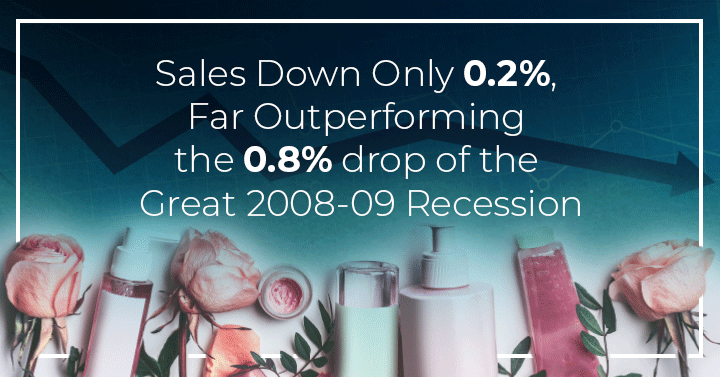

What could have been a dismal year for the U.S. beauty market in 2020 turned out just as we predicted. After analyzing 20 different product categories, five trade classes, and the performance of hundreds of brands, we have found that the overall beauty market declined by a mere 0.2% in 2020 to $77.8 billion, essentially flat with 2019 sales.

Personal cleansing products were the most obvious bright spot in 2020, with category sales surpassing $12 billion. Sales growth was driven by liquid hand soaps and, of course, hand sanitizers, led by legacy players Germ-X and Bath & Body Works but also supported by emerging brands such as Touchland and new entrants like hair care brand Suave, which generated nearly $100 million worth of hand sanitizer sales at the retail level.

In skin care, the need for facial skin care grew stronger, along with hand and body products with therapeutic and reparative properties backed by a dermatologist’s recommendation. This was especially the case for consumers experiencing irritated skin from wearing protective face coverings or increased stress related to the pandemic, the Presidential election, or social activism, all of which played a significant role in the United States last year. Most brands in the therapeutic segment, such as Aveeno, Eucerin, and Vaseline, outpaced their 2019 performance. The standouts included CeraVe, Aquaphor, and Cetaphil, which registered 62%, 23%, and 13% sales increases, respectively. CeraVe, under L’Oréal, entered the top 10 in the skin care product class for the first time.

In the makeup category, which was on a downswing before the pandemic, sales of lipsticks and lip glosses, along with eye and face makeup, posted double–digit declines in 2020, caused by quarantining and mask–wearing. The only bright spot in makeup was nail polishes, which experienced double–digit increases as people took to their own nail care.

While sales of fragrances for men and women also experienced 2020 declines, they were not as severe as those of other categories. The fragrance category pivoted to focus on more of a self-care approach offering various benefits. Sales of clean fragrance brands experienced stamina at the expense of the leading legacy players.

Hair care recorded upwards of 3% growth in 2020, far healthier than was anticipated at the onset of the pandemic. Hair color was expected to record relatively strong double–digit gains due to temporary salon closures, which forced many consumers to do their own color. Boxed color flew off the shelves, and some direct–to–consumer brands focusing on personalization, such as eSalon and Madison Reed, nearly doubled sales, advancing the category by low double digits. These numbers are unprecedented compared to the slight declines recorded in previous years.

Several other dynamic stories underneath the surface layer allowed retail sales in the beauty and personal care market to remain relatively flat in 2020, according to Kline’s upcoming Cosmetics & Toiletries USA report. This comprehensive analysis sheds light on key drivers, trends, and relevant product launches in the ever-evolving U.S. beauty and personal care market. The report also offers forecasts by year to 2025. To learn more about what the future holds across the dynamic beauty market, subscribe now»