Kline + Company Leads The Way

In Market Research

For decades, Kline + Company has been the trusted leader in industrial market research, delivering deep insights and strategic advisory services across the specialty chemicals, lubricants and petroleum specialties, and beauty industries. When industry leaders need data-driven decisions and game-changing research, they turn to Kline. Many of our long-standing clients routinely say, “It’s Kline at the top of the stack and then everyone else.” Let's Talk

Industries We Serve:

Founded in 1959 by chemist and Princeton graduate Dr. Charles Kline, our company was built on specialty chemical research—a sector that remains at the heart of our expertise today.

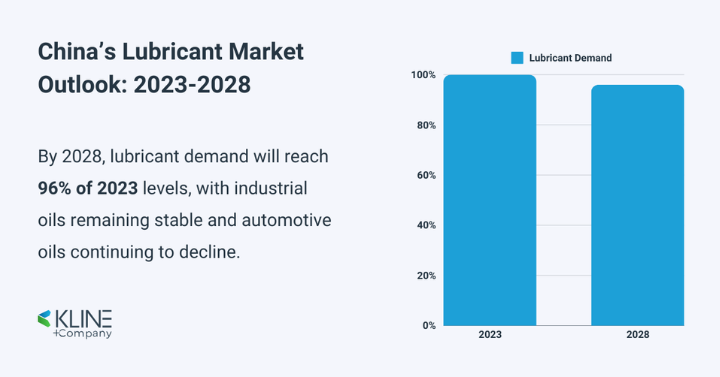

We are dedicated to helping our lubricant clients innovate, adapt, and lead as they navigate the transformation of the energy industry, ensuring long-term success in an ever-evolving global market.

We are the undeniable industry leader in professional beauty, providing expert data and business growth consulting for professional hair care, skin care, nail care, and beyond.

Markets are constantly evolving, and staying ahead requires more than just data—it demands strategic insight and that’s where our name stands out among all the other market research firms. Learn More

Not All Market Research Firms Are Created Equal……

At Kline + Company, we offer strategies that drive real-world impact. But what makes us different? Interactive consulting, customized research, and forward-thinking analysis. Our clients call us their go-to resource because we don’t just track trends—we predict and shape them. So, are you ready for insights that fuel smarter decisions and drive real growth?

- Decades of Expertise – With a legacy dating back to 1959, we bring unparalleled experience in specialty chemicals, energy, beauty, and beyond.

- Actionable Insights, Not Just Data – We go beyond reports, delivering strategic recommendations that drive real-world impact.

- Customized Research & Consulting – No one-size-fits-all solutions; we tailor our analysis to meet your business’s unique challenges.

- Forward-Thinking Approach – Rather than just monitoring industry trends, we forecast changes and shape the market, keeping you ahead of the competition.

- Trusted by Industry Leaders – Our clients see us as their go-to resource for market intelligence, guiding them toward smarter decisions and sustainable growth.

Don’t just react to market changes—stay ahead of them with a team that truly understands the landscape of market research. Let’s build your success together.

Business Growth Consulting & Market Intelligence That Works

In a rapidly evolving world, having the right intelligence isn’t just an advantage—it’s a necessity. We decode complexities, uncover opportunities, and build strategies that fuel lasting success. Whether you’re tackling competitive pressures, industry disruptions, or innovation challenges, we provide the insights and foresight to keep you ahead. Potential areas that we can help you out with include (but not limited to):

- Market Intelligence – Make informed decisions with competitive research, market analysis, customer insights, and opportunity screening. We help you understand the full value chain and identify your next move.

- Predictive Analytics & Forecasting – Stay ahead of market changes with scenario planning, market simulation, and price elasticity analysis to anticipate risks and opportunities.

- Strategy & Business Growth – From growth strategy and M&A due diligence to go-to-market models, we help businesses expand and thrive.

- Technology & Innovation – Optimize your portfolio, assess emerging technologies, and commercialize innovations with expert guidance.

- Sustainability – Adapt to an evolving landscape with best practices research, marketing support, and sustainability-driven strategies.

- Food & Ingredients – From M&A assistance to nutraceuticals and functional food strategies, we help you capitalize on market trends.

Don’t just react to market changes—stay ahead of them with a team that truly understands the landscape of market research. Let’s build your success together.