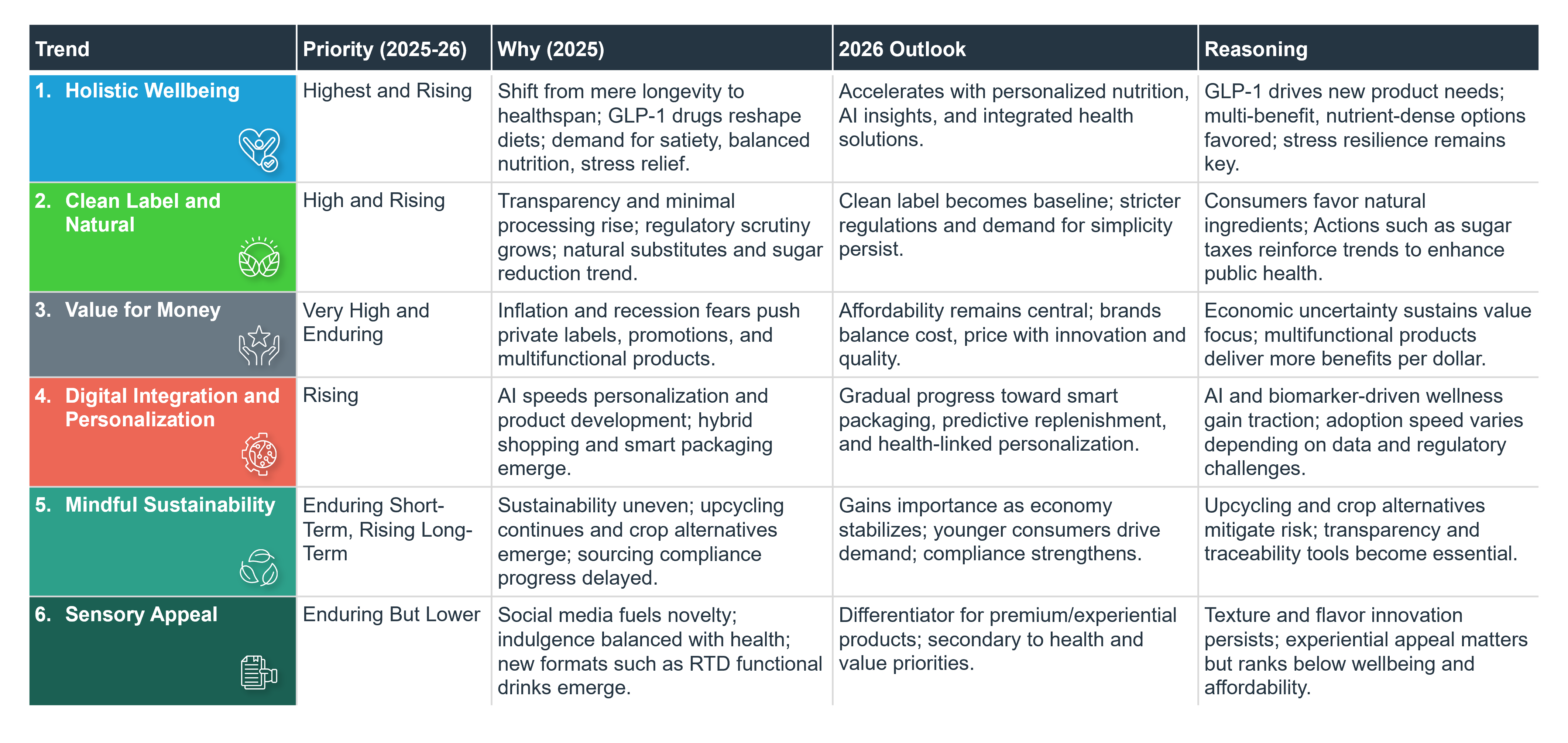

In 2026, the broad macrotrends shaping consumer behavior and industry priorities remain remarkably consistent with those observed in 2025, underscoring the enduring relevance of themes such as holistic health and wellness, value for money, and digitalization andpersonalization. Yet, beneath this steady surface, the sub–trends are actively migrating, reflecting both scientific advances and shifting consumer expectations.

In examining Food & Nutrition Trends 2026, we highlight the balance between stability and evolution, and what it means for innovation in the year ahead.

1. Holistic Wellbeing

Priority: Highest and Rising

Subtrends:

- Healthy lifespan

- Weight management

- Gut-brain axis

Why:

Health and wellness continue to shape the sector in 2026, with the focus shifting from mere longevity to health span, living longer in good health. The rise in GLP-1 weight management drugs has introduced both challenges and opportunities for food and nutraceutical sectors, as consumers seek complementary solutions for satiety, balanced nutrition, and metabolic support. With increased competition in the market, prices of GLP-1 medications are projected to decline, driving higher penetration rates in the United States, with other countries following suit. Simultaneously, gut-brain axis, while not new, continues to be highly relevant in 2025. Global economic uncertainty, geopolitical tensions, and fast-paced lifestyles amplify consumer demand for solutions that promote calm, focus, and overall balance, further fueling interest in functional products enriched with fibers, pre- and probiotics, and other ingredients designed to support mental wellbeing.

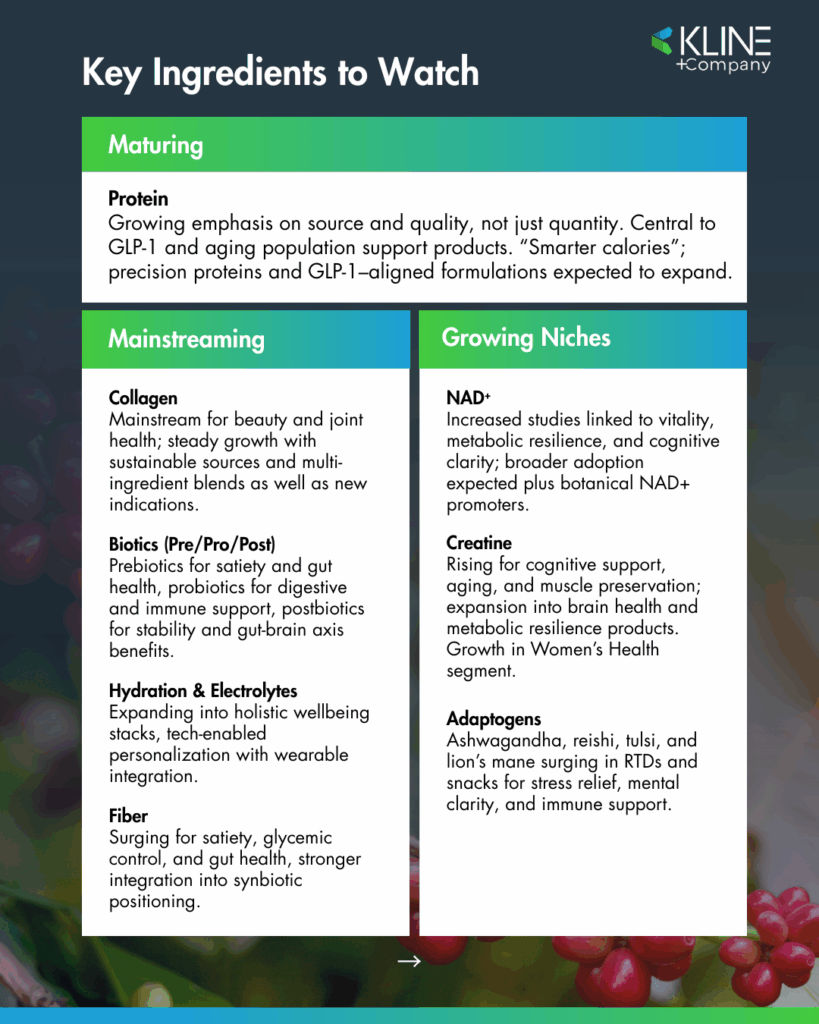

Watch List of Ingredients

Example of Subtrends:

Healthy lifespan: Nicotinamide adenine dinucleotide (NAD⁺) products and research on NAD⁺ precursors such as nicotinamide riboside (NR) and nicotinamide mononucleotide (NMN) surged in 2025, pivoting from “anti-aging” to holistic longevity, emphasizing vitality, metabolic resilience, and cognitive clarity.

Weight management: Nestlé introduced Boost Pre-Meal Hunger Support and Boost Advanced protein drinks in the United States, specifically designed for GLP-1 medication users to manage hunger, stabilize blood sugar, and preserve muscle mass during weight loss. UK retailers such as Marks & Spencer and Morrisons in collaboration with Applied Nutrition) kicked off 2026 with new ranges of ready-meals designed to meet smaller portion sizes and higher-nutrient density, especially protein and fiber, by GLP-1 consumers and beyond.

Gut-brain axis: Recess and Kin Euphorics expanded their portfolios with ready-to-drink adaptogen beverages featuring ashwagandha, reishi, and tulsi, marketed as stress-relief and mental clarity solutions.

2026 Outlook:

Holistic wellbeing will accelerate further, fueled by personalized nutrition, tech-enabled health insights, and integrated lifestyle solutions. Physical, mental, and metabolic health is expected to converge with innovation in multi-benefit formulations, stress-resilience products, and AI-driven recommendations that synchronize with wearable data for proactive health management. Younger generations (Millennials and Gen-Z) view healthy aging as a lifelong journey, thereby investing early in nutrition, fitness, and mindfulness.

Strategic Imperatives for 2026:

Seek practical, empathetic, and compound solutions to address everyday challenges such as emotional balance, energy restoration, and sleep quality

Innovate for GLP-1 users with satiety-supporting snacks, protein-rich beverages, and nutrient-dense options to complement weight-management regimens

Explore personalized nutrition and tech by connecting products with AI-driven recommendations for proactive health management

2. Clean Label and Natural

Priority: Very High and Rising

Subtrends:

- Simpler ingredients

- Debates around ultra-processed foods (UPFs)

- Sweetness reduction

Why:

Consumers in 2025 became increasingly focused on ingredient transparency, recognizable components, and minimal processing. Regulatory scrutiny of UPFs intensified, with new labeling laws and FDA actions pushing manufacturers toward cleaner formulations. According to a Walmart survey, 62% of customers want greater transparency in food ingredients, and 54% actively review ingredient labels. The UPF debate, ignited by The Lancet studies, amplified this trend: reports linking UPFs to health risks sparked global concern, while industry countered with arguments about scientific uncertainty and consumer confusion, noting that UPF classification lacks consensus and often oversimplifies nutrition science. In response, brands doubled on innovation, adopting natural ingredient substitutes, such as plant-based thickeners and fruit-derived sweeteners, to replace artificial additives, while continuing efforts to reduce sweetness driven by public health initiatives and sugar taxes.

Example of Subtrends:

Simpler ingredients:

PepsiCo launched Simply NKD™ versions of Doritos® and Cheetos® in late 2025, removing artificial flavors and dyes to meet consumer demand for simpler, cleaner ingredient lists.

Walmart U.S. is removing 11 synthetic dyes, and more than 30 other ingredients (certain preservatives, artificial sweeteners, and fat substitutes) from its private brand foods.

Marks & Spencer UK expanded its minimal ingredient range to 25 products, ranging from their olive oil mayonnaise with six ingredients to beef burgers with three ingredients and yoghurts with only five ingredients.

Debate around UPFs: The Lancet published a new report linking UPFs to harm across multiple organs, sparking global debate.The report calls for stricter regulation of UPFs, while the industry argues that global health strategies should focus on nutrient quality, affordability, and access, not manufacturing methods. This concern was also referenced in the recently updated U.S.dietary guidelines, which signaled a clear recommendation for consumers to focus on “real food.”

Sweetness reduction: The World Health Organization (WHO) launched a global initiative to encourage countries to increase taxes on sugar-sweetened beverages by at least 50% by 2035, in a move designed to curb chronic diseases in July 2025, and highlights reformulation efforts since 2015 (less salt, sugar, and calories). The United Kingdom expanded its sugar tax in late 2025 to include dairy beverages as well.

2026 Outlook:

Clean label is no longer a niche trend, but it is becoming a baseline expectation shaping product development, regulatory compliance, and brand strategy. A stronger regulatory focus on UPFs, including potential front-of-pack disclosures and packaging safety standards, is expected. Meanwhile, the industry will fight to reframe the narrative, emphasizing nutrient quality and affordability over processing methods. Companies that combine clean-label reformulation, clear communication, and science-backed positioning will be best-positioned to thrive in a market increasingly defined by health, trust, and simplicity.

Strategic Imperatives for 2026:

Accelerate clean-label reformulation across core portfolios, prioritizing removal of artificial additives

Implement phased sweetness reduction plans, supported by transparent labeling and consumer education to align with global sugar-reduction initiatives

Leverage traceability and own the narrative: Use science-backed messaging to clarify misconceptions about UPFs while showcasing progress on naturalness and transparency to strengthen trust and brand equity

3. Value for Money

Priority: High and Enduring

Subtrends:

- Private-label growth

- Tariff/Supply chain challenges

- Multifunctional products

Why:

The economic climate in 2025, marked by lingering inflation, elevated food prices, and recessionary concerns, made value a dominant priority for consumers. Shoppers increasingly traded down to private-label and budget-friendly options, stockpiled essentials, and sought aggressive promotions to stretch household budgets. Moreover, global tariff volatility and supply chain disruptions introduced cost pressures for manufacturers, prompting diversification strategies to mitigate risk. Consumers also demanded multifunctional products that deliver more benefits per dollar, fueling innovation in hybrid formulations that combine performance, convenience, and health attributes.

Example of Subtrends:

Private label: According to the Private Label Manufacturers Association (PLMA), private label sales rose 4.4% across all outlets in H1 2025, while national brands grew only 1.1% in the United States.

Tariff/Supply chain: President Trump rolled back tariffs on over 200 food products, including staples such as coffee and beef, to address rising grocery costs and inflation concerns while negotiating trade deals with several Latin American countries.

Multifunctionality: Consumers want multifunctional food and nutrition products that offer more benefits and higher nutrient density per dollar. The market has witnessed an increase in the number of products with ingredient mashups (e.g., creatine + collagen + electrolytes).

2026 Outlook:

Despite some moderation in inflation, persistent economic uncertainty and geopolitical tensions will keep value for money at the forefront. Consumers will continue to prioritize affordability and perceived value, making this trend highly relevant and long-lasting. Brands should navigate competitive pricing, strong promotional strategies, and clear value communication with care, while balancing innovation and quality to differentiate beyond price.

Strategic Imperatives for 2026:

Strengthen private-label partnerships and expand value-quality offerings to capture cost-conscious shoppers, but also to deepen customer engagement

Diversify supply chains and tariff risk management to stabilize input costs and maintain margins

Innovate multifunctional products that deliver combined benefits, supported by transparent messaging on performance and value

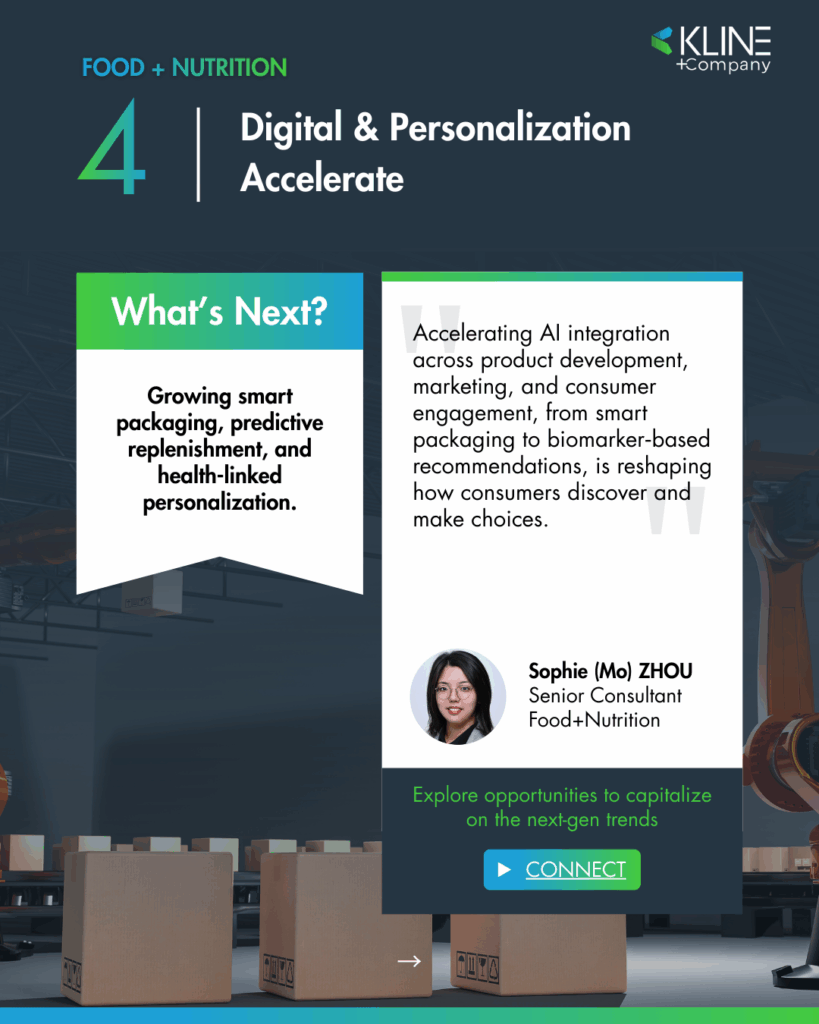

4. Digital and Personalization

Priority: Rising

Subtrends:

- AI penetration

- Phygital experiences

- Personalized wellness

Why:

The digital transformation of the sector continues to accelerate in 2025, with AI reshaping the product life cycle and AI-powered personalization and hybrid online/offline grocery experiences becoming mainstream. Adoption levels diverge widely between market participants, depending on digital maturity and investment capacity. However, the pace of AI-driven competition is accelerating, pushing more companies to adopt these tools at an exponential rate. The entire R&D cycle is being compressed, enabling faster prototyping, testing, and market launch.

AI is also penetrating every stage of the consumption cycle, from discovery to purchase to post-consumption feedback. Retailers are leveraging technology for loyalty programs, gamification, and instant commerce, while smart packaging is emerging as an extended touchpoint between brands and consumers. Interactive packaging and tech (i.e., AR/VR, animations, and recipes) enhance engagement and personalization.

Example of Subtrends:

AI penetration: In November 2025, Barry Callebaut, one of the world’s largest chocolate manufacturers, announced a partnership with NotCo AI to integrate artificial intelligence into chocolate recipe development. Walmart has partnered with OpenAI to create AI-first shopping experiences, allowing customers to shop directly through ChatGPT with features such as Instant Checkout.

Phygital experiences: Alpro‘s plant-based products use QR-enabled packaging to drive consumers to an immersive web application. This app educates users on plant-based nutrition through interactive, gamified experiences.

Personalized wellness: Hims & Hers Health’s Labs app exemplifies an AI-powered personalized wellness solution by combining biomarker-based blood testing with doctor-developed action plans and tailored lifestyle guidance to make preventive healthcare accessible and actionable.

2026 Outlook:

Personalization will remain the industry’s north star, but achieving deep, individualized nutrition solutions, such as precise micronutrient tracking and adaptive meal planning, remains complex. While AI, wearables, and connected apps will enable progress, challenges around data integration, regulatory compliance, and consumer adoption persist. Expected are incremental steps toward smart packaging, predictive replenishment, and health-linked recommendations, with full-scale personalization as a long-term ambition rather than an immediate reality.

Strategic Imperatives for 2026:

Accelerate AI integration across product development, marketing, and consumer engagement touchpoints

Invest in phygital platforms to create immersive, interactive brand experiences

Develop personalized wellness ecosystems leveraging biomarker data, connected devices, and AI-driven insights

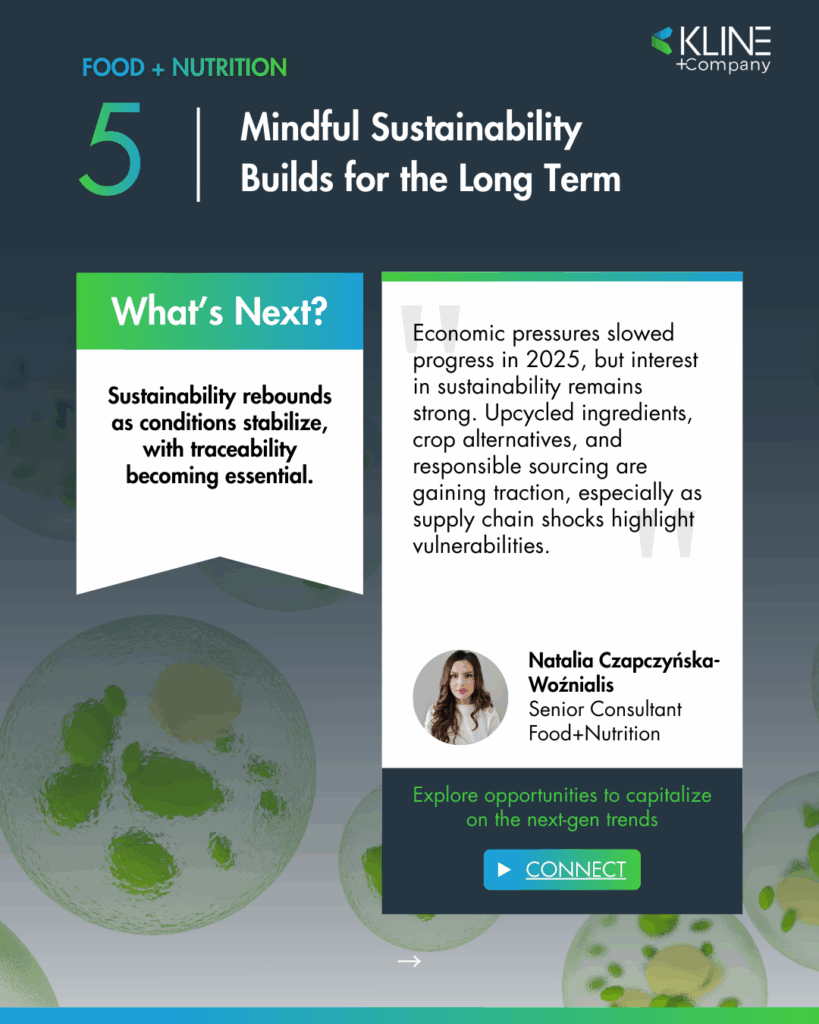

5. Mindful Sustainability

Priority: Enduring Short-Term, Rising Long-Term

Subtrends:

Upcycled ingredients

Regenerative agriculture

Responsible sourcing

Why:

Sustainability remains highly relevant in 2025 but is progressing unevenly due to a complex macroeconomic environment. Upcycled ingredients are being explored by both large manufacturers and niche players specializing in waste reduction, yet technology barriers and the cost of building new product lines require significant time and resources. Meanwhile, recent shortages of economic and staple crops such as cocoa and rice have underscored the fragility of supply chains for commodities long taken for granted. This is prompting manufacturers to seek resilient alternatives and rethink the supply chain. These efforts highlight the need for diversification, but achieving scale will be a gradual process.

Responsible sourcing is essential for a majority of consumers, but its implementation is destined to be a long and challenging journey. The EU Deforestation Regulation (EUDR) illustrates this complexity. Despite strong policy intent, enforcement has been repeatedly delayed. The path of mindful sustainability forward will be gradual and closely tied to economic conditions and consumer confidence, making sustainability a long-term strategic imperative rather than an immediate win.

Example of Subtrends:

Upcycled ingredient: Matriark Foods specializes in transforming farm surplus and vegetable remnants from fresh-cut facilities into healthy, low-sodium products such as vegetable broth and pasta sauce, reducing food waste while creating affordable nutrition solutions.

Crop alternatives: Barry Callebaut and Planet A Foods partner to develop sustainable chocolate alternatives without cocoa, addressing supply chain fragility and reducing environmental impact.

Responsible sourcing: The EUDR is designed to ensure that products sold in the EU are not linked to deforestation. Its enforcement has been repeatedly delayed, with the latest proposal pushing deadlines to December 2026 for large companies and June 2027 for smaller firms, mainly due to IT system readiness issues and industry concerns.

2026 Outlook:

The cocoa crisis underscores the vulnerability of global supply chains for beloved commodities. As economic conditions stabilize, sustainability will regain prominence, particularly among younger and affluent consumers who increasingly view environmental responsibility as integral to brand trust and product choice.

Strategic Imperatives for 2026:

Reconsider and reimagine product life cycles to reduce waste and enhance cost efficiency

Explore plan-B alternatives and resilient agricultural systems to mitigate supply chain risks

Strengthen compliance and transparency in sourcing practices, leveraging digital traceability tools to meet the evolving ESPR regulations

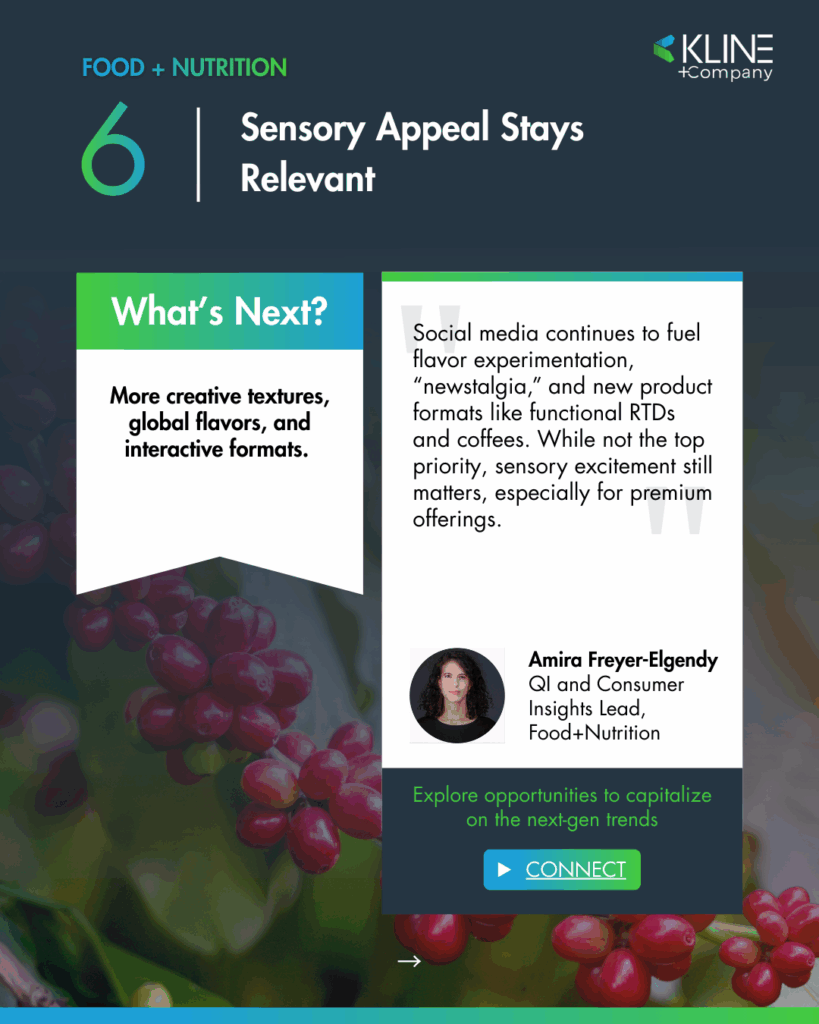

6. Sensory Appeal

Priority: Enduring But Lower

Subtrends:

Social media

Newstalgia

New formats

Why:

While not the top priority, sensory appeal remains an enduring driver of consumer engagement. Younger generations, particularly social media natives, actively seek novel experiences, from indulgent treats to health advice online. As consumers pursued joy and novelty amid economic stressors throughout 2025, ‘Newstalgia’ (a blend of nostalgia and innovation) gained traction by offering dynamic concepts grounded in familiarity. Social media amplified interest in global flavors and multisensory experiences, and brands leveraged these platforms to reach broader audiences and gather real-time insights into consumer preferences. Despite indulgence trends online, growing health awareness tempered excess, creating a balance between excitement and mindful consumption.

Example of Subtrends:

Global flavor/texture: Platforms such as TikTok fueled viral food trends, including layered desserts combining unique textures and flavors (e.g., Dubai chocolate and cocada from Latin America), transforming multisensory design from novelty into purposeful product development.

Nostalgia: Traditional practices such as fermentation and ancestral ingredients were reframed as “ancient wisdom,” delivering perceived health benefits while evoking comfort and heritage.

New formats: RTD drinks, yogurts, and functional coffees emerged as versatile delivery systems for supplements, blending convenience with experiential appeal.

2026 Outlook:

Sensory appeal will persist as a differentiator, particularly for premium and experiential offerings, but it ranks lower than health and value in shaping mainstream priorities. Continued innovation in textures, flavors, and interactive formats is expected, with social media remaining a critical catalyst for trend adoption and consumer engagement.

Strategic Imperatives for 2026:

Leverage social platforms to amplify sensory-driven innovation and capture viral potential

Balance indulgence with health benefits, using familiar yet creative formats

Explore multisensory design and interactive packaging to enhance experiential value and brand storytelling

From Our Food + Nutrition LinkedIn

These slides were originally shared on our Food + Nutrition LinkedIn page. Follow us for the latest developments, insights, and news shaping the food and nutrition industry.

Follow usFrom Continuity to Competitive Advantage in Food and Nutrition

The transition from 2025 to 2026 is only symbolic. Trends evolve continuously rather than overnight. Healthspan reframes longevity as everyday vitality, clean-label transparency is becoming the expected norm, and value for money drives both private‑label growth and multifunctional innovation.

Sustainability priorities may fluctuate in the short term but will strengthen over the long run, while digital personalization edges closer to real‑time, AI‑enabled solutions. Sensory appeal, integral to the ritual of eating, remains essential for engagement.

For brands, the challenge is not to chase the calendar but to anticipate these shifts, aligning with consumer priorities already in motion and positioning themselves to thrive in ongoing transformation.

[WEBINAR] Food & Nutrition Trends Shaping 2026 and the Future of Consumer Health

The Food + Nutrition team at Kline + Company continue to track trends at both macro and micro levels and look forward to supporting the client navigate challenges and meet their growth objectives. Connect with our VP Dr Elizabeth Thundow to discuss how Kline’s insights and advisory services can support your business in 2026.

Elizabeth Thundow

Vice President of Food+Nutrition