Retail product sales were up 6.5% in the U.S. in Q1 2022 compared to Q1 2021. This is truly remarkable news for the salon channel, which faced numerous challenges over the past three years. In addition to shutdowns and requirements to implement new health and safety measures, which impacted the service capacity, salon operators experienced increased competition from e-commerce and retailers such as Ulta and Sephora. Despite losing some share to these channels, salons remain the leading outlet for professional hair product sales. According to Kline PRO USA, our salon retail products and services database, sales are nearly back to the level of comparable pre-pandemic Q1 2019; down just 3.4%.

What are consumers buying?

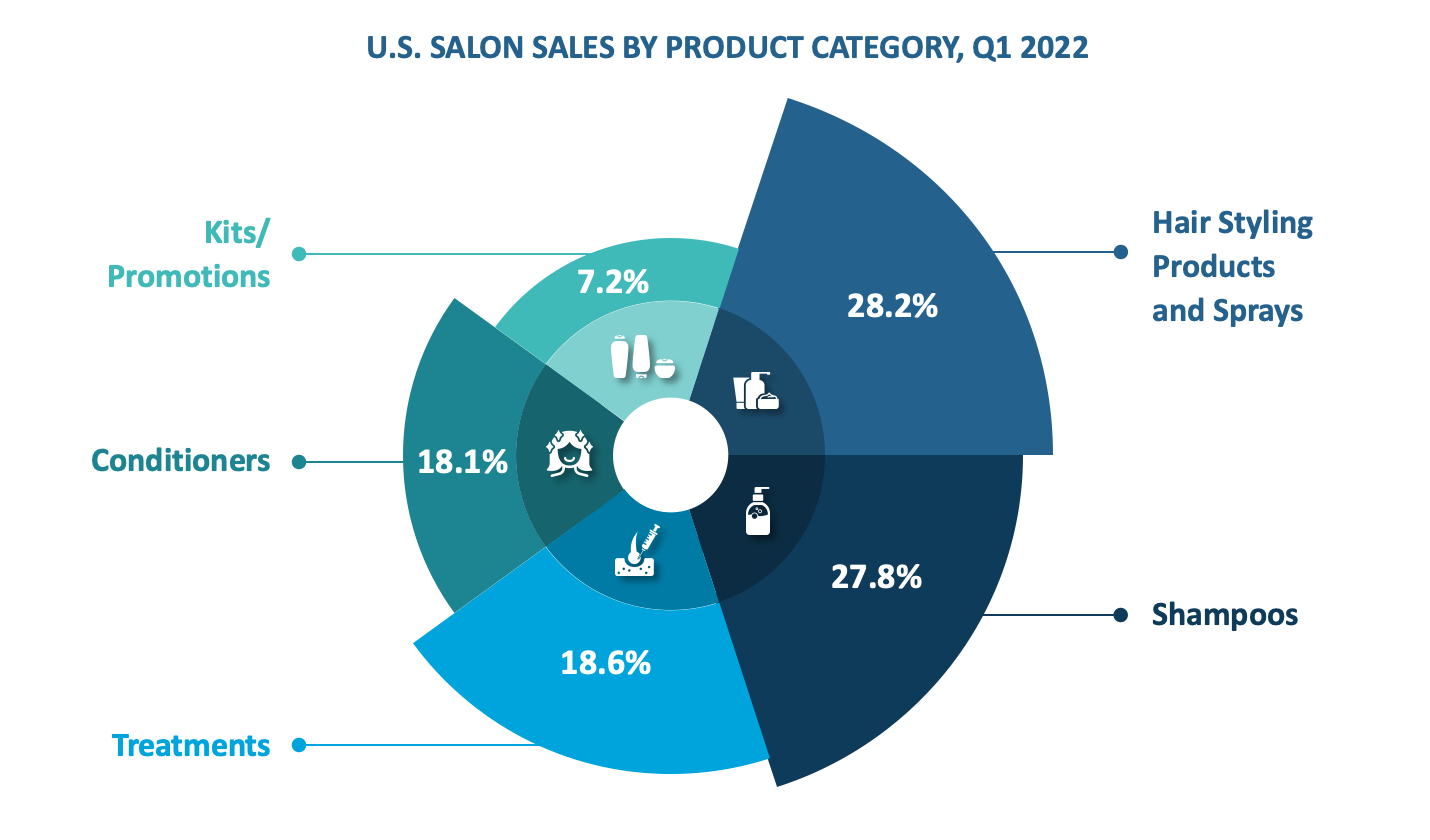

Historically, the hair styling products and sprays category has claimed over 30% of all revenues, but the number has steadily declined since 2019. Styling products remain the highest-grossing category with a 28.2% share, while shampoos have seen a significant rise resulting in 27.8% of total sales. Not to be overlooked is the fact that conditioner and treatment sales are also up. Most of this shift in demand is likely accredited to the decrease in social engagements due to COVID-19, thus lessening the need to style and finish hairstyles. Several trends that emerged during the last two years, however, extended into the first quarter of 2022 and are reflected in the sales.

Continuing product trends

- Repair/Condition

While the rollout of new bond-builder products has slowed, consumer demand for these and products that provide other repair/conditioning properties continues. The value of self-care was proliferated over the last couple of years and is likely to continue. Treatments make up 36.2% of the sales in this segment and are led by Olaplex, which expanded its already impressive portfolio with the newly launched No. 9 Bond Protector Nourishing Hair Serum.

- General/Multipurpose

Products that can provide more than one benefit are desirable for a number of reasons: they save time, take up less space in the shower, and are more sustainably responsible. Sales in this segment increased 25.1% over Q1 2021. Top products include Redken’s One United Multi-Benefit Treatment Spray and 25 Miracle Milk Leave-in Conditioner from Mizani.

- Volumizing

Volumizing care products saw a decline in demand during 2020 but are experiencing an uptick in sales. A contributing factor is the successful 2021 introduction of Redken’s Volume Injection line. Perk Up Dry Shampoo from amika: leads the segment.

- Color Care

Products that support color care have always claimed the largest share of hair care dollars but relinquished some to the repair/condition segment. Starting in the last half of 2021 and progressing into 2022, the color care segment began to regain some lost ground. Increased interest likely stems from the desire to stretch the time between color services to save money, as well as preserve hair health with less frequent exposure to hair coloring chemicals. Pureology is the leading brand for color care but faces competition from the recently launched Olaplex No. 4P Blonde Enhancing Shampoo and the newly released Kérastase Chroma Absolu collection.

Will sales continue to increase?

The number of services being performed in salons is still below pre-pandemic levels. In Q1 2022, the number stood at 28% less than that of Q1 2019. The good news is that there is room for growth, and as the public adapts to living with COVID, people will feel more comfortable resuming pre-pandemic activities such as visiting salons for services and purchasing hair care products.

To access the latest performance data on the salon hair care industry in Canada and the United States, refer to the just-released Q1 2022 data from our Kline PRO: Salon Retail Products and Services Database. Based on actual salon transactions from a panel of thousands of salons, it yields category, brand, and product-level sales and service data on a quarterly basis. To see a live demo, please get in touch.