The salon hair care market is notoriously difficult to measure because it is more fragmented than nearly all other industries. With over 170,000 locations, mostly controlled by sole proprietors, and growth of booth rentals adding to the fragmentation, quantitative gathering of credible data has been practically impossible…until now. Through the revolutionary Kline PRO, we have done what nobody else has been able to do—a tool that measures sales of products both into salons, as well as into the hands of consumers, and now also services.

From the beginning of 2016, service dollars and number of transactions are being tracked and reported for seven different categories that include typical services, such as haircutting and coloring to “other,” which ranges from beard services and eyebrow tinting. Data shows which services are trending and the average price for each of them—even down to a region of the United States and the size of the salon.

Beyond service highlights, this revolutionary tool also offers critical data on brands to watch in this industry. Since information is received at the transaction level, Kline PRO is able to pick up and track the movement of brands that may not have wide distribution, but are showing growth and, many times, the products reflect the services that clients are demanding.

Earlier this year, in our blog “Ten Professional Hair Care Brands to Watch,” we mentioned Layrite. Since then, this brand has continued to grow its share of the pomades/pastes segment from 0.5% in H1 2015 to 2.2% this half. In fact, men’s products as a whole are up 9.1% H1 2016 over H1 2015. Kline PRO tracks over 75 brands in this segment, and the list keeps growing as the popularity of men’s grooming increases. Several brands had significant gains during this period.

Jack Black topped the charts with the highest percentage increase in sales at over 3,000%, but garners a nominal 0.3% share of the segment. The brand’s top item is Double Header Shampoo + Conditioner. We suggest watching to see if this product continues to grow in the same fashion as Layrite.

V76 by Vaughn from Luxury Brand Partners more than doubled its sales over the first half of last year. The hair styling products and sprays category is currently 76% of the brand’s business, driven by Tex Texture Paste, which experienced a 345% increase in sales during the first half of this year as compared to the same period one year ago.

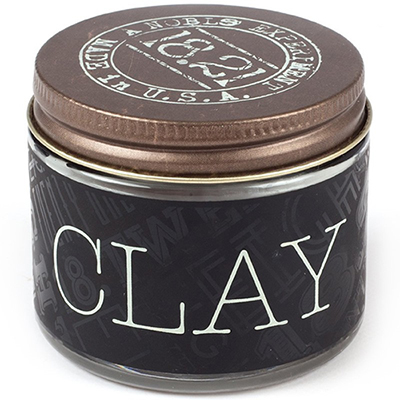

Another strong performance was seen by 18.21 Man Made. This brand won the “Audience Choice Award” at the 2015 Beauty Pitch event during the PBA Beauty Week at Cosmoprof North America. While the Man Made Wash is popular because it performs three tasks with one product, the leading item for 18.21 Man Made is Clay, which is a hybrid of wax and clay with a sweet tobacco aroma.

Baxter of California has had a steady presence in the Kline PRO database, but its recent doubling of sales both into and out of salons is not something all brands can accomplish and is certainly noteworthy. While the brand has both a daily shampoo and conditioner, pomades are the brand’s prominent products led by the Clay Pomade for a firm, matte finish and the Cream Pomade for a lighter, natural finish.

In case you are wondering, yes, there are brands that are not just for guys that are on the move. Reviv3 Procare is a drug-free system for both men and women with fine or thinning hair that is making its way into the hands of consumers according to sales in the Kline PRO panel of independent salons. The company’s sales so far this year are 12 times more than the same period one year ago. The Reviv3 part system of Prep Cleanser Shampoo, Prime Moisture + Conditioner, and Treat Micro Activ3 Treatment Spray is what is putting this brand on the map.

The TrueKeratin brand bills itself as “the ultimate eco-luxury treatment hair care brand that will transform hair immediately with visible results.” The brand was founded in 2009 and currently has less than a 1% share. However, what stands out is that, according to our database, the first half of this year saw TrueKeratin grow exponentially (18,000%) when compared to the same period last year. The Biocare line, which contains a shampoo and conditioner, drives the brand’s growth. We will watch to see if this growth extends into the second half of 2016.

A couple of other brands that grabbed our attention are Obliphica Professional and hbl. Obliphica Professional is a brand that has worked hard to make its mark. It has undergone a complete image makeover and is now reaping the benefits with sales growth for each of the last five quarters it has appeared in the Kline PRO database. Seaberry is Obliphica Professional’s miracle ingredient that is the basis of a full line of products. Conditioner products account for 49% of the company’s sales with shampoos at 27% and hair styling products and sprays at 24%.

hbl stands for Health, Beauty, Life and was founded by Patrick Dockry to offer “a holistic approach to hair care with premium ingredients without sacrificing performance.” The brand has care products for volume and hydrating with several additional conditioning products. Treatment Oil is its leading item with 30% of the company’s sales.

More about what is trending in products and services can be found in the Kline PRO database, which is published quarterly. PBA Executive Summit’s attendees will have the chance to see some key insights from this amazing program as Carrie Mellage, Vice President of Kline’s Consumer Products, is a featured speaker.

Written by Paula Gottdiner, Project Manager, Kline Consumer Products