The professional skin care market in Germany grows by 4%, in line with the overall European market growth in 2017, according to our freshly-published Professional Skin Care Germany market analysis. Germany is the third-largest country in Europe and accounts for about one-fifth of the overall region. Several factors drive professional skin care products in Germany, some of which include new product developments, substantial growth in the number of new spas and medical aesthetic clinics, as well as a greater variety of in-salon treatments for different age groups, skin care concerns, and lifestyles.

Products formulated with natural ingredients are favored by German consumers who are concerned about sustainability. In response, several professional skin care marketers, including Klapp Cosmetics and Janssen Cosmetics, launch/reformulate their products to include more natural and organic ingredients as well as exclude those ingredients that are considered harmful to the skin, such as sulfates, silicone, mineral oil, and parabens. With consumers’ growing interest about the natural trend, several spas change to a holistic approach by working with nature-inspired brands and offer treatments that heal both the body and mind.

Select Examples of Professional Skin Care Brands Offering New Lines with More Naturally-positioned Products in Germany, 2017

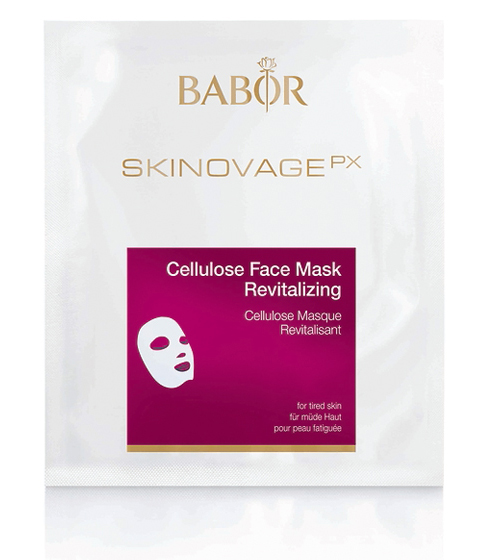

Moisturizers is the largest product type; however, masks and peels register the highest growth of nearly 7% in 2017, according to our just-published Professional Skin Care Germany study. This product type is mainly driven by the tremendous popularity of skin peels used as a treatment alone or in conjunction with other procedures or treatments. Many new products launch in masks and peels in 2017, aiding the category’s increase. There is also a growing trend of sheet masks coming from Asia with several marketers, such as Babor, Reviderm, and Clarins, launching such products in 2017.

Select Examples of New Professional Sheet Masks Introductions in Germany, 2017

Beauty institutes and salons remains the largest channel of distribution, while retail is the fastest growing channel driven by the growing popularity of online shopping. Several marketers focus on selling products through their respective websites or through authorized e-retailers. Medical care providers, the smallest channel, registers double-digit growth driven by the growing number of aesthetic clinics using and distributing professional skin care products.

For more insights on professional skin care in Germany, please refer to our just-published Professional Skin Care Germany report. This study analyzes the latest market shifts and key trends, back-bar and take-home sales by product type, sales and developments by channel, competitive landscape, marketing activities, as well as the future outlook of the market. Features detailed profiles of the five largest professional skin care players in Germany.

Written by Sai Swaroop, Project Manager and Marcela Chifu, Senior Marketing Executive