With more relaxed attitudes about sexuality, there is a proliferation of sexual wellness products in both retail and online stores. Vibrating devices, supplements for sexual enhancement, condoms, and personal lubricants are everywhere. More and more retailers and online sites are embracing consumers’ interest in adult toys. There are increased sections of brick-and-mortar stores devoted to these products while television advertisements for erectile dysfunction (ED) medications air on a regular basis. If marketers are successful in gaining FDA approval for Rx-to-OTC switches of prescription ED medications, this market is poised to see strong double-digit gains over the next few years. ED medications currently sold via prescription that could make the switch to OTC status include Cialis by Eli Lilly/Sanofi, Bayer’s Levitra, and Pfizer’s Viagra. Switch timing, likelihood of approval, impact on the market, and sales forecasts for each of these drugs are analyzed in-depth in our Rx-to-OTC Switch Pipelines USA: Competitive Assessment report.

Adult and specialty stores are major channels for sexual wellness products, but mass merchandisers and drug stores are also seeing opportunity in the category and are experimenting with introducing these kinds of products into their stores. Online sites that are specialized in these products offer not only a privacy advantage, but often serve as forums where consumers can discuss product advantages and preferences. According to our Sexual Wellness: U.S. Market Analysis and Opportunities report, about 25% of all sexual wellness products are sold online. Amazon.com is a major sales force in the category, with sexual wellness products generating an estimated $339 million in retail sales in 2014.

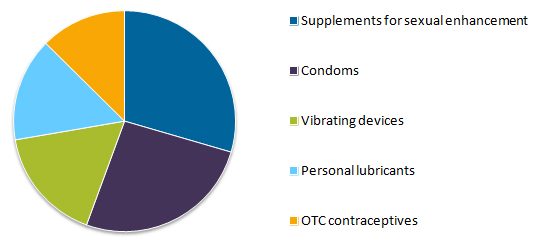

Market Shares of Consumer Sexual Wellness Products, 2014

SOURCE: Kline’s Sexual Wellness: U.S. Market Analysis and Opportunities report.Due to the increased retail shelf space allocated towards sexual wellness brands, OTC feminine products including feminine yeast infection remedies, deodorants, and itching medications need to fight to maintain shelf space in this section of retail stores, as well as expand their presence online. Increasing online presence or pairing themselves with feminine protection products online, such as pads or tampons, are ways for brands like Monistat (Prestige Brands) and Summer’s Eve (C.B. Fleet) to maintain sales and market share. A full analysis of sales through all retail outlets of feminine remedies, OTC contraceptives, and personal lubricants is covered in detail in Kline’s Nonprescription Drugs USA Feminine Products chapter.

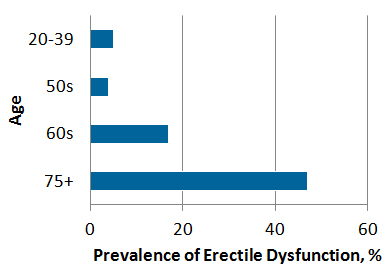

Statistics on Erectile Dysfunction

With such exciting statistics, there is certainly a healthy appetite for sexual wellness products. The aging of the population and increased incidence of ED will help this market grow even stronger in the near term. The prevalence of ED among men over age 75 is expected to drive demand for supplements that enhance sexual performance and could create a robust OTC market for ED medications.

To learn more about the sexual wellness and ED markets, please consult our insightful Sexual Wellness: U.S. Market Analysis and Opportunities, Nonprescription Drugs USA, and Rx-to-OTC Switch Pipelines USA: Competitive Assessment reports.