Oral contraceptives (OCs), known commonly as “the pill,” are prescription medications that prevent pregnancy. The most common brands of OCs contain hormone combinations of estrogen, progestin, and/or progesterone. These products have been used for years and were first launched on the U.S. prescription market in the 1960s. While OCs resulted in a new era of pregnancy protection for women, they were not without potential side effects to be considered, including risk of blood clots, heart attack, stroke, high blood pressure, and breast cancer (particularly for women who smoke). To date, OCs have proven to be one of the most popular forms of birth control, due to ease of use, efficacy, and their good safety profile for most women.

There are several groups advocating for the Rx-to-OTC switch of oral contraceptives—with the view that OCs do have a favorable safety profile and that consumers can properly “self-diagnose”. Ibis Reproductive Health, a private nonprofit women’s advocacy group, wants to “free the pill” and created a project by this name to advocate for the OTC availability of OCs. While freethepill.org claims it is not funded by pharmaceutical companies or the government and is not affiliated with or funded by any political party, Ibis Reproductive Health is working in collaboration with French pharmaceutical company HRA Pharma, the maker of NorLevo emergency contraceptives, to submit an application for switch to the U.S. FDA. NorLevo, a progestin-only OC, is sold without a prescription in France and other parts of Europe. For some women, progestin-only OCs may offer a better alternative than combination OCs, particularly for women who are at risk for thromboembolism.*

*SOURCE: “Progestin-only contraceptive pill use among women in the United States”, published June 2012, National Center for Biotech Information, U.S. National Library of Medicine.

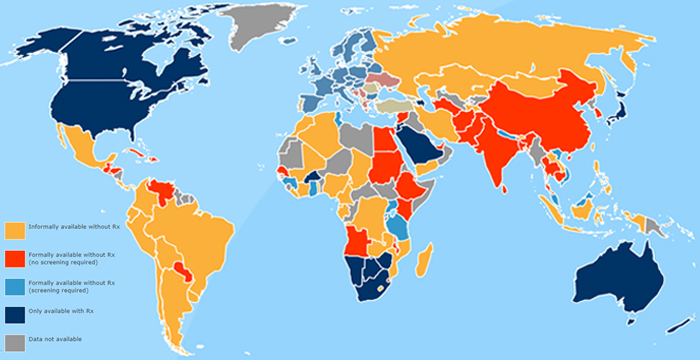

OCs are sold without a prescription in over 100 countries around the world

In the United States, the Rx-to-OTC switch of emergency contraceptives took place in 2006 with the switch of Teva’s Plan B emergency contraceptive. This switch was highly charged politically and took many years in order to gain approval and, once approved, Plan B was limited to BTC status for several years. Lawsuits and politicians’ involvement in the switch were plentiful. Planned Parenthood representatives were also vocal in the media regarding this switch. It is likely that any future switch of oral contraceptives would be fraught with politics, litigation, potentially negative press, and timing would be challenging to precisely predict. Given these political and unpredictable market conditions, it is questionable if pharmaceutical OC marketers would be willing to invest in costly clinical studies to prove the safe and effective use of these drugs without a prescription. However, if a progestin-only OC from HRA Pharma or another company advances in the OTC switch process, that is the proverbial game-changer and will most likely trigger a call to action for the major marketers of OCs in the United States, such as Johnson & Johnson, Actavis, Bayer Group, Pfizer, Allergan, Teva, etc.

There is widespread availability of other OTC contraceptive products, including condoms, films, gels, and creams. OCs do not offer any protection from sexually transmitted diseases as other barrier methods do, and this will likely be a consideration of the FDA when evaluating an application for the Rx-to-OTC switch of an oral contraceptive. Furthermore, under the Affordable Care Act, insurers are required to offer coverage of prescription contraceptive methods with no co-payment required for patients. The OTC availability of OCs would shift the costs of these medications from insurers to patients in most cases.

Today’s regulatory environment for switch in general is quite challenging, especially for prescription drugs with disputed safety profiles. Furthermore, the current conservative administration is highly unlikely to allow enhanced access to oral contraceptives. However, environments do change and while Plan B was once thought to be an extremely unlikely switch candidate, it was eventually approved under the right circumstances.

Given the current regulatory and political uncertainty, a prudent strategy would be to carefully monitor the activities of Ibis Reproductive Health (including the results of their self-selection and actual use studies, along with any potential filings with the FDA). In addition, close evaluation of changes within the political environment should also be carefully monitored.

Kline & Company has been studying the prescription and OTC women’s health markets for decades. Our Nonprescription Drugs USA and Sexual Wellness studies provide sales and segmentation information and market insights on many related categories. Our series of reports on Rx-to-OTC Switch Forecasts also offers comprehensive analysis of regulatory and market trends and forecasts on likelihood of oral contraceptive switches. Kline also offers custom consulting on women’s health and Rx-to-OTC switches. For more information on Kline’s portfolio of studies on the women’s health market and our consulting services, please contact us.