This article originally appeared in the November issue of TLT

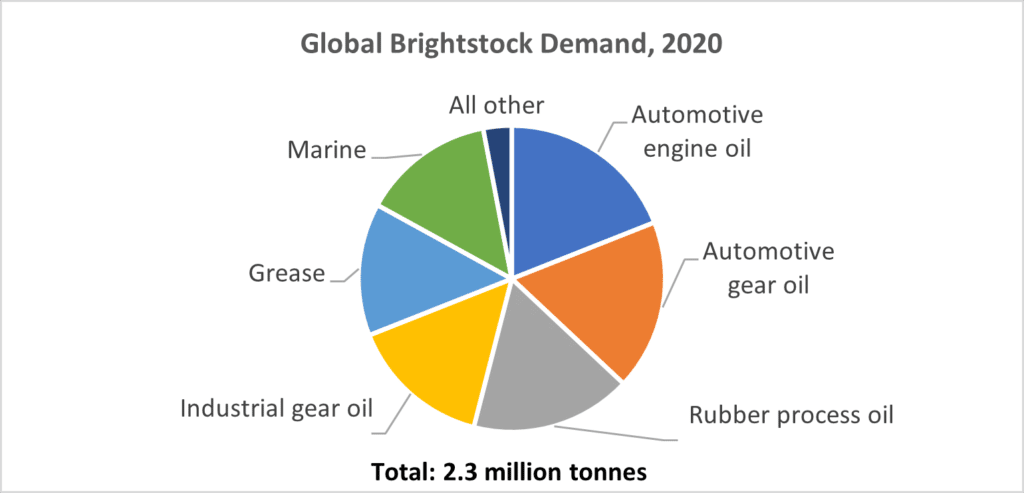

Brightstocks are mostly used to blend mid- to high-viscosity lubricants, such as automotive and industrial gear oils, marine cylinder oils, greases, monograde engine oils, and process oils. Brightstocks, along with other neutral oils, are used in varied proportions in lubricant formulations to blend various grades of finished lubricants.

In automotive applications, brightstocks are used to formulate heavier engine oil grades such as SAE 20Ws and monogrades. However, demand for such engine oils is declining across the world and is mostly concentrated in regions such as Africa and the Middle East, South America, and certain parts of Asia-Pacific and Eastern Europe. Brightstocks are widely used in formulating gear oils, which represent a key demand outlet. Products such as automatic transmission fluids (ATFs) are produced in a lighter-viscosity range and do not require brightstocks in their formulations.

On the industrial side, rubber process oil, gear oil, marine, and greases are the key applications of brightstocks.

Resilience of Brightstocks

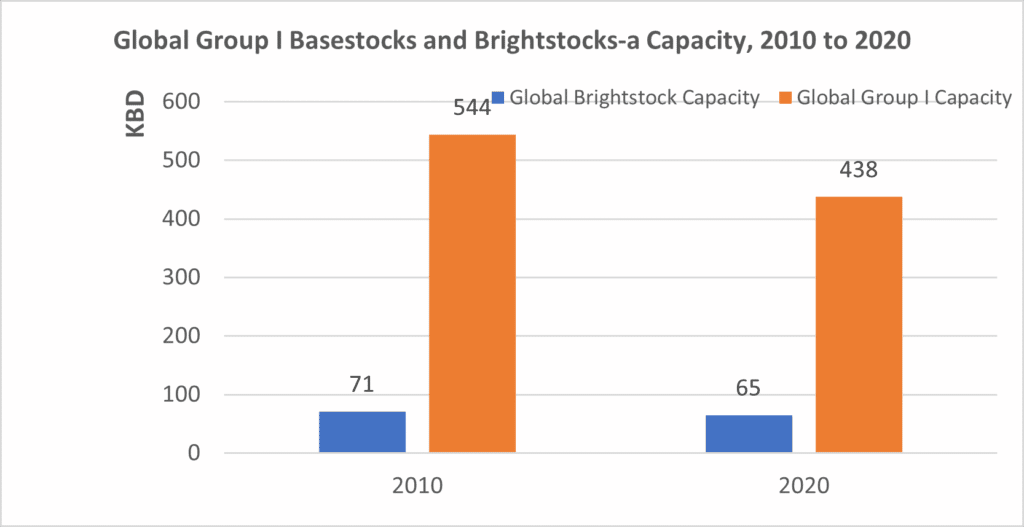

Over the last 15–20 years, the global Group I market has been facing challenges of declining technical demand and growing competition from high-performance basestocks. Consequently, Group I supply has suffered, with the global Group I basestock capacity declining almost 20% in the decade 2010–20. However, brightstock supply has displayed resilience, and its capacity reduction (9% reduction on 2010 capacity) was much smaller than that of Group I.

While Group I capacity has been continuously getting rationalized with no new capacity set up in more than 15 years, brightstocks capacity has been supported by new capacity additions and expansion, both greenfield and debottlenecking. For instance, Luberef expanded its brightstocks capacity in 2017. Also, Ergon started producing Group I quality brightstocks at its Vicksburg (U.S.) refinery using naphthenic crude. SK started producing Group II quality brightstocks at its Ulsan refinery; however, the company ceased its production a few years ago. PetroChina at Karamay, China, produces Group II quality brightstock using a naphthenic crude source. Thus, brightstock has always remained a product of interest despite declines in the overall Group I market.

a: Includes only Group I brightstocks capacity.

| 2010 | 2020 | |

| Share of brightstock in Group I capacity | 13% | 15% |

The resilience of brightstocks can be attributed to a variety of factors.

- There are limited substitutes available in the market. Brightstocks have a very high viscosity, and producing them in a Group II refinery is replete with challenges. These cannot be produced in a Group III refinery.

- Brightstock production offers a higher margin than other Group I grades to refineries producing it, which provides an extra cushion against the deteriorating Group I market conditions.

- Synthetic substitutes such as polyalphaolefins and polyalkylene glycol are highly expensive. Only polyisobutylenes come close to offering any techno-commercial rationale for substitution.

Sustainability and Its Impact

Historically, Group I closures have been driven by market supply and demand forces. Growing competition from Group II and III basestocks edged out Group I basestocks, even from several industrial applications where the use of Group II and III basestocks is not technically warranted. As the use of Group II and III basestocks grew in a wide range of formulations, blenders preferred using them in other applications as it allowed them logistical and storage advantages. Thus, Group I basestocks suffered, and their demand declined more rapidly.

However, over the last couple of years, the market has undergone significant changes, and the global basestock supply landscape is anticipated to alter by factors beyond the supply-demand interplay. To meet their carbon emission reduction target, energy companies across the world are rejigging their energy mix by focusing more on renewables and pledging to reduce their footprint in the fossil fuel segment.

ENEOS in Japan has announced the closure of two of its refineries (both of which house a Group I basestock production unit) to meet its long-term decarbonization goals. Shell has plans to rationalize its Singapore refinery, which will impact its basestock production as well. The company has, for now, deferred its closure plans by a few years, but the closure is expected to eventually take place.

Future Supply Outlook and Alternatives

The demand outlook for brightstocks is better than that for other Group I grades, resulting in a continued interest in this market. However, there is a concern regarding brightstocks availability, as it could decrease with any Group I closure in the future since some Group I plants also house a brightstock facility. To address the likely shortfall in the brightstock market, two new brightstocks capacities are planned to be set up, both of which will produce brightstocks in a Group II refinery.

ExxonMobil has plans to set up a 20.0 KBD Group II refinery, which would also include the capacity to produce very high-viscosity basestocks (EHC 340 MAX with viscosity in the range of 32.5 to 35.5 cSt at 100° Centigrade), by 2025. Likewise, Lotos Group in Poland is upgrading its Gdansk refinery to produce Group II basestocks by 2025. This refinery will also produce Group II brightstocks.

Key advantages of a Group II brightstock are its lower sulfur content and clarity in color. This makes it suitable for applications like greases (where its clarity improves the color of the final product) and applications where low sulfur content is desirable. On the flip side, a Group II brightstock has inherent solubility disadvantages. However, this shortcoming can be addressed by adding solubility-enhancing fluids.

One of the simplest means to address brightstock shortfall is reformulating by using higher proportions of heavy neutrals and lesser quantities of brightstock. However, there is a limit to which this can be applied since substituting beyond a limit would require adding a thickener. There are a few synthetic substitutes available for meeting the brightstock deficit, including PIB, PAO, and PAG, of which PIB presents the most techno-commercially feasible solution.

There are varying levels of flexibility in replacing brightstock with substitutes in different applications. Certain applications such as marine are influenced by OEM recommendations. Substituting brightstock would require a great amount of investment for approvals, which is generally a long-drawn-out process. Other applications are relatively less dependent on OEM approvals. Brightstock substitution in these applications is dependent on factors such as technical suitability, availability, and prices.

Summary

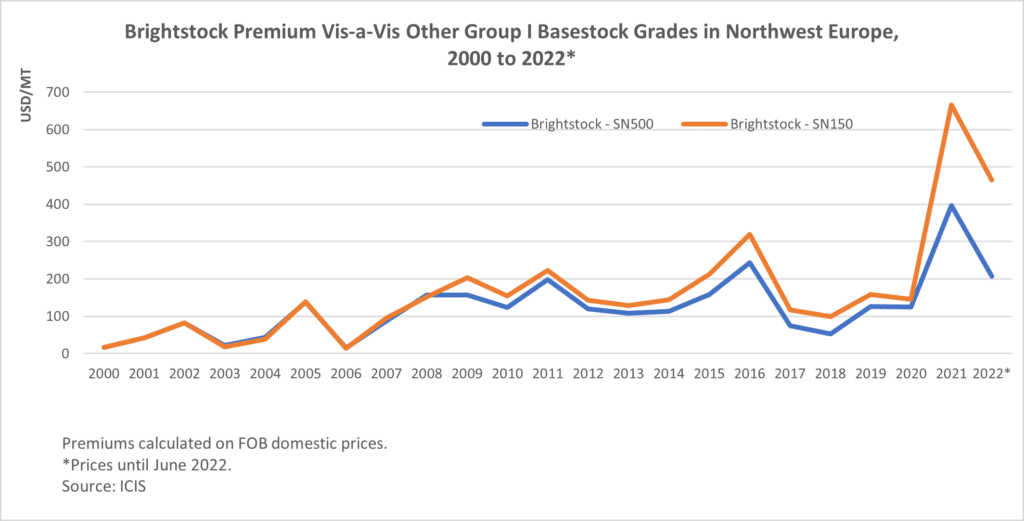

Brightstock supply constraints, which are expected to evolve in the future, make the product a deficit commodity. With the acceptance of Group V and Group II brightstocks within the industry, a new horizon has opened for the market. However, the volumes generated from these classes of brightstock may not be able to offset the declining supplies of basestocks arising due to the closure of Group I basestocks plants.

The increasing shortage in brightstock, in the long run, is expected to increase its price, which in turn will raise the premium with respect to light neutral grades. The increase in premium will lead to substitution growth, as well as a decrease in demand for cost-sensitive applications.

Moreover, supply shortages will encourage blenders to develop new formulations and reformulate lubricants with PIB and other substitute products. Although substitute products for brightstock face relatively fewer barriers, pricing and widespread availability would be the major limiting factors that substitute product manufacturers need to focus on.

Kline’s Global Business Outlook for Brightstocks is scheduled to be published in Q1 2023. The report will focus on key trends, developments, challenges, and business opportunities in the global brightstock market, covering Africa and the Middle East, Asia-Pacific, Europe, North America, and South America.