These days, reports of rising inflation are seen everywhere—be it the grocery store or the gas pump. But what about salons? Our just-released Kline PRO data indicates that salon prices are on the rise but not at the same rate as those reported for the overall market.

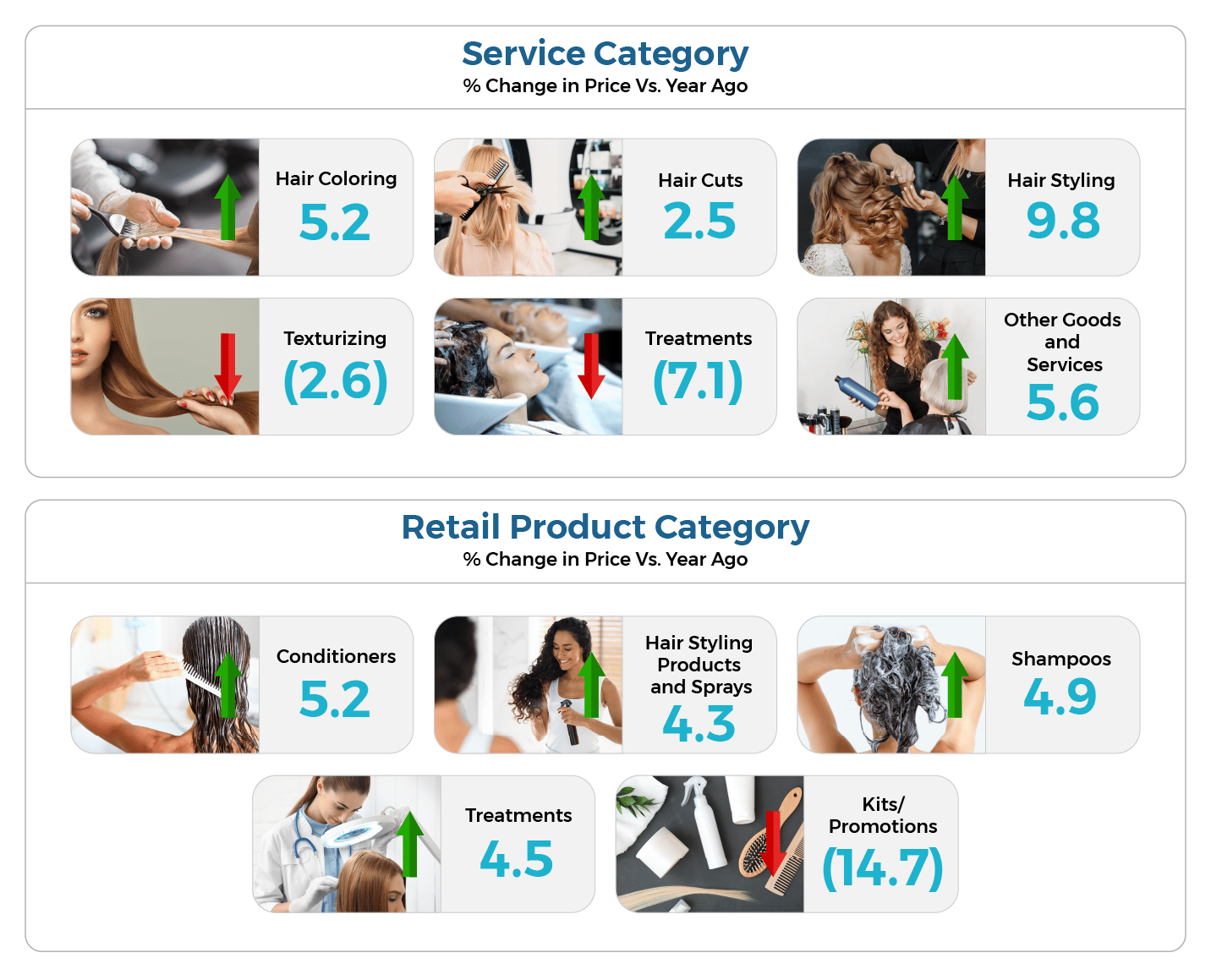

The U.S. Bureau of Labor Statistics stated that the Consumer Price Index for the year ending June 2022 increased 9.1%. This increase was the largest in 40 years, according to the U.S. Bureau of Labor Statistics. Our Kline PRO: Salon Retail Products and Services Database indicates that service prices are rising at an average of 3.7% in the United States but at varying rates across service categories. The same rate holds for salon retail products.

Source: Kline PRO: Salon Retail Products and Services Database

Source: Kline PRO: Salon Retail Products and Services Database

Hair Styling

Salons have played it smart and capitalized on the return of social engagements. Styling service requests have risen 19% and revenues are up 31% over Q2 year ago (YAG). Revenue gains are outpacing the number of services performed due in large part to the 9.8% increase in pricing overall. Blowout services are the most popular and increased in price by an average of 12.2%. Both braiding and flat ironing saw prices rise by 27%.

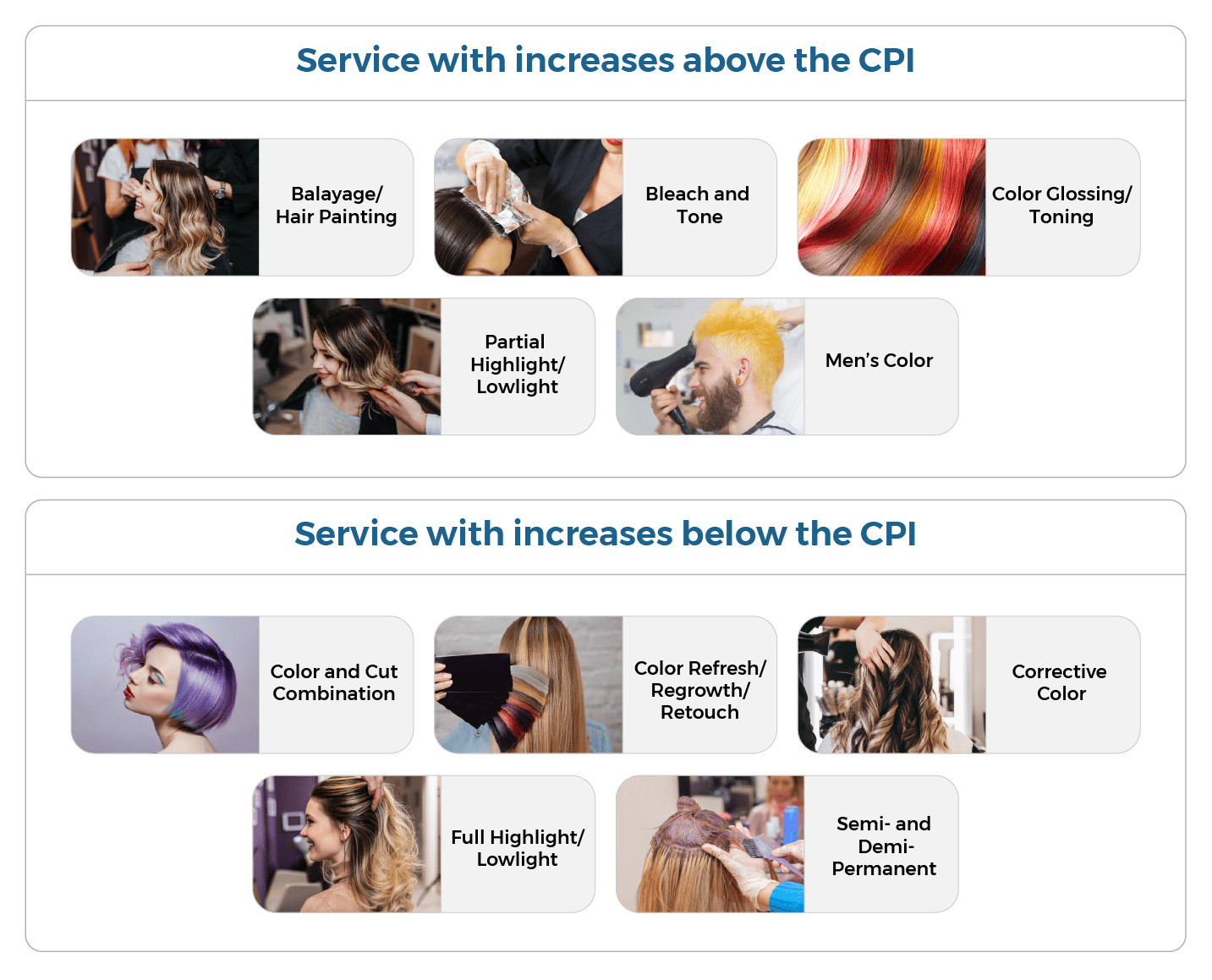

Hair Coloring

Hair coloring services make up 22% of all salon services performed and account for a hefty 40% of revenues, making it a cornerstone for salons. While coloring service prices are up an average of 5.2%, there is room for salons to raise prices and stay within or under inflation rates.

Source: Kline PRO: Salon Retail Products and Services Database

Source: Kline PRO: Salon Retail Products and Services Database

Texturizing

Texturizing is a small segment within salon services but, like hair coloring, one that requires expertise and extended service time. Consequently, clients would likely be tolerant of a price hike. The Permanent Wave/Cut Combination and Keratin Straightening are both keeping up with inflation, but Relaxers and Thermal Conditioning saw a decline in prices versus YAG.

Treatments

Thinning hair treatments saw a surge of 53% in pricing, and the scalp treatment pricing was up 10%. Both treatments are a part of the continuing skinification of hair trend. A third element of that movement, clarifying treatments, is a prime candidate for a price increase, witnessing a 70% increase in demand. However, the average price fell to $25.18, recording an 8% decline.

Haircuts

Haircuts constitute 40% of the number of services for salons. Just because they are high in volume does not mean they should be loss leaders. In fact, the number of cuts has declined, which actually may necessitate a bump in pricing. The current average price stands at $35.40; if the period’s inflation rate of 9.1% for personal services had been applied, that would be $38.62.

Salons are not exempt from the rising costs of labor, rent, utilities, and goods that the rest of the world faces. They should evaluate the impact that these factors have on their business and make sure that their prices are keeping pace to support these growing expenses.

Kline PRO: Salon Retail Products and Services Database helps you keep up with the latest salon trends. Based on actual salon transactions from a panel of thousands of salons, it yields category-, brand-, and product-level sales and service data on a quarterly basis. In addition, our newest digital tool Salon Distribution Benchmarking: Performance Insights of Companies, Brands, and SKUs in U.S. Salons zeroes in on salons that stock your brand and provides performance data compared to brands with which you compete head-to-head. It analyzes distribution and the quality of distribution using numeric, service dollar-weighted, and product dollar-weighted measures available from the company level all the way down to the SKU level. Q2 2022 findings for both the U.S. and Canada are now available.