The global finished lubricants market has been going through a phase of uncertainty, with a multitude of factors hampering its growth outlook. Several years ago, some countries faced a sovereign debt crisis, which cast a shadow on the global economic environment. Thereafter, the outbreak of the COVID-19 pandemic forced the world into a recession. More recently, the emerging geopolitical situation has had a cascading effect on the global economy, leading to high inflation and interest rates, simultaneously creating an uncertain trade environment. All of these events invariably have impacted the demand for finished lubricants, contributing to the inherent changes that the lubricants and basestocks market had already been witnessing—a shift toward better-quality lubricants and the increasing use of high-performance basestocks, reducing the need for lubricants.

Synthetic basestocks: A higher growth opportunity

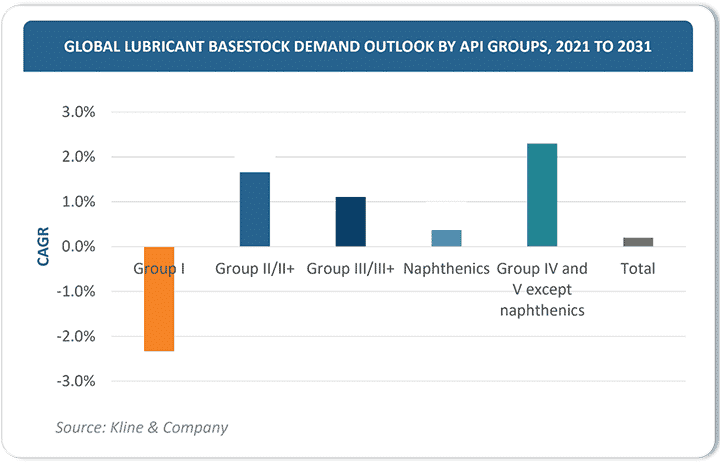

Amid the turmoil in the market, synthetic lubricants offer a sweet spot for growth. Per Kline’s analysis, Group IV and synthetic Group V basestocks will grow the fastest over the next decade. Although the overall flat/negative finished lubricants growth estimation negatively influences the market outlook for synthetic lubricants, compared with the historical growth rates, there are several fundamental factors at play driving the demand for synthetic lubricants and, consequently, synthetic basestocks. Some of these factors are the need for higher fuel efficiency, compliance with stricter emission norms, the need for longer drain intervals and reduced maintenance costs, and, more importantly, sustainability.

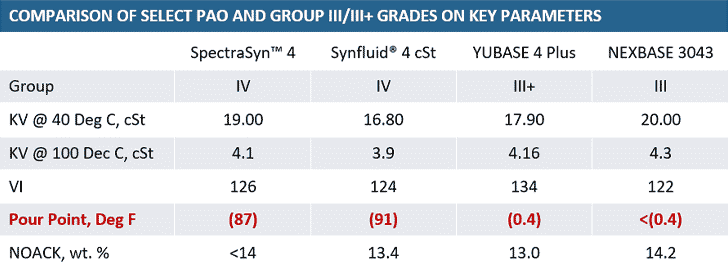

Polyalphaolefin (PAO) plays a critical role in blending top-tier automotive engine oil and automatic transmission fluids. It can also be used in gear oil (both automotive and industrial), greases, and general industrial oils, among other applications. Historically, PAO had been a gold standard for automotive engine oil formulations. However, its share in formulation declined as Group III (and later Group III+) availability grew. Moreover, the price differential between the two remained considerably high, which restricted the use of PAO to an as-needed basis. Gradually, PAO’s position was taken over by Group III/III+ basestocks in synthetic automotive lubricants applications. There are hardly any mainstream engine oil marketers that pursue the formulation approach based on 100% use of PAO.

Besides price, the availability of PAOs is much lower than that of Group III+. Per Kline’s estimates, the global PAO capacity was around 730–740 kilotonnes at the end of 2021, while that of Group III/III+ stood at around 7.7 million tonnes.

What is behind PAO’s resilience?

The use of PAO in formulation enhances the performance characteristics of finished lubricants in certain aspects, including performance in low-temperature conditions and oxidative stability. One segment wherein the use of PAO is almost inevitable is OEM, in which approval standards are stringent, warranting the use of PAO in at least some proportion. Globally, the OEM segment for finished lubricants is growing, which directly drives the market demand for high-performance basestocks, including PAOs.

Also, PAOs are available in very high viscosities, making them suitable for a variety of industrial applications, including greases and gear oil. One application area where PAO scores highly is gear oil for wind turbines. The growing focus on sustainability opens a whole new paradigm of growth for high-viscosity PAOs.

Experts have deemed PAO to be a lost cause with diminishing significance. However, PAO has proven itself to sustain and grow despite all the challenges. It has created a niche for itself, which helps it grow further. Several factors have contributed to the growth of PAOs, including:

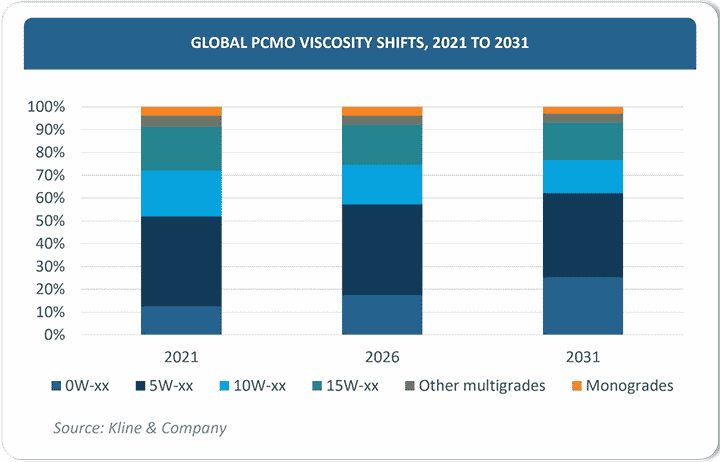

- Transition toward lighter-viscosity engine oils: While the overall PCMO demand outlook remains constrained owing to a bleak economic outlook and the growing penetration of electric vehicles (EVs), the transition toward lighter-viscosity engine oils with stricter performance requirements is a boon for PAO’s growth. Contributing to the factor is the foreseeable transition of the PCMO market toward 0W-16 and 0W-12 grades—where the use of PAO offers distinct advantages—in the long term.

- Limited availability of Group III+: In a stricter sense, PAO competes with Group III+ (and not so much with Group III), for which the availability is small. Therefore, when blenders exhaust options to source Group III+, PAOs are direct beneficiary.

- Disproportionate increase in prices for Group III/III+: While PAO prices mainly reflect the increase in crude oil prices, the price increased in Group III/III+ in the aftermath of COVID-19 was mainly due to the constrained availability of feedstock, owing to lower fuel production. As the market was normalizing, the crude oil prices spiked, resulting in a further rise in Group III/III+ prices. A declining difference between PAO and Group III/III+ prices incentivizes blenders to use PAO. Also, at one stage after COVID-19, Group III/III+ availability was so scarce that blenders lapped up whatever PAO was available to meet their blending requirements, which was a short-term phenomenon but seemed to have normalized now.

- Fit with sustainability objective: The ability of PAOs to offer better fuel efficiency supports the sustainability objective, albeit partially, in the short term.

New avenues for growth: Sustainability to aid PAO growth

While the proliferation of the EVs will have a negative impact on the demand growth for PCMO (and hence basestocks), it opens certain market opportunities for PAOs:

- Engine oil: A sizeable portion of EVs will comprise hybrid EVs and plug-in hybrid EVs, which will require engine oil.

- Transmission fluid: Synthetic basestocks such as PAO will be preferred for the transmission fluid application, as it is also used as a coolant in some cases.

- Grease: PAO can be used in blending greases for EVs.

- Coolant: PAO, owing to its favorable thermal conductivity properties, is one of the potential candidates to be used as a coolant in immersion cooling. This application offers growth avenues beyond EVs, as demand for coolants is likely to grow alongside the growth of immersion cooling requirement in data centers worldwide.

Another growth opportunity presented to PAOs is in the form of various countries’ pursuit of a sustainable future, which envisages green hydrogen as a key fuel for meeting energy demand in the future. All major countries either have green hydrogen policies and targets in place or are formulating them.

As witnessed in recent times, due to the Russia–Ukraine situation and the resulting gas shortage scenario, the pursuit of green hydrogen as an alternate energy source has only strengthened. The region is planning to reduce its long-term dependence on Russian gas, of which green hydrogen will be a beneficiary. Therefore, not just sustainability targets but the emerging geopolitical situation too is creating newer growth opportunities for green hydrogen.

Besides Europe, green hydrogen is at the center of other countries’ future energy road maps. For example, China targets to set 100–200 Kilotonnes of green hydrogen by 2025, which will magnify considerably in the mid and long term. India has set an ambitious target of 5 million tonnes of green hydrogen capacity by 2030, for which around 115 GW of renewable energy would be required (Per a EY-SED Fund report – Accelerating Green Hydrogen Economy). Japan has set a target of 3 million tonnes of green hydrogen production capacity by 2030 and 20 million tonnes by 2050. Australia, on the other hand, is significantly investing in developing electrolyzer capacity and so are several other countries. Evidently, the momentum to make a transition toward green hydrogen is building, as research to improve the efficiency of electrolyzers is underway.

The setup of more green hydrogen capacities will directly impact the demand for renewable energy to power electrolyzers employed in green hydrogen production. The major renewable sources used are solar and wind. Wind energy assumes greater significance in regions that are not well-endowed with favorable sunlight patterns to power green hydrogen plants leading to an increased need to set up more wind energy capacities.

As wind energy capacity grows to aid green hydrogen production, it will create new demand for PAOs, since they are highly favored in that application. However, wind energy will compete against solar energy and may not be preferred in some markets.

PAO supply outlook to remain bullish

Defying the challenge presented by EVs, the development of new PAO capacities is being planned. For instance, INEOS has recently started its 120 KTPA low-viscosity PAO plant at Chocolate Bayou in the United States and is planning to expand the capacity of its high viscosity PAO plant at La Porte in the United States to 40 KTPA by 2025. Chevron Phillips plans to double its PAO capacity in Belgium to 120 KTPA by 2024. On the LAO (feedstock for PAO production) front, ExxonMobil plans to ready its 350 KTPA plant in Baytown in the United States by 2023.

On the other hand, Sinopec Maoming Petrochemical in China has recently commenced with the production of PAO at its 12 KTPA plant in Guangdong province. Apalene Technology Co., a Chinese company, is setting up a 10 KTPA PAO plant in Eastern China.

Conclusion

The transition toward a sustainable future brings its own challenges and opportunities. While a part of demand may be lost due to the loss in PCMO demand owing to growing EV sales, new applications are emerging that will offer new growth avenues. The emerging opportunities are still in the nascent stage of development, but the market is bracing itself for the future by accelerating new supply creation.