Fueled by the acne category, the U.S. beauty devices market rebounds and is back on a growth trajectory, according to Kline’s recently published Beauty Devices: U.S. Market Analysis and Opportunities, analyzing the full year of 2017. Contributing to the healthy growth, many new, innovative products were launched and new marketers have made their way into the industry.

The acne category grew over 40% in 2017, which is the largest growth seen for the category since Kline started tracking the market in 2012. This is due to Johnson & Johnson’s investment in the category at the end of 2016 and into 2017, as well as the launch of Neutrogena’s affordable blockbusters—$34.99 Light Therapy Acne Mask and the $19.99 Light Therapy Acne Spot Treatment. “Filling a white space on the mass mask market, coupled with Neutrogena’s marketing prowess, the brand reaped an estimated 30% of acne device sales in 2017, which no other brand in the acne category has ever been able to garner,” comments Kelly Alexandre, Senior Analyst and the research lead.

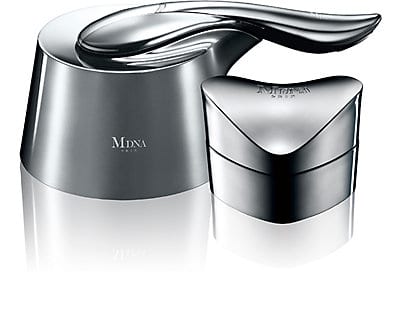

The 2017 market was energized with new product launches. e.l.f., known as a budget cosmetics brand, steps into high-tech skin care with two affordable beauty devices—a Facial Cleanser and a Massaging Wand Set, both under $25.00, in the anti-aging products category. HoMedics, which exited the U.S. market several years ago, re-entered in 2017 with several offerings in the cleansing, hair removal, and anti-aging categories. Dr. Dennis Gross, a skin care company with historically only one at-home beauty device on the market, a steamer, enters the anti-aging category. One of the most expensive anti-aging devices on the market at $600.00, MDNA Skin Rejuvenator was launched by the superstar Madonna.

While there are still no devices that have been approved for cellulite reduction claims, brands are beginning to get around this barrier by launching devices approved for similar claims as seen in NuFace’s recent launch of NuBody Skin Toning Device. This device, launched by the leader of the U.S. anti-aging market, is the brand’s first venture into the cellulite reduction and body firming/toning category. This is an important launch for the industry due to its FDA 510(K) approval in July 2017, for body skin stimulation.

Channel Investments acquires leading marketers, TRIA Beauty and Iluminage Beauty, in 2017 with the plans of strengthening these brands’ hold in the market, by eliminating poor performing retail partners and investing more aggressively in digital and e-commerce strategies. With the Internet continuing to be one of the strongest sub-channels in the United States, growing by almost 7%, Channel Investments’ new retail strategy for these brands, as well as selling them in conjunction with its sister skin care brand, Nuvesse, is projected to help revamp the brands.

Beauty Devices: Global Market Analysis and Opportunities sheds light on the latest dynamics and innovations in the industry. It examines the non-invasive forms of power-operated at-home skin care tools. The analysis covers beauty devices that offer benefits including acne elimination, anti-aging, cellulite reduction and body firming/toning, cleansing, hair regrowth, and hair removal, with products sold to consumers through all channels of distribution.