When it comes to the professional cleaning of commercial kitchens, key market trends including control of foodborne illness, food safety, and strict sanitation regulations are all drivers propelling growth of foodservice cleaning products. Regulations increase cleaning frequency for end users but also push manufacturers to develop new products that protect human health and the environment. Food safety and prevention of foodborne illness are concerns for all end users but particularly those serving the public. These have led to improved sanitation practices and include higher cleaning standards, sanitizing of hands, sanitizing of dishes and other kitchen wares, and hygiene programs and training for employees.

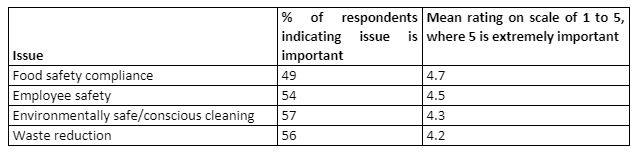

Kline’s consulting staff has conducted extensive research on Foodservice Cleaning Products in Europe: Market Analysis and Opportunities in France, Germany, and the United Kingdom for the report published in September 2019. Many end users agree that food safety compliance, environmentally safe/conscious cleaning, waste reduction, and employee safety are the most important issues they face. When asked which issues are most crucial for their businesses, cleaning professionals indicate the following:

When it comes to food safety compliance, about half of the end users in our survey manage this internally, while the other half use external partners such as Diversey, Ecolab, Anios, Dr. Schnell, and Steinfels to help them comply with food safety regulations.

Several European Union (EU) regulations are impacting the market for professional cleaning products, most prominently Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), aimed at improving the protection of human health and the environment from the risks posed by chemicals, Classification, Labeling and Packaging (CLP), adopted to clearly communicate to workers and consumers the hazards of chemicals through classification and labeling, and the Globally Harmonized System of Classification and Labeling of Chemicals (GHS), which went into effect in 2015, repealing Directive 67/548/EEC, for the classification, packaging, and labeling of dangerous substances.

The introduction of the CLP regulation provides the following advantages for the cleaning industry:

- Enhances the scientific basis for international accord on the safe use of chemicals and provides a technical basis for the management of chemicals.

- Places an emphasis on both human health and the environment with the development of sustainable practices.

- Allows for internationally effective communication channels related to the labeling of cleaning chemicals to protect workers, consumers, and the environment.

However, there are some challenges that chemical suppliers will face due to the introduction of the CLP regulation:

- Some products needed reclassification, triggering additional expenses for manufacturers.

- The simplicity of the classification system makes it more difficult for cleaning personnel to distinguish between products that are relatively safe and products that are relatively hazardous.

- Some substances are relabeled with more severe hazards than before due to the tendency to opt for the safest option. This over-cautious labeling results in more frequent usage of personal protective equipment and thus a greater cost to end users.

- Smaller manufacturers are placed at a disadvantage as they may not have access to data, and the cost of obtaining expert consultation may be prohibitive.

The eco-sustainable pressure by EU authorities, coupled with a push by several leading manufacturers and sensitization of end users, are strengthening the trend towards environmentally-friendly and safe chemicals. End users are becoming increasingly sensitive to environmental issues and safety in use, and therefore demand for safe products is increasing. Certain end-use segments are more affected than others, most prominently the public sector, due to the European Green Public Procurement Criteria (GPP), promoting environmentally friendly procurement by public bodies.

Part of end users efforts to be environmentally conscious in Europe include waste reduction and waste recycling programs, both of which are widespread. 58% of the end users we surveyed have waste recycling programs with 85% recycling plastics, 71% recycle oils, 51% recycle chemicals, and 19% recycle other materials including glass, paper, and food. In terms of waste reduction programs, 83% focus on plastic, 65% on food, 64% on water, and 55% on paper waste reduction from their operations.

Foodservice Cleaning Products in Europe: Market Analysis and Opportunities was published in September 2019 and is based on hundreds of interviews with end-use decision makers to gauge usage, perceptions, and satisfaction with foodservice cleaning products. Channels of distribution including online searching and purchasing are also topics explored. Business critical issues including food safety compliance, customer ratings and reviews, such as “Scores on the Doors,” employee safety, waste reduction programs, dishwashing machine servicing, and leasing programs, and technology-enabled appliances with smart features are also examined.

In addition to structured surveys of end users, which deliver a bottom-up view of the market, Kline’s seasoned staff also conducted in-depth interviews with suppliers and distributors in each country in the native language to understand the market at a more macro level. These discussions provide critical insights on key issues impacting the market including sales, reasons for growth and declines, competition, regulations, general economic indicators, cleaning trends, and knowledgeable forecasts. This two-pronged approach means that subscribers are provided a comprehensive, objective market assessment with actionable recommendations and forecasts grounded in reality.

For more information on how this research can help your company with strategic planning, please contact us and look for an upcoming study from Kline’s I&I practice on Green Cleaning Products in the U.S. and Europe.