The development of biological technologies for pest control in Latin American markets has been growing at an impressive rate over the last few years. As demand for healthier foods increases, so does organic farming, and the government actively supports the use of biological pesticides by purchasing from suppliers and selling to farmers at a lower price. On a global scale, the United States remains the leading participant in the global biopesticide market, with 35% of total sales, being followed by China at a distance with just over 11%. Argentina, Brazil, Chile, and Mexico are enjoying a steady growth rate, reaching ranges of between 2% and 3% of total global sales. Overall, the global biopesticides market is projected to grow at a CAGR of just under 10% over the next five years, reaching nearly USD 3 billion by 2024. However, the COVID-19 outbreak is a new potential source of volatility and a threat to the macroeconomic stability of Latin America and the Caribbean, but it is still too early to fully understand its impact on growth in these countries.

The rapid growth of the biological pesticides market is explained by a few factors. They include the high cost of developing a new chemical defensive, greater focus on sustainable agriculture, increased resistance of pests to chemical pesticides, limited supply of new molecules by producers of agrochemicals, and significant technological advances verified in the area of biological pesticides, with the development of more efficient formulations and longer shelf life. One of the key market drivers for the biopesticide industry, however, is food safety.

In Brazil, as organic agriculture grows in interest, the market for biological pesticides is in full development, especially in crops such as sugarcane, soybeans, corn, and beans. At present, the total production capacity of the companies dedicated to the biological control sector is enough to cover only 20% of the area sown in the country and is insufficient to meet a possible sharp increase in demand.

Brazil is a world leader in the production and export of many agricultural products, and its production of coffee, cocoa, sugar cane, soybeans, and corn plays an important role in the global economy.

Agribusiness is responsible for an estimated 23% of the GDP in 2019, with just over 3% growth over the previous year. Mexico, on the other hand, is the 11th country in the production and export of tomatoes, chilies, berries, avocado, and corn, playing an important role in the global economy. Agribusiness is responsible for an estimated 3% of the GDP in 2019, showing solid growth since 2012. Chile’s share of the agricultural, livestock, and forestry sectors in the total economy averages 3% of the GDP. The agriculture industry is responsible for 28% of total Chilean trade.

Mexico, Brazil, and Chile are three countries that play a vital role in production and export of many agricultural products, accounting for nearly 3% of the global sales, followed by Argentina at 2%.

One of the factors explaining the excellent sales performance in Brazil is the increase in the launch of innovative products, and this can be applied to all four markets. The market for Chilean and Argentinian biopesticides is dominated by mineral pesticides, accounting for more than 60% of the total sales for Chile, specifically. The other 40% is divided among microbiological, botanical, and biochemicals.

The use of biopesticides is an attractive business in both Mexico and Brazil and has seen opportunities in recent years due to demand from the export market. The arrival of new generations of farmers in the Mexican fields brought new ideas and technological solutions that are commonly accompanied by Integrated Pest Management, which involves the use of biopesticides. Presently, the use of chemical pesticides still dominates in these markets, but the value of biological over chemical control of insects and pests has increased in recent years.

When it comes to the supplier landscape in Mexico, Brazil, Chile, and Argentina, several leading U.S. companies have a significant presence in these markets. Notwithstanding, the domestic market has not been left behind, and over the last few years, the government has provided funding to support a growing number of biopesticide-based laboratories. To be more specific, the leading suppliers of biopesticides for the Mexican market in 2019 were BASF, Valent, and Bayer. As far as the Brazilian supplier market is concerned, Ballagro remains the leading supplier of biopesticides in 2019, followed by Koppert and Bayer. There are common players in all four markets, including BASF and Bayer.

The natural tendency is that chemical pesticides companies will introduce into their product portfolio those of biological control. Existing small businesses can be looked at as an opportunity for entering the market. Experts believe that in 20 years, the advance of natural control will become exponential. The biopesticides market in all four countries is a promising market, growing at a fast pace and introducing new products every year. For instance, in Chile, the mineral sector is the largest, accounting for about 64% of the biopesticides market; that market is steadily growing at 5% and spreading at higher rates to Latin America. Meanwhile, in Mexico, the sector of microbiological products represents 2% of the total Mexican turnover of plant protection, and despite the still-small share, this sector is rapidly evolving, both in quantity and in technological levels.

The factors behind the increase in biopesticides demand are the restrictions on chemical pesticides, the need for residue-free products, and an increase in environmental awareness. In Chile, for instance, the benefits are related to the prospect of exporting products to foreign markets. Fruits and wines are susceptible to strict control of chemical traces, and the use of biopesticides is the best opportunity to export them without risking the protection and assurance of bio-production.

It can be concluded that growth prospects are enormous both with existing products and with those that are expected to be launched in the coming years. Knowing this, large chemical insecticide companies are increasingly interested in opening biological control lines, especially with an emphasis on microorganisms.

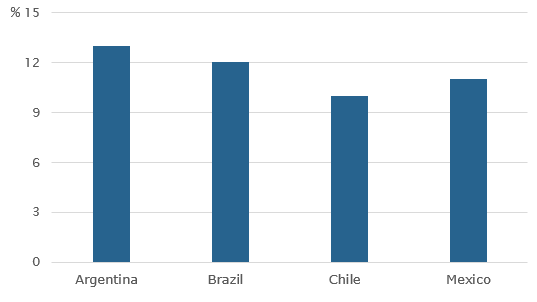

Going forward, Kline forecasts that the biological pesticide market in Chile, Brazil, Mexico, and Argentina will expand at a rapid pace over the next five years.

Biopesticide FutureView Forecast by Country, 2019 to 2024

The rapid growth forecast can be explained by the large growth areas in the export-oriented nation and the pressures imposed by the United States, China, and Europe. The American market requests lower chemical traceability of products, and this represents the answer in solutions such as biopesticides to comply with requirements in manufacturers who want to compete in that market.

Kline’s Global Biopesticides: Overview of Natural and Microbial Pesticides report, featuring Latin American markets is now live. It provides a detailed and invaluable analysis of the market, its trends, and sales of biopesticides for field, fruit, vegetables, specialty crops, non-crop, and seed treatment segments. Please, send us your feedback regarding which country would you prefer to see in our next report.