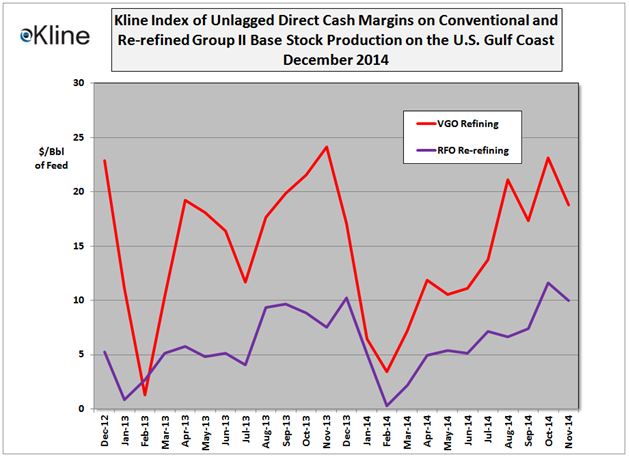

In January, Kline & Company, a worldwide consulting and research firm serving needs of organizations in the lubricants and base stocks industry, introduced its monthly Base Stock Margin Index, a characterization of recent cash margin contributions in the U.S. base oil market over the past 24 months.

The Index estimates cash margin contributions associated with U.S. Group II base stock production. It simulates EBITDA before the deduction of corporate SG&A expenses for typical VGO-based virgin base stock plants and RFO-based re-refineries.

“Margins on spot trade, as well as on lagged postings, are showing a downward cash margin trend. Since June of 2014, as Brent crude oil has collapsed from $110/Bbl to around $60 today, VGO and refined products have quickly followed suit. Base oil prices, notably on contract business linked to postings, have weakened also, as evidenced by the latest round of posting adjustments recorded in mid-December. If the free fall in mainstream oil prices is finally halted by the end of 2014, we expect to see a slide in contract cash margins as the embedded lag in base oil price adjustments finally catches up with real time market conditions. Underlying fundamentals continue to be weak, as new capacity has come on line in Europe (SK-Repsol ), and in Korea (Shell-Hyundai Bank).”

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff, Director (Ian.Moncrieff@klinegroup.com) at (973)-615-3680 in Kline’s Energy Practice.