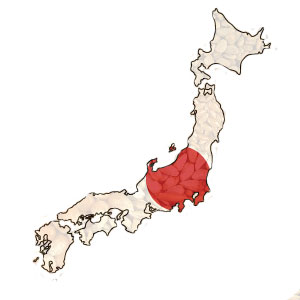

The market for seed treatment products in rice areas in Japan approaches USD 48 million at the manufacturers’ level applied to approximately 1.54 million base hectares in 2013.

Seed treatment represents approximately 8% of the Japanese market for fungicide, insecticide, and fungicide/insecticide products applied in rice, valued at roughly USD 611 million distributor-level values in 2013. The market for foliar, planter box, and in-furrow fungicide and insecticides represents the remaining percentage of total sales to control disease and pests in rice.

As a result of a slight increase in planted area and favorable yields due to generally positive weather conditions throughout the growing season, overall rice production volume increased over the previous year. Likewise, bullish wholesale prices encouraged increased planting in 2013.

The aim of seed treatment is to prevent diseases in the post-seeding stage when the crop is growing. Seed treatment is mostly done with agrochemicals, but the increasing interest in reduced-chemical cultivation in recent years has motivated some farmers to treat seeds with hot water instead of chemicals to kill bacterial pathogens in seed rice.

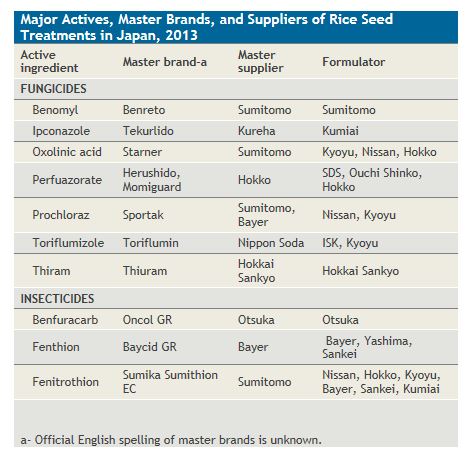

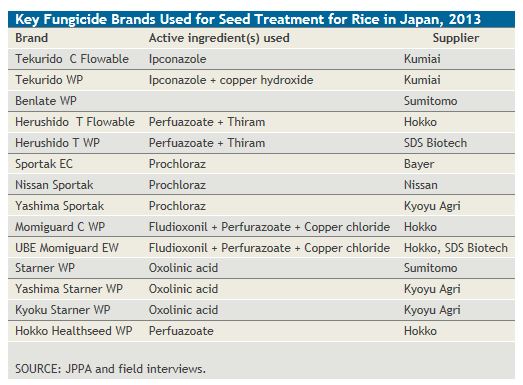

While microbial pesticides and hot water treatments have gained some market share in the past decade, synthetic agrochemicals continue to provide the most stable and effective approach to control a broad range of rice diseases. Chemical seed treatment products in Japan are based on a few active ingredients formulated into branded products.

Only three insecticide active ingredients are used to protect rice seed: fenitrothion, fenithion, and benfuracarb. These are formulated into multiple products to enable formulators/marketers to provide rice growers with insect protection for rice seed.

In recent years, Japanese consumers have become increasingly interested in environmental conservation-oriented agriculture and are becoming increasingly concerned about food safety. There is presently an increasing demand for environmentally friendly techniques to replace chemicals in pest and disease control in crops, including the one sown over the largest area in Japan (rice).

Kline’s chapter on Japan of the global seed treatment market research is a detailed analysis of the Japanese seed treatment market in 2013 covering the following topics:

- Crop background and planted acres

- Crop end use by acres or volume

- Production and crop protection methods

- Key seed suppliers and their product capability with treatment

- Role of seed treatment as crop protection method

- Key diseases, insects, nematodes, and other reasons seeds are treated; regional differences within countries when appropriate

- Chemical treatment methods for target diseases and insects and non-chemical alternatives

- Product sales and market share for seed treatment products

- Active ingredient use for seed treatment products

- Sales by company for seed treatment products

- Seed treatment outlook and assumptions by crop background