For a product to be considered a clean-label one, ingredients are the main consideration. There are no current scientific, legal, or regulatory definitions for clean-label ingredients. However, three main criteria are generally followed to recognize an ingredient as clean label: Ingredients should be naturally derived, non-GMO, and easily recognizable or do not have a chemical-sounding name.

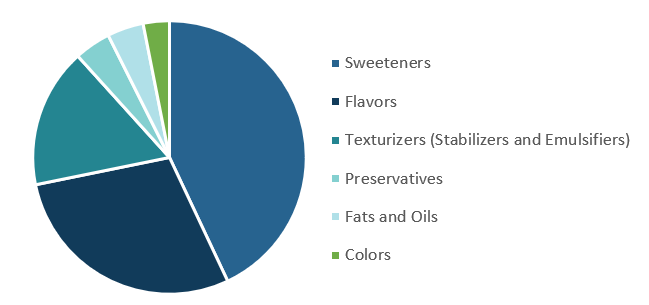

Today, the U.S. clean label ingredient market for sweeteners, flavors, texturizers (stabilizers and emulsifiers), preservatives, fats and oils, and colors represents around 7%-10% of the total food ingredients market in the U.S. According to Kline’s Clean Label in Food and Beverages: Perception vs. Reality, sweeteners, flavors, and texturizers (stabilizers and emulsifiers) are the three leading categories, accounting for around 88.3% of the total clean-label market in the United States in 2019. Here’s some information on them:

CLEAN LABEL INGREDIENT MARKET SHARE IN THE UNITED STATES, 2019

Source: Kline’s Clean Label in Food and Beverages: Perception vs. Reality report

- Sweeteners

Sweeteners, a common ingredient used in large quantities in various food items, are the largest clean-label ingredient category with a total market value of around USD 2.2 billion. The clean-label sweetener market is projected to continue to dominate the U.S. clean-label ingredient market through the forecast period. There are various ingredients, such as sorbitol, xylitol, mannitol, stevia, and honey, that are used as clean-label alternatives to conventional sweeteners in food items in the United States. Calorie-counting diets and price are driving the usage of ingredients such as sorbitol, xylitol, and mannitol, which offer fewer calories than sugars and are also relatively lower priced. - Flavors

Flavors is another ingredient category that has been deeply impacted by the shift toward clean-label ingredients. They are expensive ingredients, leading to high market value for them, and while they are consumed in small quantities, flavors are projected to be the fastest-growing segment in the U.S. clean–label ingredient market. In fact, the segment is projected to grow at the highest CAGR of 10.2% during the forecast period. Major food flavors used for clean-label solutions are natural extracts, essential oils, and spices. - Texturizers (Stabilizers and Emulsifiers)

The demand for processed and convenience foods is growing. Texturizers provide a stable structure to a food item and thus help increase its shelf life. As processed and convenience foods need to have a longer shelf life, texturizers are an important constituent of such food items. Thus, the growing demand for processed and convenience foods is driving the demand for texturizers (stabilizers and emulsifiers). Common clean–label texturizers used in food items are lecithin, acacia gum, xanthan gum, and guar gum.

The Clean Label in Food and Beverages: Perception vs. Reality report shines a spotlight on key ingredients, category offerings, and retailer initiatives. Additionally, this analysis assesses market opportunities throughout the value chain, from ingredients to consumers. Whether it is consumers’ views on clean-label products, brand offerings and ratings, or an outlook on the entire industry that you’re looking to gain competitive intelligence about, we’ve got you covered with reliable data and insights that will help you pick up on trends, developments, and business opportunities.