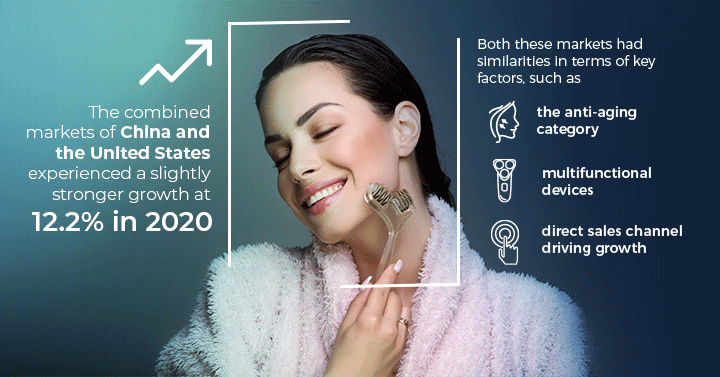

Valued at approximately $2.5 billion at the retail sales level, the market for at-home beauty devices in the United States and China performed better in 2020 compared to 2019 despite the coronavirus pandemic. The combined markets experienced a slightly stronger growth at 12.2% in 2020 compared to 11.9% in 2019. Both these markets had similarities in terms of key factors, such as the anti-aging category, multifunctional devices, and the direct sales channel, driving growth.

Anti-aging continued to be the key category driving growth for the United States, while increases in China were supported by the hair removal category. The continued popularity in the category was aided by the coronavirus lockdown, which brought out the inner aesthetician in consumers as they became self-dependent and resorted to using at-home beauty devices in the absence of spas, salon, and dermatologist office visits.

Moreover, marketers have been supportive of consumers, providing them with education and how-to demonstrations for devices through various social media platforms. Anti-aging devices targeting the periorbital area were the key trend across both markets and saw various new launches, such as Ya-Man’s X-EYE-Shield and Tripollar’s Stop VX in China and the Tripollar Stop Eye in the United States.

|

|

|

Multifunctional devices targeting various skin care concerns continued to be a trend from previous years across both markets. More often than not, these multifunctional devices are based on multiple technologies to offer variable functionalities. In China, some of the new devices included Dr Arrivo’s Zeus II and Notime’s 1703-RF, while in the United States, Reduit Spa and the Foreo Bear and Bear Mini were new in 2020.

|

|

|

|

For more insights, refer to our already published report series, Beauty Devices: Market Brief, offering an understanding of the at-home beauty devices market in China and the United States with a focus on the size and growth, importance of skin care concerns, product trends and notable new launches, technology landscape, key changes in distribution, and competitive landscape.