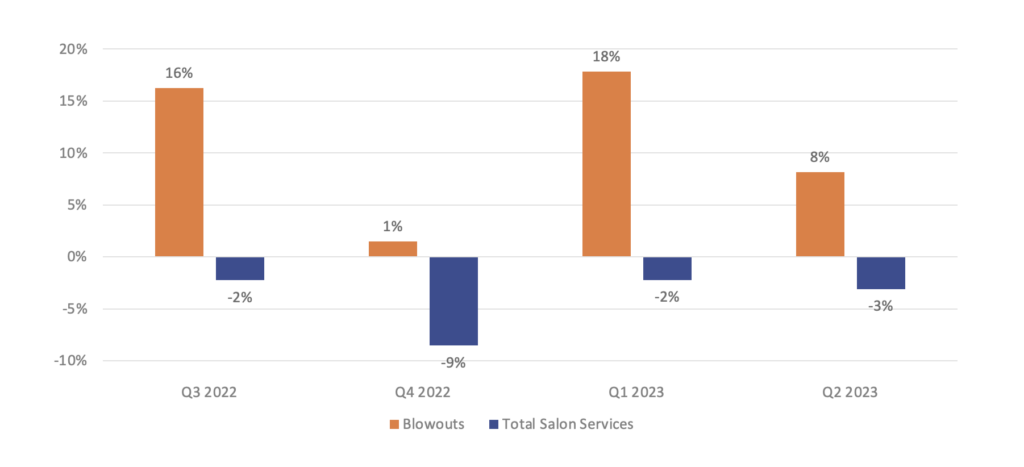

Inflation has cast its shadow over various consumer categories and retail services over the past two years. Hair salons, too, have been facing the same pressure. According to U.S. data from Kline PRO, covering the past four quarters through Q2 2023, the overall number of services sold at independent hair salons has been in decline, with elevated pricing holding revenue about flat.

Amid this general downturn, styling services—specifically blowouts—have been booming. In Q2 2023, the latest quarter reported in Kline PRO, blowout services recorded an 8% increase in units sold, resulting in a 14% gain in revenue compared to the corresponding period in the previous year.

Number of Services Sold in Independent Hair Salons Versus a Year Ago

Source: Kline PRO USA, Q3 2022–Q2 2023

Several factors appear to contribute to this trend, including the continued success and expansion of dry bars, which is likely haloing back onto traditional salons. Additionally, blowouts, being relatively affordable compared to other hair services, are an economical option to achieve a fresh look suitable for various occasions, from a night out to a professional setting. Moreover, the versatility of blowouts in achieving so many different looks, spanning from the 70s inspired voluminous look to the more modern smooth and sleek styles, adds to their popularity across social media channels and in celebrity circles.

The large uptick in blowout services seems to also be helping the lagging product sales within salons. While overall product sales have seen revenue declines in recent quarters, hair styling and spray products have been declining at a slower pace. In Q2 2023, hair styling and spray product revenues in independent salons only fell 2.8%, compared to the same period the previous year, contrastating with the broader decline of 6.3% in total product sales.

Notably, within styling products, those featuring thermal care and finishing functions were even up in Q2 2023 versus a year ago. While L’Oréal’s Redken takes the lead with the top two highest revenue-generating products in thermal care, the top two positions in finishing styling product are secured by Estée Lauder’s Aveda and Henkel’s Kenra.

It’s also worth noting that Kerasilk’s relaunch as a standalone brand has been successful in salons, earning them 4 of the top 10 spots for new launches the Styling Aids category.

Finally, amika: was a standout brand in Q2 2023, generating double-digit positive sales for styling products. According to our Salon Distribution Benchmarking: Performance Insights of Companies, Brands, and SKUs in U.S. Salons much of this success can be attributed to solid distribution gains as amika: is stocked in 16% more salons in Q2 2023 versus a year ago.

Looking ahead, Kline expects blowouts to continue trending up in the United States. To uncover other bright spots in the professional hair care industry in the United States and Canada, refer to Kline PRO, our salon retail products and services database. Based on actual salon transactions from a panel of thousands of salons, it yields category-, brand-, and product-level sales and service data on a quarterly basis. Book a product demo to see for yourself how powerful data can be in driving well-informed business decisions.