The home and personal care products industry has blamed de-stocking for slow sales. But, as purchasing quantities stay the same, what is really happening?

For the chemical industry, personal care and household cleaning are two key outlets. The former is an innovation-driven specialty market, while the latter is a large and steady consumer for many specialty chemicals suppliers. Long have these markets been considered a safe harbor for specialty chemicals manufacturers. Through the years, both segments had proven to be rather non-cyclical, which they proved again during the COVID-19 pandemic.

Following a very strong demand for ingredients in 2022, most of the key players in the area were expecting 2023 to be another strong display of growth and profitability for specialty ingredients suppliers. Unfortunately, many were surprised by sales being significantly below expectations in the first half of the year. Consequently, after the second quarter of 2023, many of the large publicly traded chemical companies announced revised forecasts or issued profit warnings.

Among many different reasons behind lower-than-expected revenues of the overall chemical industry were the troubled geopolitical situation, the slower-than-expected rebound of the Chinese economy, high energy costs in Europe, and the general hardships of U.S. and European economies.

In the home and personal care area, one different factor was often discussed: destocking. Destocking happening at both the level of stocked ingredients as well as stocked finished products was, according to many industry participants, one of the main reasons behind a slower-than-expected 2023. It was also the main reason emerging when trying to explain diverging financial results between ingredient suppliers and finished product manufacturers in 2023.

While destocking started to be discussed in the first quarter of 2023, continued difficulties through the second and third quarters of the year made the destocking scenario less and less likely. It was based on the assumption that manufacturers would run out of stock and purchase new stock for their production; but that was not the case.

To gain insights into the situation, Kline conducted a survey involving 100 senior executives in purchasing roles in home and personal care products manufacturing companies. The survey’s goal was to understand the views of ingredient purchasers on the current situation and their expectations over the next 3 to 6 months.

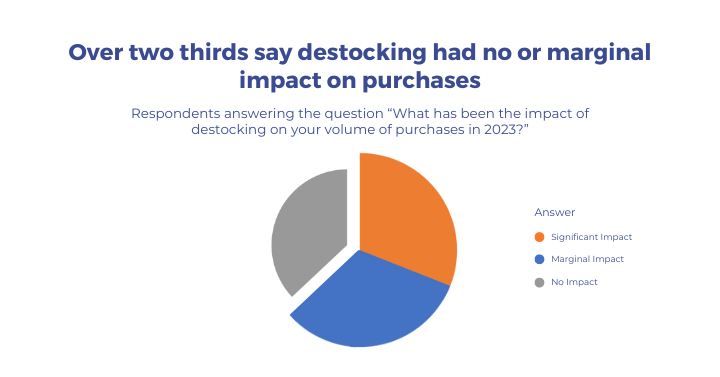

The results of this survey are very interesting: Not only did a majority of professionals surveyed report an increase in their business volume in 2023, but also destocking is seen as having no or only a marginal impact on purchase volume by more than two-thirds of the respondents.

Source: Kline’s Home & Personal Care Ingredients: Purchasing Manager Expectations Survey

While it seems true that destocking was influential to certain groups of companies, it was interesting to find out that it was ranked fourth overall in terms of the importance of purchase decision-influencing factors. We also asked our participants if they had considered changing their supplier portfolio in 2023, and the results were very worth noting.

All details in answers—differences between smaller or larger companies, United States versus Europe, and branded manufacturers vs contract manufacturers—can be found in our recently published Home & Personal Care Ingredients: Purchasing Manager Expectations Survey. Coming as a report highlighting key findings, as well as a dashboard giving access to raw data, this new product not only analyzes the 2023 situation but also gives a perspective on buyer’s expectations for early 2024.