The Green Value Compass

The energy sector is undergoing a major transformation in multiple places. As with any system-wide change, it raises the question of whether the current industry leaders will be agile enough to adapt and retain their influence, or if we will see new players using the shift to reset the playing field. Possibly a bold leap to make by looking at the current landscape, but still a question that energy leaders need to continuously ask themselves to avoid costly strategic blind spots.

We recognize that the incumbents’ task is not trivial: To match the agility of the disruptors while reassuring their key stakeholders, maintaining their vital services, and appealing to current and future talent with a credible narrative. Challengers who want to enter the field will need to work hard to find the most likely places where they can survive and thrive. Financial and institutional investors will be looking at how credible and future-proof the strategies are before voting with their money. A challenging terrain to navigate for all the above actors, and yet collective forward progress is essential.

Today, the clean energy space is made up of various green solutions such as biobased feedstock, several low carbon alternative fuels, green mobility solutions, recycling technologies, renewable power technologies, and more. Each of those could potentially branch into alternative value chains, the value of which is yet to be shaped. For the many companies operating in this space, the burning question remains: Are we looking far and wide enough, and are we doing enough today to secure our seat at the future energy table?

Kline’s Energy team is keen to be a useful part of the solution to a complex but urgent challenge transcending multiple sectors. We offer our expertise and research skills to ease the navigation of the ever-shifting strategic options and constraints, reducing the risk of blind spots by looking at ‘what if’ not just ‘what is or was’. Through breadth and depth of our insights in our Green Value Compass we hope to make our clients’ path as clear as it can be, so that inevitable uncertainty and change never stop them from taking the next right step.”

Yana Wilkinson

Practice Head, Vice President, Energy

Reflect & Check for Misalignment

1. Overall, clean-energy investment worldwide has increased by 40% since 2020.

2. Yet, Oil & Gas companies are spending just 2.5% of their investment on clean-energy.

3. This is just 1% of the total global clean-energy spend.

4. And 60% of that comes from just four companies out of thousands of producers.

Companies need an external perspective to ensure their strategy is robust when reflected through industry narratives.

The difficult truth is that the margin on the barrel does not yet match the margin offered by clean energy solutions. However, investments must be made to secure a seat at the future table. This requires business leaders to make bold yet well-informed investment decisions. And, companies that successfully navigate this transition will be best placed to succeed.

As always, there are trade-offs and uncertainties to consider. There are several technologies and pathways to choose from, several markets to invest in and several new unexplored terrains to tap into. It’s time to pivot boldly yet wisely by addressing some serious questions such as, “Which technologies and markets will stand the test of time? Which will deliver long-term economic viability?”

To navigate this uncertain landscape, a compass is needed to guide business leaders to the areas of value, pointing to the “true North” and urging them to apply the same level of rigor as traditional businesses.

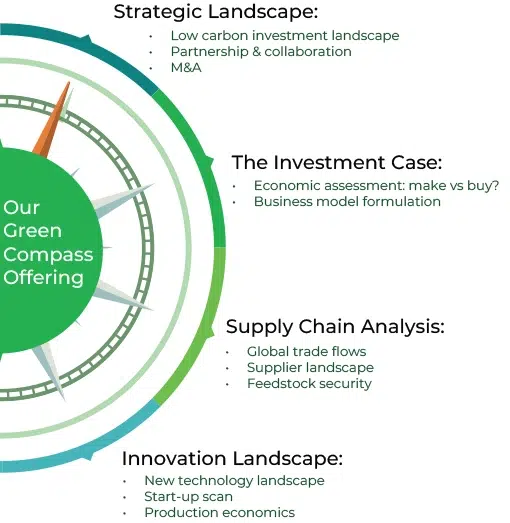

The Green Value Compass (GVC) is Kline’s unique offering to help clients unlock and protect commercial value in their sustainability journey by helping to manage uncertainties and evaluate trade-offs.

Why do you need Kline’s GVC? In the ever-evolving clean-energy space, new technologies emerge, some older ones gain economic traction, while others fade. Against this background, business leaders must make informed decisions to secure investments and chart a resilient path for the future.

Kline’s GVC provides direction based on business intelligence to inform and help make uncertain investment with greater confidence, supported by real-time market insights. With the power of our industry expertise and advanced analytical skillset, the Green Value Compass helps deliver forward-looking, data-driven insights and strategies, adding certainty to our client’s future.

Biobased Feedstocks

- Biofuels

- Automotive

- Aviation

- Marine

- Agriculture

- Bio-Oil (Pyoil)

- Biogas

- Biolubricants

Recycling

- Battery recycling

- Tire recycling

- Plastic recycling

- Used oil recycling (lubricants)

Carbon Sinks and

Carbon Recycling

- Carbon sink: Nature-based and CCUS

- Carbon recycling

- C02 to syngas

- C02 to aviation fuel

- Co2 to PtF

- Co2 to polymers

Allied Sustainability Services

- EV charging

- New fuels: Infrastructure landscape

Circular Economy

- New materials

- New logistics

- End of life

- R&D (New Technology scouting)

New Power & Fuels

- Electrification

- Hydrogen fuels (PtF)

- Green ammonia

- Green methanol

- Solar, wind, geothermal, tidal