries due to cost concerns. Advanced Si-OAT or PHOAT-based coolants are significantly more expensive, making them less accessible to cost-conscious consumers.

a-The share for Si-OAT coolant is included within OAT coolant

b-The share for NOAT coolant also includes the shares for PHOAT and NAP-free

Impact of Electric Vehicles (EVs)

Another important development in the automotive industry that is driving changes in coolant formulation is the proliferation of electric vehicles (EV). Nations around the world are embracing the era of e-mobility, and the electric vehicle market is experiencing explosive growth. Thermal management systems in EVs are of supreme importance for ensuring extended driving range, improved battery life, and safety in these vehicles. Therefore, auto manufacturers are currently optimizing these vehicles with several designs for thermal management, such as air-cooling, in-direct liquid cooling, and direct liquid or immersion cooling.

Currently, the majority of EVs use indirect cooling technology, where the coolant does not come in direct contact with heated batteries. These coolants are used in a combination with water at a ratio of 50:50, as pure water offers good heat transfer properties. In smaller-sized EVs, such as Nissan LEAF and Wuling Mini EV as well as some Japanese EV models, the air cooling method still prevails, as this method offers cooling that is good enough to keep small-sized batters of these cars under optimal temperature range. The third technology is immersion cooling, where the EV battery unit is completely immersed in a dielectric cooling fluid, with electrical conductivity well below 10 micro siemens. This new technology is currently in the R&D phase and undergoing trials and has not yet been applied at scale by passenger car OEMs. However, the trend toward immersion cooling seems strongly driven by the developments in electric and fuel-cell vehicles.

Innovations in Immersion Cooling

Several new players are entering the market to offer immersion cooling solutions for EVs. For example, Taiwan-based Xing Mobility is developing modular battery pack systems based on immersion cooling technology, partnering with Castrol to advance these solutions.

As thermal management systems become crucial for vehicle efficiency, the coolant industry is poised for significant advancements. Our Opportunities in Automotive Coolants: Global Market Analysis provides an in-depth look at these developments. Discover the future of coolants in our latest analysis.