Biopharmaceuticals commonly called “biologics,” include a wide variety of products derived from human, animal, or microbial sources with the help of biotechnology. A surge of bio-APIs and their growing penetration into multiple therapies create an attractive market for pharmaceutical chemical suppliers.

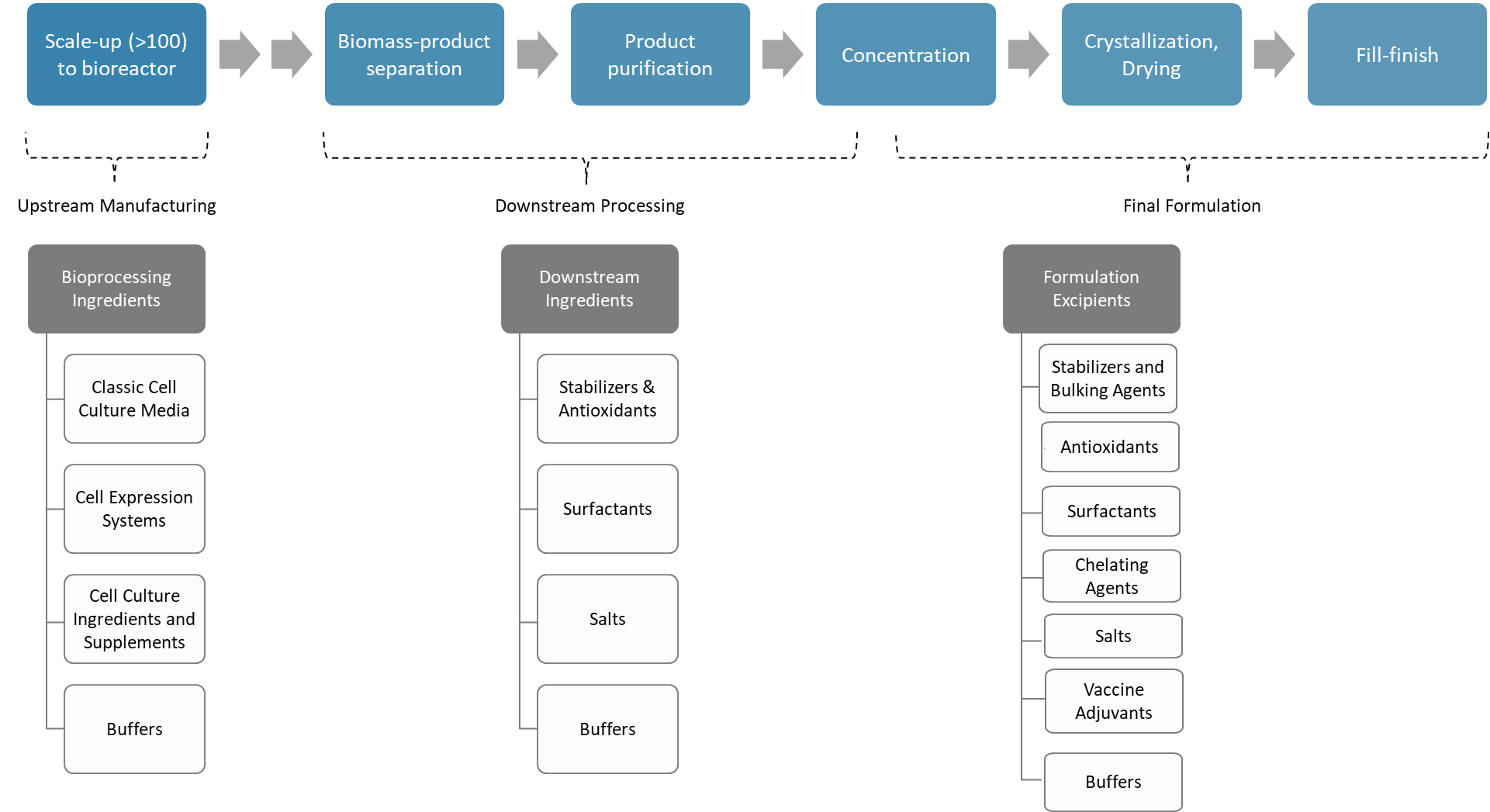

Biologics are complex to develop and need extra care to maintain their size, shape, form, and stability. All these factors correlate to the requirement of specialty chemicals in several stages of their development. Hence, unlike for small molecules, the role of inert pharmaceutical ingredients is not limited to formulation excipients but, more importantly, plays an important role in the development and manufacturing of the biologic API itself. The selection and use of the right specialty chemicals throughout the different stages of manufacturing and formulation are extremely critical for biologics.

Kline’s new study, Biologics: Market Opportunities for Chemical Suppliers, provides a comprehensive assessment of biologics production and formulation stages with in-depth coverage of the ingredients and excipients for each.

Overall biopharmaceutical chemicals market value is estimated at over USD 3.0 billion and anticipated to grow at a CAGR of 9.4% between 2018 and 2023. This creates a pool of opportunity for the entire value chain of the biopharmaceutical industry, including suppliers of upstream and downstream processing ingredients as well as formulation excipients.

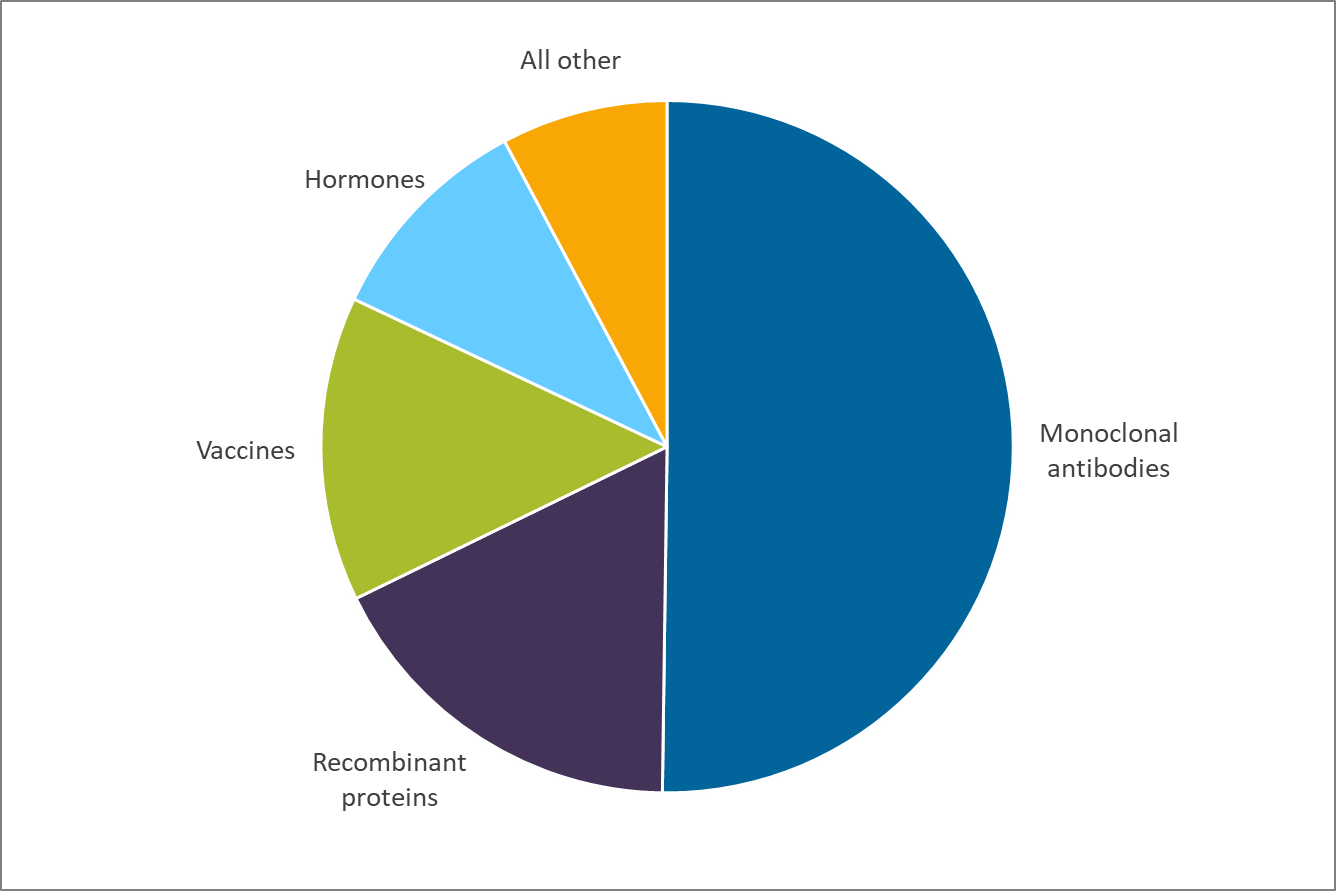

The biopharmaceutical market can be categorized as monoclonal antibodies (mAbs), vaccines, recombinant proteins, hormones, and growth factors, among others. mAbs dominate the market in terms of revenue and are the key focus area for the majority of pharmaceutical companies. The higher growth of mAbs is attributed to their application for the treatment of various cancers.

In terms of the number of biologic drugs, there will be a growth of 10% to 12% over the next five years, including novel biologics, biosimilars, and bio-betters. The highest growth in terms of the number of drugs is expected for mAbs, with a CAGR of more than 15% over the coming years. The number of biological vaccines and hormones is also expected to grow at strong rates of 8% to 10% and 4% to 7%, respectively.