The beauty retailing landscape is constantly in flux and has changed dramatically in the 50+ years that Kline has been tracking the market. The consumer’s path to purchase is not always clear as offline and online shopping are more intertwined than ever before. Brands that were previously exclusive to the professional channel are now using retail outlets as part of their channel strategies. The internet has become a legitimate venue for professional products thanks to initiatives like Loxa Beauty by BSG and L’Oréal’s collaboration with StyleSeat. The formula for a winning marketing approach can be created based on the right retailing mix and what is appropriate for a particular product, brand, or category.

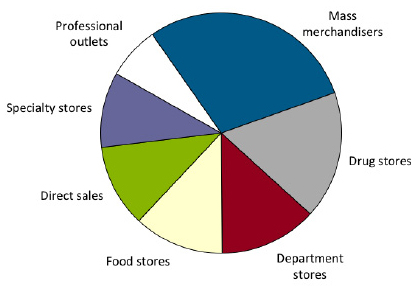

The professional sector has always been a place where consumers can find a high level of quality when it comes to both service and products. Professional outlets—which include salons, spas, beauty institutes, and doctors’ offices—account for about 7% of total U.S. market sales when factoring in back-bar (professional use) products, making it the smallest retail outlet.

In contrast, mass outlets (food stores, drug stores, and mass merchandisers combined) command the lion’s share of market sales at 61%. Department stores also control a sizable portion at 13% of the U.S. beauty industry. Both of these channels have been gaining share, while newer venues like online and mobile shopping have also been carving out a growing piece of the shopper’s basket. What do these outlets have that the professional sector lacks? For one: Big Data. Until now.

Technology is a driving force that is changing the face of beauty retailing, and retailers are no longer bound by a particular channel. Instead, most view themselves omni-channel in order to reach out to the largest possible audience made up of smaller sub-demographics. Technology has also made it possible to capture information and insights on shoppers and transactions like never before.

Kline has teamed with the Professional Beauty Association (PBA) for its own “big data” initiative: to offer a source for timely, detailed sales performance data on the professional beauty market. Kline PRO is based on transactional data culled from a panel of independent salons, chain salons, and distributors. This data initiative yields category, brand, and product-level sales data on a quarterly basis.

Among the highlights from the data just released covering Q2 2014 is that men do like to look stylish, so long as it’s quick and easy. Products specifically targeting men outpaced the overall market in both chain and independent salons. Of particular note are products that add texture, which comprise 84% of men’s hair styling products. The top items in this segment are American Crew’s Forming Cream, followed by two items from Paul Mitchell’s Mitch line: Reformer Strong Hold Texturizer and Clean Cut Medium Hold Styling Cream.

Treatments is another bright spot, with the second quarter of 2014 witnessing the product type’s highest sales since 2012. The treatment segment currently represents 20% of the conditioners category in independent salons. The new Pureology Strength Cure range has helped repair damaged hair and segment sales alike. Kevin Murphy’s BODY.MASS, with its eyelash thickening and lengthening technology, is another one of the top movers for the quarter.

With this type of data now becoming available, industry participants will be in a better position to identify the latest market trends and emerging product innovations helping the professional beauty industry carve out a larger piece of the total beauty market.