The pandemic had a profound impact on the beauty retailing world last year, forcing retail outlets like Ulta and department stores to temporarily close while creating a tremendous shift to e-commerce during lockdowns. The big story of the year was how Internet sales surged 47.5%, as revealed by Kline’s soon-to-be–published Beauty Retailing: U.S. Channel Analysis and Opportunities. The pandemic accelerated changes that were already in progress, such as the move to a stronger digital landscape, with years worth of digital enhancement happening in a matter of weeks and months and even consumers who previously resisted online shopping becoming avid users.

While the acceleration of e-commerce was the most obvious bright spot, essential retail played a significant role in the beauty market’s amazing resiliency during pandemic times. Brick-and-mortar sales through essential retailers, encompassing mass merchandisers, food stores, and drugstores, accelerated to a 3.9% sales increase in 2020 from the minimal 1.1% increase the prior year across all beauty categories. These outlets also outperformed the total market, which declined 0.2% during the year.

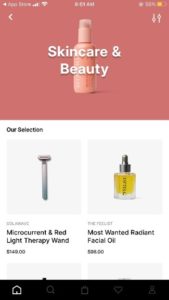

Mass retailers benefited from staying open throughout lockdowns, while non-essential retailers of beauty and personal care products had to quickly pivot and discover new ways to reach their consumers with an emphasis on speed and convenience. As such, new services and apps emerged, as described below:

- FastAF is an app that is even more convenient than traditional e-commerce purchases. It offers same-day delivery in New York City and Los Angeles for premium and DTC beauty brands including Le Labo, Glossier, Byredo, and Drunk Elephant.

FastAF app - Bluemercury pivoted to virtual masterclasses and shopping appointments, with some consumers preferring the new virtual model to the in-store environment even when the retailer’s stores reopened. The retailer has continued these efforts into 2021 with virtual events centered around health and wellness trends.

Bluemercury’s live virtual event - Nest, offering fragrance, home scent, and personal care leaned on the digital strategy as well and hosted a virtual masterclass for its retail customers and sales associates. This provided an excellent opportunity for the brand to get closer to its retail partners, convey the scent story behind its fragrances, and elevate the at-home discovery experience.

Kline’s Beauty Retailing series will discuss the most significant beauty retailing moments of the year, including the trend toward enhanced technology, engagement, and partnerships. The report also contains an outlook by year to 2025 and dive deeper into the initiatives we expect to shape the beauty retail scene in the short and long term. Additionally, it will answer questions regarding how long essential retail will remain essential and when and what categories other brick-and-mortar channels like specialty stores and department stores will rebound in as consumers return to these outlets. For a further understanding of vertically integrated retailers like Bath & Body Works, Kline’s new Retail Tracking: Monthly Monitor of U.S. Boutique Beauty Retailers provides a monthly update on the brick-and-mortar performance of these dynamic outlets through an analysis of foot traffic data from SafeGraph. The recently-released data for March shows the first increase in foot traffic since the beginning of the pandemic.