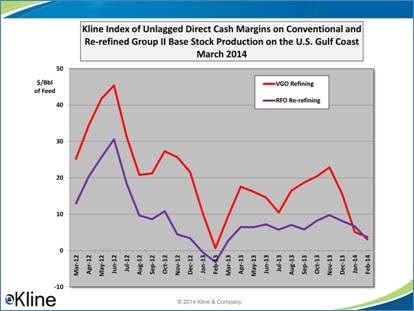

Two months ago, Kline & Company introduced its monthly Base Stock Margin Index, a characterization of recent cash margin contributions in the U.S. base oil market over the past 24 months.

The Index estimates cash margin contributions associated with U.S. Group II base stock production. It simulates EBITDA before the deduction of corporate SG&A expenses for typical VGO-based virgin base stock plants and RFO-based re-refineries. A more detailed description of the Margin Index can be found in the January release.

“With higher feedstock costs in February, after a full month of the lower Group II posted prices announced in January, margins on both types of refineries tightened over the past month,” said Ian Moncrieff, who manages Kline’s price forecasting activities. “The run on distillates that occurred at the end of January continued to a lesser extent in the first half of February. Though market fundamentals remain weak, and cash margins for both conventional and re-refined base oil production are low and declining, Chevron is rumored to be mulling an increase of $0.25-$0.30/gallon in its West Coast postings in mid-March.” In addition, last month’s margin developments can be found in the February Index.

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff, Director (Ian.Moncrieff@klinegroup3dev.wpenginepowered.com) at (973)-615-3680 in Kline’s Energy Practice.