With a turbulent geo-political and economic environment as its background, personal mobility is struggling to adapt to a post-COVID world. In this article, Sharbel Luzuriaga, Industry Manager in our Energy division, will discuss how the collateral effects of the pandemic — including supply chain shortages and inflationary pressures — impacted the adoption rate of electric vehicles, along with the direct implications for the passenger car motor oils (PCMO) market.

“Passenger vehicles were just entering into a new phase of electrification transition when the pandemic hit,” says Luzuriaga. “During the worst phase of the COVID-19 pandemic, sales of new internal combustion engine vehicles contracted abruptly, but EV sales continued rising, primarily because of renewed and stronger governmental support but also due to other factors such as the fact that the category of customers buying these EVs were less impacted by COVID and because EV sales were growing from a very small base.”

The government support, however, varies widely individual governments pursue different goals in their policies bolstering EVs.

How governments are prioritizing EVs

“The years 2021 and 2022 saw strong EV sales as several European countries including Germany, France, and the United Kingdom reinforced their determination to move toward a carbon-neutral future by offering purchase incentives targeting electric vehicles,” says Luzuriaga. “With the outbreak of the military conflict in Ukraine, Europe was facing an unprecedented energy crisis, leading to historically high fuel prices. These events reinvigorated the decision to accelerate the EV transition as the most viable future to ensure Europe’s energy security.”

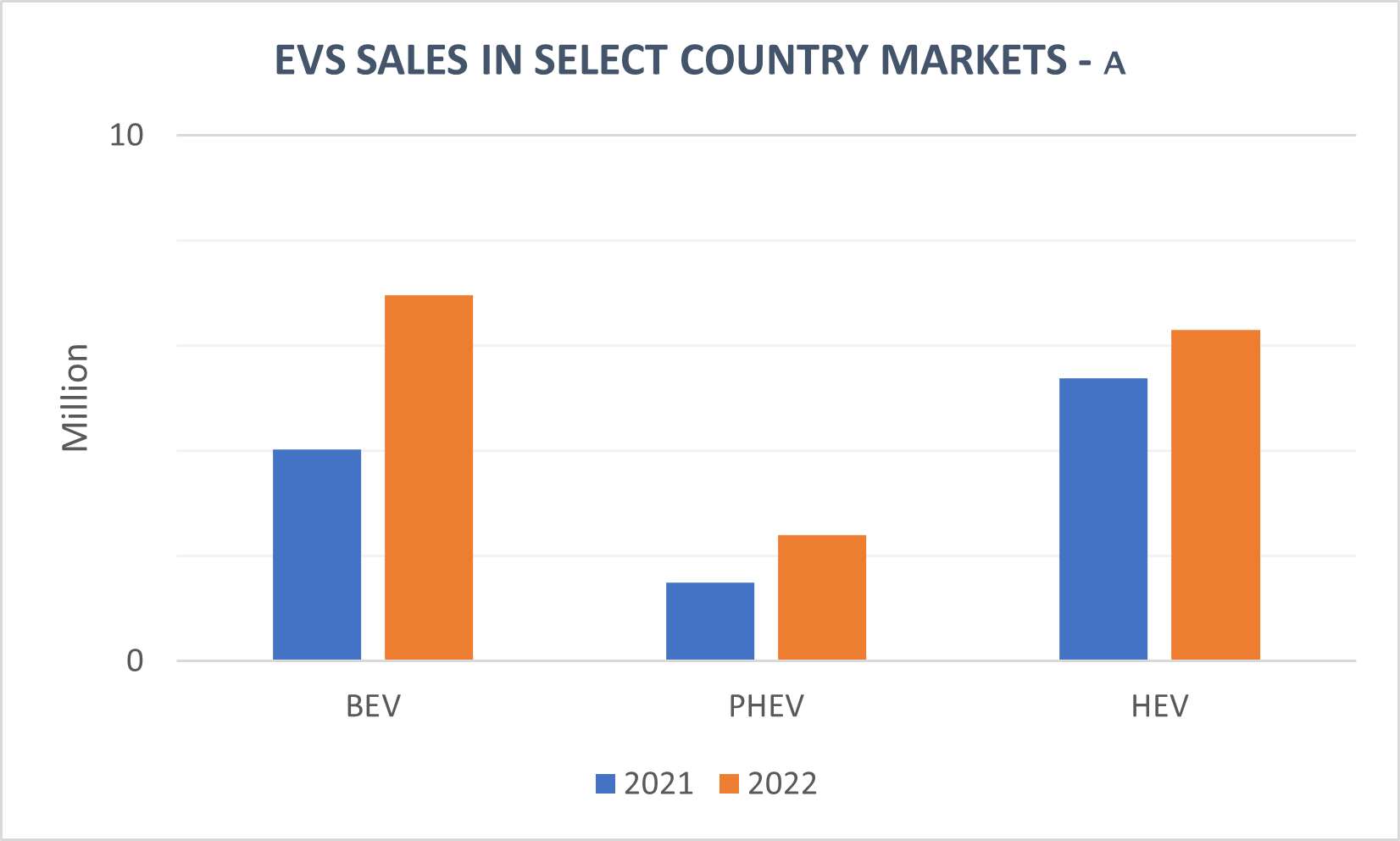

SOURCE: Kline Analysis

A: Includes 14 leading country markets covered in Kline’s PCMO Market in 2050 Report

In the United States, the Inflation Reduction Act (IRA) was enacted to mitigate the negative effect of inflationary pressures and bolster employment; now, EVs are a priority area that will greatly benefit from this legislation.

And in emerging regions, which heavily rely on exports to countries that will apply an ICE ban, car manufacturing countries are attempting to secure competitiveness by reinventing themselves and transforming their established ICE vehicle manufacturing capacities to make them able to produce EVs.

Currently, some countries are removing purchase grants and moving toward incentivizing the building of the charging infrastructures in prioritized localities and rural or low-income communities, as well as providing incentives for the sales of used EVs.

According to Luzuriaga, those efforts are beyond recall. “Electrification is an irreversible process for several reasons,” he says. “First, OEMS have invested an onerous amount of funds into R&D and the expansion of production capabilities and battery production. Second, the electrification of personal mobility is part of an overarching roadmap to achieve carbon neutrality by 2050. To attain this end, it is imperative that more renewable energy will be used to power EVs. Third, EVs are fixed in the zeitgeist as the preferred and responsible choice as opposed to ICE, and their usage can only grow.”

Who’s winning the race for an electrified future

Undoubtedly, three markets are in the lead when it comes to electrification: China, Europe, and the United States. A second tier of countries — including Japan and South Korea — will represent leading developed economies home to leading car manufacturing companies. A third category will comprise emerging economies with less stringent emission norms and lower levels of governmental support, such as Brazil and Mexico in Latin America and Indonesia in the Asia-Pacific region. India stands out in the third category as an exception with strong government support for electrification.

The effects of electrification on PCMO demand

The 14 country markets covered in Kline’s upcoming PCMO Market in 2050: A Long-Term Outlook account for approximately 70% of the global PCMO market.

“Some of them, including China and the United States, are going to post rapid surges of EVs, notably BEVs (battery electric vehicles), in the forecast period,” says Luzuriaga. “Inevitably, growth in EVs has the potential to greatly reduce PCMO consumption, especially for BEVs, as they do not need engine oil at all.”

According to Kline’s analysis, the effect of EV deployment on PCMO demand can be assessed in different periods of time. In the early stages, the detrimental effect is expected to be minor or negligible. In fact, growth in PCMO demand can be expected in some countries with low EV penetration. There will then be a transition period, with an inflection point, most likely in the second half of 2030, when the effect of EVs on the PCMO market will be more palpable.

In contrast to reducing PCMO demand, EV growth will create a new market for EV fluids. This new generation of fluids will address key challenges presented by new electric powertrains, which are sustainable (reducing carbon footprint), tribological, and have cooling features.

“Electric powertrains will require the development of new fluids for thermal management,” says Luzuriaga. “Some lubricants products, such as transmission fluids and greases, will continue to be used but will have to be reformulated to meet new performance requirements such as thermal conductivity, electrical resistance, material compatibility, and enhanced wear protection.”

Kline’s PCMO Market in 2050: A Long-Term Outlook, set for publication next month, will include an assessment of the current and projected passenger vehicle fleet in the leading country markets; analysis of vehicle ownership and usage characteristics in the leading country markets; current and projected PCMO demand in the leading markets; current and projected penetration of electric vehicles and impact on the PCMO market; the current and projected size of ride-sharing fleet and impact on the PCMO market; the effect of decarbonization targets on the penetration of electric vehicles and implications on the PCMO market; market outlook and opportunities and challenges in the emerging PCMO market; and much more. For further information, contact us.