From 2010 to 2011, the U.S. OTC drug market posted a gain of 2.4% from $20.9 billion in 2010 to $21.4 billion in 2011 at the manufacturers’ level. The fastest growing categories include allergy relief products, which grew 16.3% in 2011 aided by the market launch of Rx-to-OTC switch brand Allegra (Sanofi-Aventis) and the strong growth of private-label allergy relief products. Past Rx-to-OTC switch brands continue to perform well with Rogaine (Johnson & Johnson) and Plan B (Teva Pharmaceutical), both posting strong gains in the hair regrowth products and contraceptives markets, respectively.

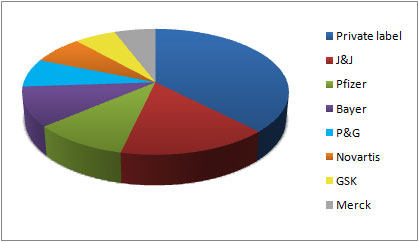

Private-label OTCs continued to have another stellar year in 2011, mainly benefiting from new product launches and the sustained outages of many of Johnson & Johnson’s OTC brands from store shelves. Overall, private-label OTCs are up 8.7%, now accounting for more than one-fourth of overall sales for the OTC market.

Johnson & Johnson’s OTC unit continues to experience steep declines as a result of its manufacturing issues. However, most other major branded OTC companies performed well in 2011. Sanofi-Aventis’ OTC sales are up over 100% in 2011 because of the launch of Allegra, and Pfizer’s sales are up 5.6% based on strong sales gains of the Centrum, Advil, and Caltrate lines. Novartis’ sales are up 4.6% driven by growth of Excedrin, Triaminic, and Maalox. Sales gains of Nyquil, Dayquil, Metamucil, and Align help to lift Procter & Gamble’s OTC sales up 4.5% in 2011. Bayer’s OTC sales are up 4.0% in 2011 based on gains of One-A-Day, Aleve, Bayer Aspirin, and Alka-Seltzer.

Smaller companies have also managed to post solid gains, above the industry average in 2011. Prestige Brands’ OTC sales rose 15.1% as it experiences strong growth from its Pediacare, Little Remedies, and Little Tummy’s lines of children’s OTCs, as well as gains from the recently acquired cough drop brand Luden’s.

Market shares of leading OTC marketers, 2011