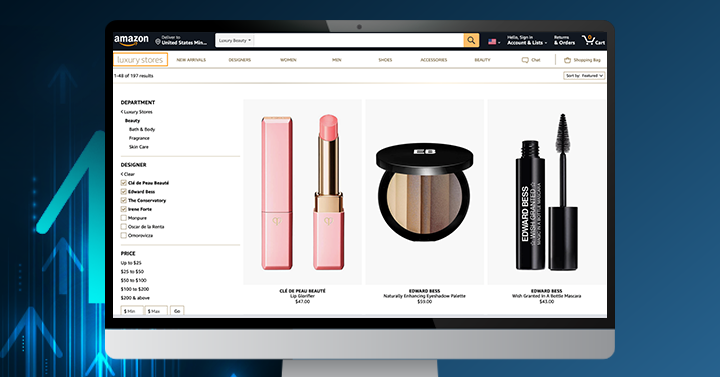

At the onset of the COVID-19 pandemic, premium and luxury beauty brands began doing what was once almost unthinkable — offering their goods on Amazon, with a growing number of them now calling the e-commerce giant’s separate Luxury Stores section “home.” So why the shift in attitude and sales strategies for brands like Kora Organics, Irene Forte, Edward Bess, Clé de Peau Beauté, and a selection from The Conservatory boutique?

According to Dana Kreutzer, our Project Lead of Consumer Products, “In the past, many prestige brands decided to enter Amazon simply to eliminate the pool of unauthorized sellers. But now, there are additional benefits to being there, which is why we’re seeing an influx in new partnerships being established between beauty marketers and Amazon.”

With consumers sheltering at home and brick-and-mortar outlets shuttered during the pandemic, a different approach to shopping became a necessity; accordingly, new preferences developed. For one, convenience became increasingly important to consumers, particularly among the younger generation, with Amazon becoming the go-to destination literally across the globe. These changes have led many brands to rethink their direct-to-consumer (DTC) strategy and capitalize on new opportunities.

Among the many advantages that Amazon offers is access to its two-day delivery service for Prime members, of which there are many millions, in addition to enabling brands to take control of their messaging in the face of unauthorized sellers. “Amazon also puts a world of merchandising and marketing opportunities — including livestream and influencer affiliate marketing — at brands’ fingertips and enables them to reach an exponentially larger audience than they could on their own,” says Kreutzer. “Further, with consumers becoming increasingly vocal about environmental concerns, Amazon, in its commitment to obtaining carbon-neutrality, offers brands a tremendous channel through which they can very visibly and very effectively align themselves with Amazon’s sustainability initiatives.”

Be on the lookout for Kline’s upcoming Beauty Retailing USA report, which will cover all channels across 19 beauty categories, paying special attention to e-commerce. In addition, our Cosmetics & Toiletries USA report will highlight how the market has evolved post-pandemic. Both are scheduled for publication this summer.