Operating under tight budget constraints, many small businesses are purchasing jan/san chemicals from retailers as they offer convenience and value pricing. While the majority of jan/san chemicals are sourced from janitorial supply and paper distributors, there has been an increase in sales through retailers for these products. In this article, we profile three retail channels that are emerging as popular sources for jan/san chemicals and examine their appeal to small business, contract cleaners, and other institutional end users.

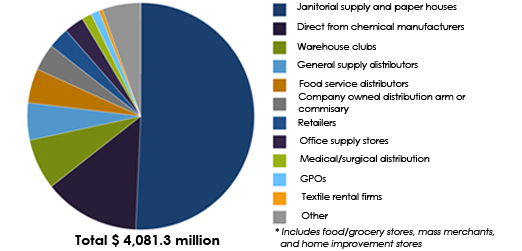

Share of Jan/San Sales by Distribution Channel, 2014

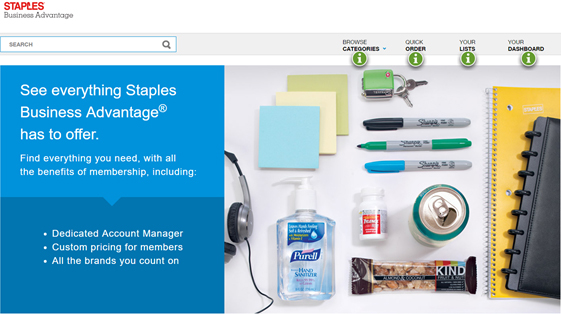

OFFICE SUPPLY STORES

With over 3,000 stores in 26 countries, U.S. retailing giant Staples builds a technology platform to simplify purchase processes for businesses and institutions. Today, named a truly industry disruptor, Staples Advantage is gaining momentum among the office supply stores. Staples Advantage provides a one-stop shop for all business supplies offering personalized programs to each client regardless the industry and company size. End users can choose from office supplies, janitorial cleaning products, breakroom items, and other categories, from national brands and niche manufacturers, which are guaranteed to be delivered the next business day free of charge. For value-seeking customers, Staples Advantage has a green program, where clients can purchase eco-friendly products and keep track of their progress in building sustainability. With the brand promise “We make buying office products easy,” the company positions itself as an easy solution for businesses to simplify purchasing process and reduce associated costs.

WAREHOUSE CLUBS

Costco is the largest membership-only warehouse retailer selling a wide variety of products and services. To serve business clients, Costco Wholesale established a Costco Business Center, an annual Business Membership Program. Executive membership allows members to save 2% on each purchase, with an annual membership price of $55.00. Business members are allowed to shop for business, personal and resale uses in the Business Center or online. Providing free next-day delivery on orders over $250.00, a wide selection of national brands, strategic location of the warehouses in 15 states, a 100% risk-free satisfaction guarantee, and the lowest prices on the market, Costco is winning the loyalty of U.S. small businesses and institutions.

Sam’s Club is a members-only subsidiary of Walmart that caters to small companies through 655 warehouses in the United States. With the $45.00 annual Sam’s Club Business card, clients can purchase business supplies and janitorial cleaning products and save extra on top of the regular low prices offered by the retailer. The company continues to add value to its clients through additional services. In 2014, it introduced three new programs, including health care, payroll, and legal planning. In 2015, Sam’s Club introduced five new services, claiming that it can help small-businesses save up to $2,300 per year. These new services include assisting small businesses in building their online presence, accounting services to help with the tax planning and bookkeeping, and online payment processing. Sam’s Club Business Lending provides loans up to $350,000 to small business owners.

HOME IMPROVEMENT STORES

Offering DIY solutions for small and medium-sized businesses, Home Depot is the leading player in the U.S. home improvement market. With a nationwide network of warehouses, the company has a capacity to provide a wider selection of products and lower prices compared to competitors. Moreover, it offers a wide range of additional services, including truck and tool rental, installation, and décor. In addition, Home Depot has its own credit center offering pay and manage cards and loans for up to $55,000. To help professionals and contract service providers to improve their bottom line, this big-box store offers faster ordering and pickup, job site delivery, and bulk pricing.

Retailers are an increasing source of competition for jan/san purchases. Warehouse clubs, home improvement retailers, and office supply stores offer small business owners one-stop shopping, value pricing, and value-added services that are appealing to many end users. Other factors, such as store location, length and price of delivery, product portfolio, membership benefits, and value-added services, are also driving end users to buy from these stores.

The new edition of Kline’s Janitorial and Housekeeping Cleaning Products: U.S. Market Analysis and Opportunities report will provide an in-depth analysis of the distribution channels for jan/san chemicals, including major channels, such as janitorial and paper supply houses, direct sales, and warehouse clubs, and niche channels such as office supply stores, home improvement retailers, cash and carry, and online sales.

To get more details about the report and how it can help in your strategic planning process, please visit our WEBSITE or directly CONTACT our team.

Articles you might be interested in:

|

|

|

| The Face of the Jan/San Market Continues to Change

|

Floor Care Robots and Wide Area Air Care Products Steal the ISSA Interclean Show

|