The most recent merger impacting the OTC market was announced yesterday and involves Sanofi acquiring the consumer health unit of Boehringer-Ingelheim Pharmaceuticals in exchange for Sanofi’s Merial Animal Health business. This swap is still in negotiations; however, the addition of Boehringer-Ingelheim’s consumer health business will serve to broaden Sanofi’s global OTC portfolio in cough/cold, digestives, analgesics, and vitamins, as well as expand the company’s reach in key markets, such as Germany, Japan, and China. In 2014, Sanofi and Boehringer-Ingelheim had combined OTC sales of $942 million in the United States, ranking sixth in the market.

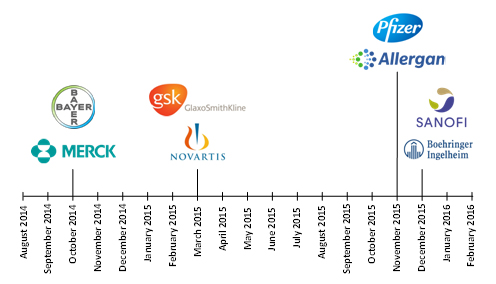

This deal follows several that have taken place over the past 14 months where major competitors in the OTC industry have merged or created joint-venture companies in an effort to expand their global reach, widen brand portfolios, achieve higher revenue growth, and seek cost synergies. Beyond strategic bolt-on acquisitions, such as Reckitt Benckiser’s acquisition of the Schiff vitamin and supplement business in October 2012, these recent mergers have made large competitors into global giants with portfolios that span nearly every consumer health category.

In October 2014, Bayer acquired Merck’s Consumer Care division, adding Claritin and Miralax to its existing OTC franchise. The newly combined company had OTC sales of $2.2 billion in 2014, ranking second behind the perennial leader Johnson & Johnson. In March 2015, GlaxoSmithKline and Novartis Consumer Health announced the creation of a joint-venture company to market their collective OTC brands, with Rx-to-OTC switches at the forefront and expected to drive future sales growth for the new venture. In 2014, the combined OTC portfolios from GlaxoSmithKline/Novartis delivered sales of $1.2 billion, ranking fourth among the major marketers.

While news of the Pfizer and Allergan merger stirred up talk of tax inversion and offshore assets, this deal, which was announced in November 2015, will also modify the makeup of Pfizer’s OTC portfolio, adding future switch opportunities to an already robust switch pipeline.

Aside from expanding global OTC portfolios and distribution into new markets, these mergers also cause drastic shifts in cost structures. Initially, there are costs related to the merging of two businesses, but eventually cost synergies are realized with increased buying power, expanded manufacturing capacity, and more efficient marketing spending and development costs.

As a result of recent significant changes in the competitive makeup of the OTC industry, Kline is kicking off fresh research for the 10th edition of its OTC Drugs: U.S Competitor Cost Structures study. This unique and objective report offers clients with a source to benchmark internal cost structures against those of the competition and to understand how new corporate alliances have affected cost structures. The research reveals profit and loss line items for each player’s OTC business and their largest OTC product classes and has been a trusted resource among finance and business development executives in the industry for many years. To learn more, please contact our team.