Despite a decade of industrial growth, the base oils market remains stagnant. Yet, a surge of new Group III/III+1 plants is underway. What’s driving this paradox?

In 2024, overall base oil demand is approximately at the same level as 2014 despite growth in the global vehicle parc, more miles driven, increased fuel consumption and increased industrial activity in the last decade.

Why hasn’t base oil demand budged? What’s holding it back and why are producers still investing?

Flat Demand, Rising Capacity: What’s Going On?

Vehicle parc electrification and lubricant quality improvements have negated any growth in lubricant and base oil demand due to growth in automotive and industrial segments. The future looks more of the same with flat to mild demand growth. The industry had an overall surplus of 5.0 million tons which is more than 10% of the overall supply.

So, if the market is already oversupplied, why are we seeing a surge in new Group III/III+ plants, with nearly 1.4 million tons of new capacity planned, to be added? What do these producers know that others don’t?

To understand this, we need to look beyond the topline supply-demand trend lines. As we delve into the details several areas of competition become apparent. In this article, we explore what is happening in the Group III/III+ market space.

Inside the Group III/III+ Market

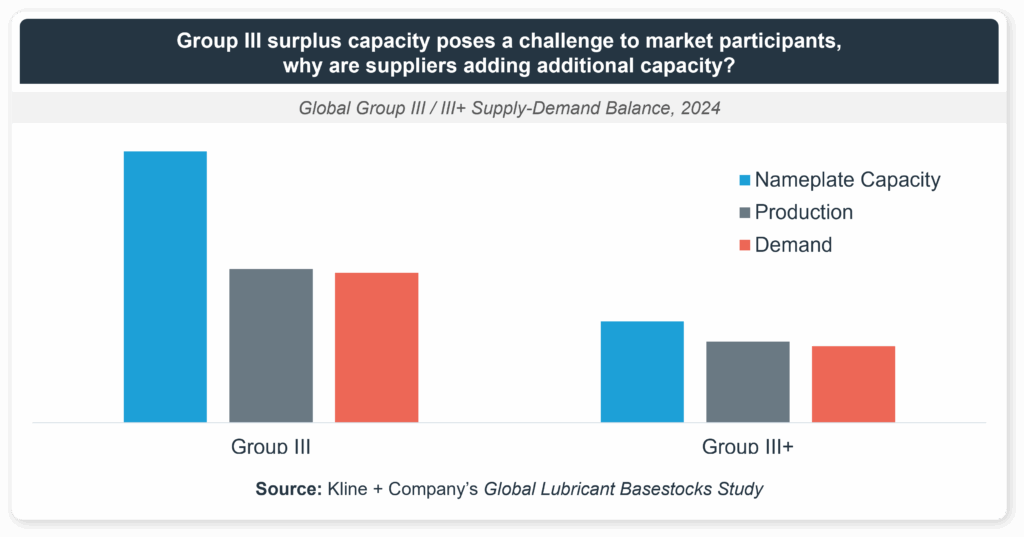

Group III/III+ accounts for 16% of the total market. The Group III market has significant excess capacity resulting in a weak capacity utilization factor of about 56%: the lowest among all base oil groups. While the Group III+ market is in a healthier position, the overall picture is concerning.

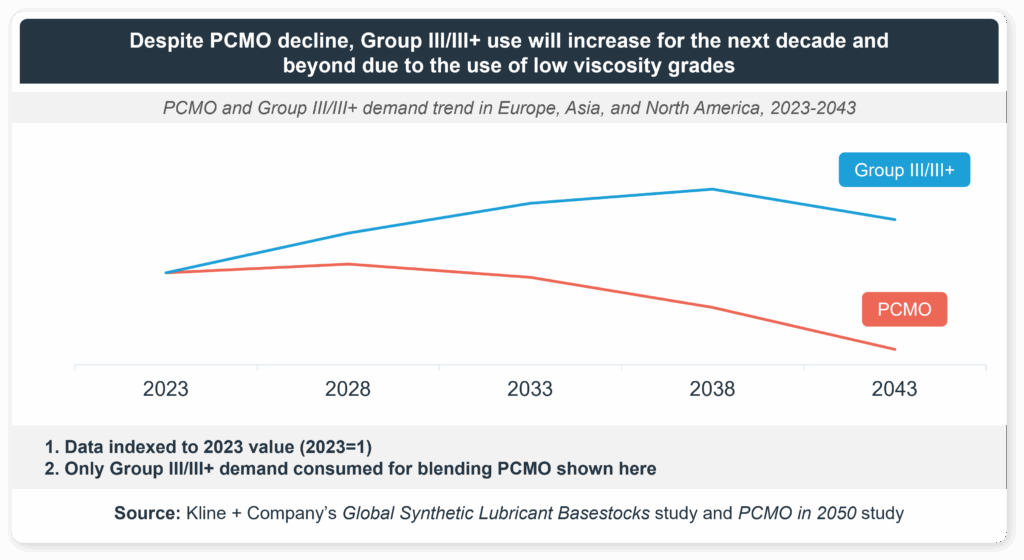

What makes the picture even more worrying is the fact that more than 50% of the demand for Group III/III+ comes from blending PCMO. Due to electrification of the passenger car parc, global PCMO demand is likely to drop by 1% from 2024 to 2034 and 15% from 2034 to 2044.

The global demand decline looks less severe due to demand growth in regions like South America, Africa and the Middle East and developing markets in Asia-Pacific. Viewed in isolation the decline in North America, Europe and select markets of Asia-Pacific will be much sharper.

How then to explain the more than 800 KT of new Group III/III+ capacity being planned, most of which was announced in the last 12 to 18 months? Could it be that the answer lies not in total demand but in how that demand is evolving?

Formulation Dynamics: The Blend vs. Volume Story

Group III/III+ are predominantly used to blend low and ultra-low viscosity PCMO which will continue to gain share from mid- and high-viscosity grades. The net result is that Group III/III+ has a growing share in PCMO demand even as the overall PCMO demand is declining.

Due to these opposing trends, Group III/III+ demand will continue to grow at-least for another 10 to fifteen years for PCMO blending. If other applications like immersion cooling are included, the Group III/III+ demand picture is very different: showing growth for a long time.

Group III/III+ demand does not exist in vacuum. There is competition between Group III, III+ and PAO. The use of base oils is driven by each blender’s priorities and business environment. Factors such as final product performance claims, supply chain considerations, support for product development, and marketing push from base oil and additive companies all play a role.

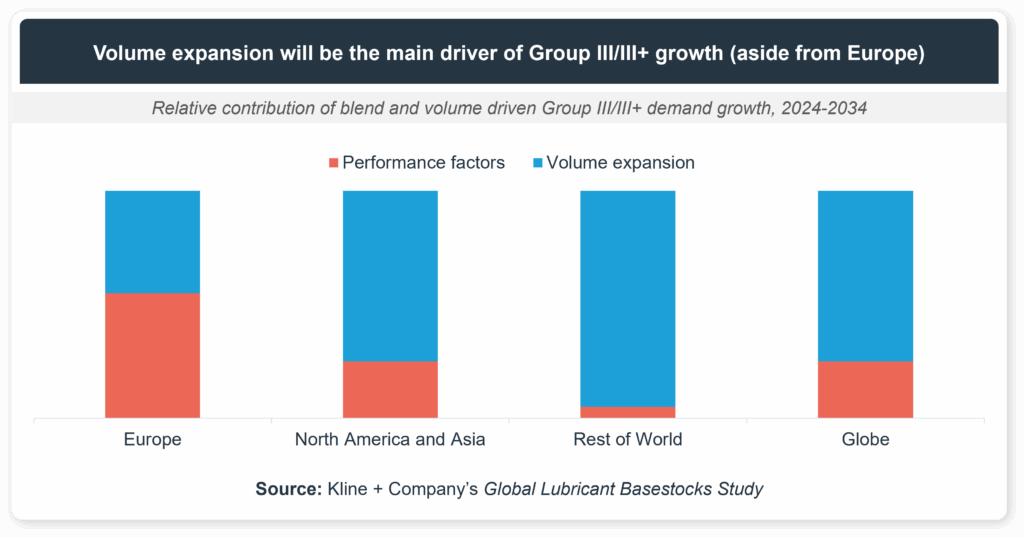

The ultimate growth might be thought of as coming from two sources: blend driven growth – how changing base oil blend contributes growth, and volume driven growth – how final lube demand growth affects base oil demand.

Europe which is most impacted by passenger car electrification will have a significant dependence on blend driven growth. At the other extreme rest of world, which includes AME and South America will depend on volume growth to drive Group III/III+ base oil demand.

Price Premiums and Supply Chain Shifts

Group III/III+ price behaviour has changed since 2020 due to product premiumization and changes in blender behaviour related to supply chain.

Blender behaviour and supply chain. Group III margins over VGO feed reached all-time highs from 2021-2024, due to a combination of supply chain problems and plant outages causing panic buying.

Historically, lubricant and basestock supply chains have been optimized for cost efficiency, with a high reliance on long-distance imports and concentrated production hubs. However, escalating geopolitical tensions are forcing stakeholders to reassess this model.

Companies are now prioritizing supply security, regional redundancy, and logistical flexibility over cost minimization. Blenders are now embracing multi-source resilience, nearshoring, and regional buffer strategies to counteract geopolitical risks and shifting trade landscapes. Thus, having more supply plants will be welcomed by them.

Product premiumization. In the current market scenario Group I and Group II base oils have largely become commoditized. In contrast, Group III/III+ along with PAO is a premium base oil. As a result, factors such as base oil capacity and demand, supply chain logistics, parcel sizes play a small role for this market.

For Group III/III+, a big influence is R&D and tech support offered to blenders. But the most material influence is the degree to which each Group III/III+ base oil possesses OEM, additive company and certification agency approvals. In Europe, Group III grades that have OEM approvals enjoy significant premium over less approved Group III grades – typically in the $50-200/Ton range. These premiums have widened in 2023-2024.

This aligns with the insight that Europe demand growth is driven more by blend changes than other regions. As a result, Europe values Group III grades with approvals more than unapproved Group III. This is not seen in other regions.

Local Logic: Why Global Trends Don’t Tell the Whole Story

While the global picture for Group III/III+ supply-demand looks grim, market participants are more focused on their own market opportunities and challenges. Investment logic varies based on each company’s business environment.

Three key takeaways:

In summary analysing the base oils market solely on the global supply-demand balance and outlook can be misleading. This is especially true for the Group III/III+ market. The Group III/III+ market has several facets which makes for a complicated picture.

- Group III/III+ demand is growing despite flat overall market: In the next 10 to fifteen years, the Group III / III+ market will see significant change – more supply plants, more suppliers, and more products.

- Supply chain resilience and premiumisation are reshaping investment logic: Base oil marketers need to monitor how the new supply impacts their core markets and have an appropriate response to protect and grow their business.

- Europe’s blend-driven growth contrasts with volume-driven growth elsewhere: Blenders will have greater options for blending their high-performance lubricants. They need to look at their blend options and assess if they have the optimal base oil mix for their finished lubricant portfolio and market position.

As Group III reshapes the landscape, marketers must rethink their positioning. Join our webinar Base Oil’s Group III Paradox: Increasing Capacity in a Shrinking Market as we unpack the future of base oils.