Chronic pain continues to be an area consumers seek to treat with a variety of methods including prescription drugs, OTC medications, topical rubs, and pain management devices. The increasing U.S. aging population will continue to generate the demand for pain relief products. Seniors increasingly seek to mitigate pain associated with old age and sedentary lifestyles, thereby increasing sales. The baby boomer population is the most rapidly increasing age segment in the United States, with an estimated 23% of the population reaching 55 years of age in 2015. The physically active baby boomer generation is concerned about maintaining health and wellness, far more so than previous generations.

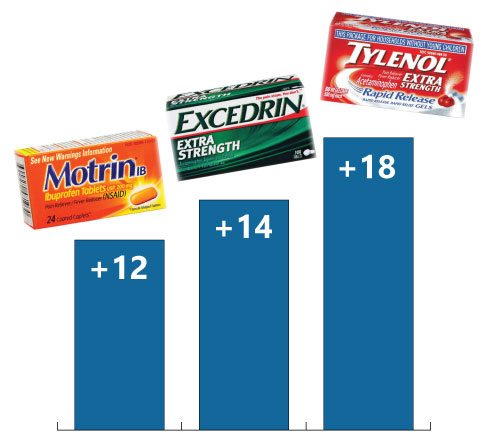

In the OTC pain relief market, after years of being out-of-stock and off of retail shelves due to recalls and manufacturing plant shut downs, venerable internal analgesic brands, Tylenol and Motrin (Johnson & Johnson) and Excedrin (GSK/Novartis) all experienced strong double-digit sales gains in 2015. This growth is the result of the strong, continuing return of former consumers to the previously recalled brands over the past two years. With strong marketing support re-instated and almost fully restored retail product distribution, these three brands contribute to a significant portion of total category growth in 2015.

These brands rebuild share in a more “normal” market which has suffered alternating growth and decline, caused by the numerous massive shelf inventory disruptions over the past five years due to recalls and plant closings by two leading manufacturers: Johnson & Johnson, marketer of Tylenol and Motrin brands, and Novartis, now part of GlaxoSmithKline, but marketer of Excedrin at that time. Johnson & Johnson, with adequate supplemental third-party production in place, all three of its manufacturing facilities fully operational as of September 2015, and restored heavy marketing support, sees sales for Tylenol and Motrin increase strongly in 2015. Novartis remedied its manufacturing issues initially by quickly engaging third party production resources, and then by merging its consumer health care unit into a joint venture with GlaxoSmithKline consumer group as October 2014, benefiting from the increased combined manufacturing capacity in place for 2015.

Sales Growth of Motrin, Excedrin, and Tylenol, 2014-1015

Many brands in the topical analgesics OTC market also experienced strong double-digit gains in 2015 as a result of consumers’ need for topical relief. Topical analgesics are often used by consumers in lieu of, or in addition to, internal analgesics, so there is not as much of cross-category competition with internal analgesics as might be expected. Certain consumers shy away from using internal analgesics because of the possible side effects, such as stomach upset, ulcers, change in blood pressure, and/or blood thinning and may opt for topical analgesics instead. The launch of new line extensions including the addition of lidocaine to Aspercreme as well as increased marketing and advertising investments by leading brands delivers sales gains of the topical analgesics market in 2015.

Fast Growing OTC Topical Analgesics, 2014-1015

SOURCE: Kline’s Nonprescription Drugs USA reportThe OTC market for analgesics has also been impacted by increased use of pain management devices and the launch of two major TENS devices for use by consumers at home. In 2014 Sanofi launched Icy Hot Smart Relief TENS Therapy device and in 2016 Bayer launches Aleve Direct Therapy TENS device for lower back pain. Powered devices in the U.S. market, such as those with TENS and light technology are estimated to post double-digit gains. Light-based devices have the highest growth at 18%, but not all light devices are the same, and some do not use the same type of light.

Although powered devices for consumer use are the new kids on the block, more traditional products like braces and wraps are seeing a boost in sales as well. In the non-powered devices category, braces offer a significant growth opportunity due to the development of products that specifically target particular ailments allowing the 2015 average brace price to slightly increase.

According to our recently conducted survey with pain management practitioners, the leading parts of the body that patients come for help with is back, followed by knee and shoulder. Reflecting this trend, makers of braces are reacting to consumers who want specialized products that are specific for the ailment that is hindering them.

We will continue to monitor the internal and topical analgesics categories through the upcoming 43rd edition of our annual Nonprescription Drugs USA report. With in-depth profiles of 11 major market players and 30 major OTC markets, this insightful report also offers sales data for 2015 and 2016, key trends and developments, new product activity, retail channel sales, marketing activity, and five-year forecasts of this prosperous industry. In addition, our soon-to-be-published Pain Management Devices: Global Market Analysis and Opportunities will round out the pain remedies landscape by exploring the latest in powered and non-powered devices.