Shayna Hofmann

Analyst, Beauty and Wellbeing

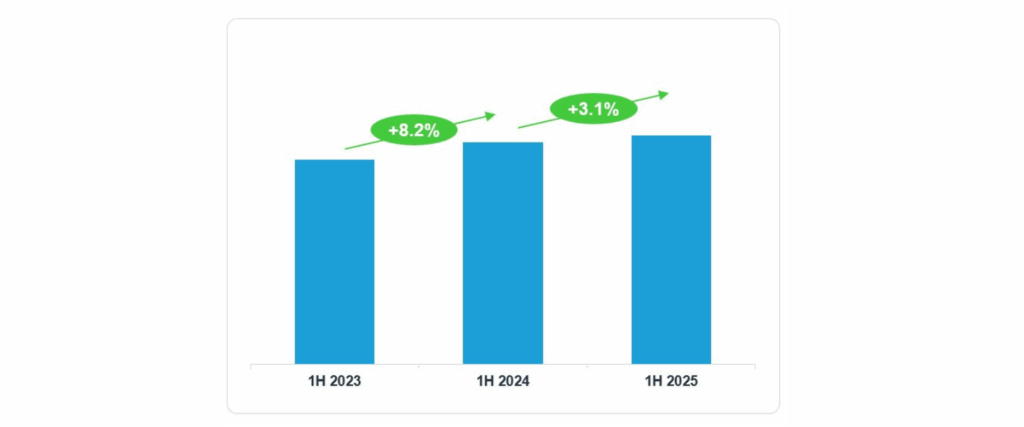

The U.S. medical-dispensed skin care market grew only 3% in the first half of 2025, indicating a sharp deceleration from the 8% pace seen in 2024 and double-digit growth in prior years, finds Kline’s latest Medical-Dispensed Skin Care: 2025 Mid-Year Update. Supply chain pressures, economic headwinds, and increasing caution in consumer spending contributed to softer in-clinic traffic and slimmer order volumes from clinics.

First Half of 2025 Sell-in Growth Trends in the Medical Care Providers Channel*, 2025

Leading professional skin care brands are sustaining growth through innovation and stronger clinical alignment.

SkinCeuticals maintained its #1 position on the leaderboard, with momentum sustained from its 2024 procedure-paired P-TIOX launch. It was further supported by the H1 2025 debut of Advanced RGN-6, a post-laser recovery cream, which helped the brand outpace the market.

Hydrinity nearly doubled sales, driven by more flexible physician terms and rapid field expansion, marking itself as one of the fastest risers in the channel.

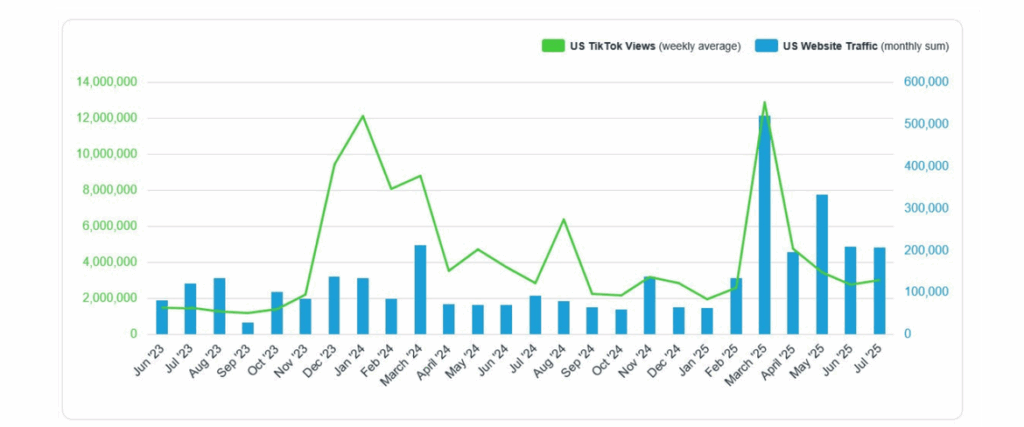

Colorescience delivered strong, double-digit growth overall, supported by shade extensions in its mineral SPF portfolio, robust esthetician adoption due to post-procedure tolerability, and viral traction on TikTok. According to our just-published Beauty Indies: U.S. Analysis of Brands to Watch, the brand witnessed a peak in March 2025 due to paid search to Total Protection Face Shield FLEX SPF 50, which helped stimulate organic search.

Colorescience U.S. Popularity: TikTok Virality and Website

Economic caution is shifting clinic and consumer behavior.

Practices are streamlining protocols and favoring multifunctional, procedure-paired products, while patients are simplifying at-home regimens and seeking stronger value perception around innovations. In line with this, brands such as Hydrinity, Senté, and Plated position SKUs to complement and enhance the existing regimens while delivering multifunctional benefits, including Senté’s Neck Cream, Hydrinity’s Restorative Kit, and Plated’s exosome-based serums.

Regenerative technologies, including exosome- and peptide-based formulas, are emerging as the next growth vector in professional skin care.

The exosome skin care market is seeing triple-digit growth rates, fueled by shoppers seeking proof and shifting toward evidence-backed solutions. Given the novelty of this segment, the professional channel has become the most critical pathway, with brands targeting dermatologists, nurse practitioners, and other healthcare providers who validate efficacy, educate patients, and ultimately drive adoption.

New players such as Provoque highlight the momentum of regenerative ingredients. Moreover, Hydrinity’s new launch of RetaXome Daily Retinal Hydrator showcases how biomimetic exosome delivery is being applied to elevate core actives such as retinal.

E-commerce continues to outpace the medical care providers channel, with sales up double digits in H1 2025.

Amazon remains a critical growth engine, offering brands both consumer reach and margin resilience. Colorescience, EltaMD, and Alastin are standout performers online, while SkinBetter and ZO Skin Health continue to grapple with diversion risks due to their medical-dispensed channel exclusivity.

Amazon’s Premium Beauty segment, where professional brands such as Colorescience sit, grew nearly 20% YoY to $15 billion (Apr 2024–Apr 2025), providing a margin-accretive buffer against tariffs and supply-chain volatility, according to Reuters. Dermstore also remains a critical online hub for professional and clinical skin care, underscoring the role of curated platforms in driving category visibility and consumer trust.

Looking ahead, the second half of 2025 is expected to rebound to more moderate single-digit growth, supported by blockbuster launches timed to post-summer clinic engagement and holiday promotional cycles. With regenerative science innovation and flexible clinic partnerships shaping strategies, the medical-dispensed skin care market is entering the second half of 2025 with a more measured but steady growth trajectory.

For a deeper dive into the U.S. medical-dispensed skin care market performance, including brand-level growth, channel trends, and emerging innovation, refer to Kline’s Medical-Dispensed Skin Care: 2025 Mid-Year Update.