The 2025 edition of MCB Paris confirmed some evolving fault lines in professional hair care: Contraction in exhibitor presence, consolidation of key trends, and a sharpening focus on retailing directly to salons.

With Kline’s Professional Hair Care 2025 Mid-Year Update, soon to be published, Soufiane Abeddaa, Project Manager of Kline’s Beauty and Wellbeing vertical, was on site to take stock of the latest developments. Below is a breakdown of what stood out, from brand moves and innovation highlights to market dynamics shaping the professional hair industry:

- The Fade-Out: Brands That Pulled Back

Several long-established brands—including Wella Company, Alfaparf Milano/Eugène Perma, Bleue Libellule, Treatwell, Booksy, Fauvert Professionnel, and Eleven Australia—were absent, while others entirely skipped the event or reduced their footprint maintaining a minimal presence. This signals caution or a reallocation of marketing budgets in a challenging market.

The overall exhibitor footprint was also observed to be more compressed, with fewer large-scale or premium booths. This contraction had noticeable ripple effects, such as reduced foot traffic in secondary aisles and intensified competition for attention among those that remained.

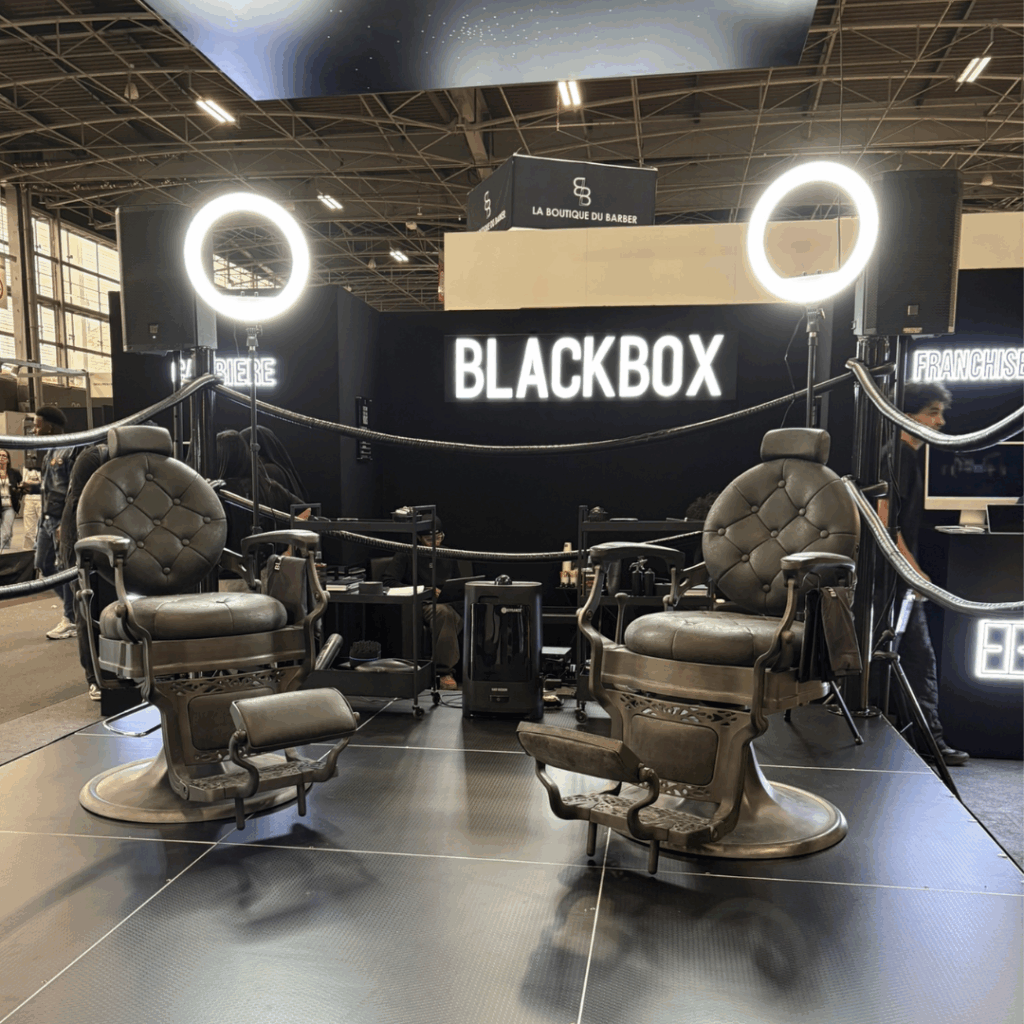

- The Return of Coiffidis and the Rise of Blackbox

Coiffidis made a noticeable comeback. Its list of distributed brands (Moroccanoil, Les Secrets de Loly, Matrix, Lashilé, Olaplex, Phytodess, Pro You) was more visible than ever, with Moroccanoil and its coloring lines particularly emphasized.

Blackbox, a barber-oriented franchise concept, also drew attention. Its model has scaled quickly, now reporting nearly 20 franchise locations in France. The company’s presence at MCB speaks perhaps to the resilience of higher-end barbering and lifestyle barbershops.

- Retail-First Mindset and “Boutique Coiffeur” Zone

La Boutique Coiffeur zone turned the trade fair into a mini retail marketplace. Rather than just product sampling, many stands in this area were set up like mini salons or buyer shops, with transactional intent. Some of the standout features included:

- Corner displays featuring Babyliss Pro, Jaguar, GHD, Dyson, Wahl, and Olaplex

- Mini market area where hairdressers could directly purchase from brands such as L’Oréal, Wella, Kerasoin, Happycurl, K-Liss, Revoon, One Silk, Les Secrets de Loly, Maiandra, and more.

- Curl, Texture, and Natural Positioning

Legacy powerhouses such as Schwarzkopf and L’Oréal were prominently showing their curl-focused lines and extensions, while Patrice Mulato introduced Blim; a new styling range developed specifically for curls.

Emerging and niche brands such as Kalia, In Haircare, Curl Bloom, Brille, and Luxeol also emphasized curl care and repair, particularly through formulas based on natural actives.

Across the show floor, many stands framed their messaging around “natural,” “clean formulation,” “moisture first,” and “dermatologically gentle,” echoing consumers’ expectations, especially among younger/digital-native clients, for ingredient transparency, gentler chemistry, and formulations tailored to textured hair.

- Tech, Diagnostics, and Salon Tools

Schwarzkopf presented Salon Lab, a 10-minute hair diagnostic tool that analyzes hair condition onsite and recommends personalized protocols. It also promoted its Fiber Clinix line, highlighting Bondfinity, alongside BlondMe and Ammo Zero—showing through live demos that color technology is still evolving to penetrate hair cores rather than just surface layers.

Tool brands—such as L’Oréal Professionnel Air Dryer, Dyson, GHD, Dreame, Parlux, Gamma+, and Wahl—also got premium attention, with a focus not only on ergonomics, but on delivering measurable hair benefits such as damage reduction, faster processing, and integrated sensors.

- Group Strategy: Mélanine/Patrice Mulato/Kalia/Generik

One interesting strategic thread was the frequent mention of Patrice Mulato, Kalia, and Generik in connection with the broader “Mélanine” group. While Generik was not present at the show and Patrice Mulato and Kalia were not exhibiting together, conversations repeatedly referenced this grouping—particularly following the recent acquisition of Patrice Mulato.

These brands bring distinct philosophies, positioning, and target segments, which makes their association under one umbrella a notable play to diversify within the textured/ethnic hair space, as well as the natural/clean beauty segment. Industry watchers continue to speculate on how the group will balance this portfolio (e.g., premium vs. accessible and curl-focused vs. mixed textures). Ultimately, whether this strategy succeeds will hinge on clear differentiation, disciplined marketing, effective synergies, and strong channel management.

- L’Oréal, New Flags, and Extension Surge

L’Oréal’s stand remained a central hub, featuring Redken with its Liquid Color Mantra, the AirLight Pro dryer, and its coloration lines Inoa, Majirel, Dia Color, and Dia Light. The marketer’s Kérastase area also spotlighted the Hair Spa line.

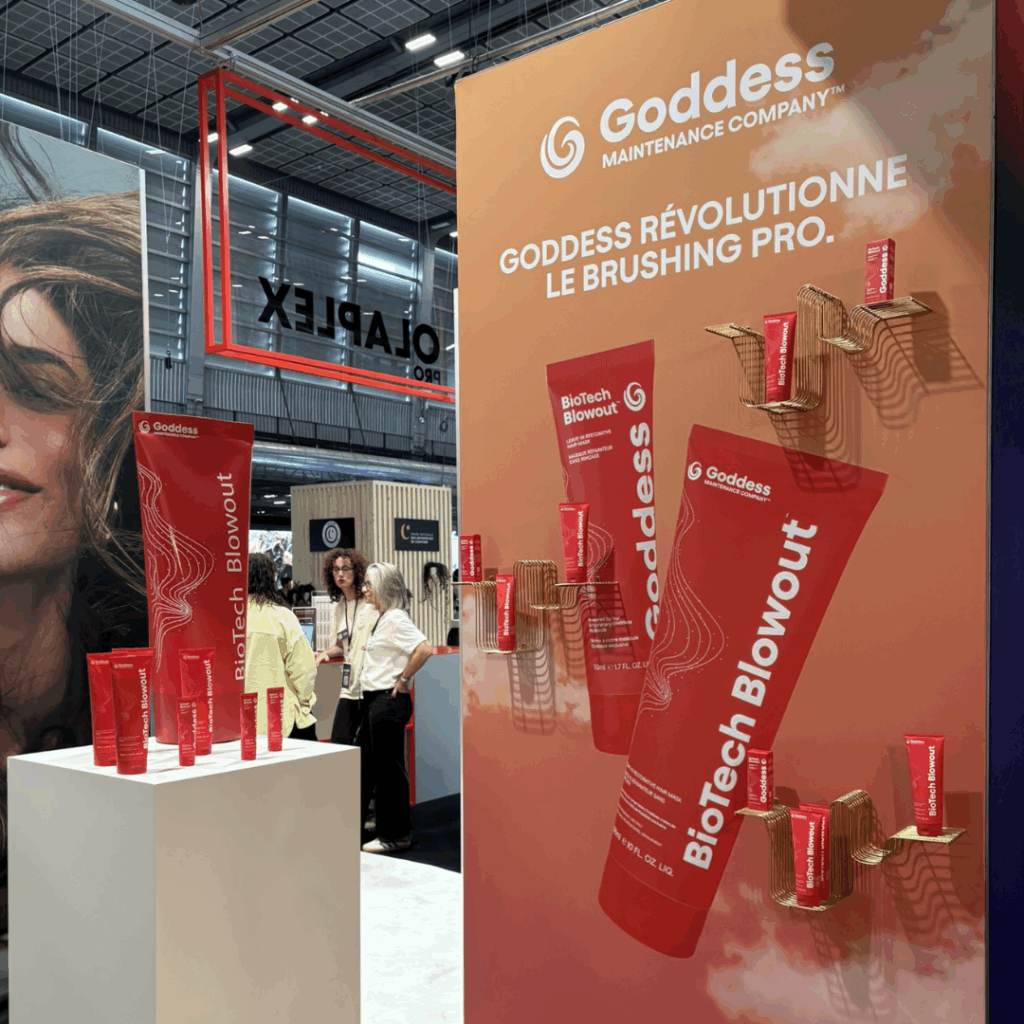

New Flag, a salon and distribution operator, expanded its footprint this year, introducing a new brand called Goddess, revamping Urban Alchemy, and giving added visibility to Original & Mineral (O&M) — a clean, salon-driven brand from Australia that continues to gain traction in France and beyond.

Another notable growth area was hair extensions, a category historically underrepresented at this event. Royal Extensions occupied a large stand, while Great Lengths, a certified B Corp, also stood out, suggesting that extensions and hair augmentation are maturing into a more established segment within the salon business.

- Influencers and Social Media Narratives

A notable branding move came from Patrice Mulato, which tapped into social media influence by launching a new green line in partnership with beauty and lifestyle influencer Océane Avakian. With a strong following among younger audiences, Avakian brings authenticity, reach, and conversational relevance to the brand.

The collaboration reflects a broader shift in how professional brands engage consumers where digital literacy, influencer alignment, and ongoing storytelling have become essential components of product launches and visibility strategies.

- Conference Stage and Educational Insight

The educational line-up skewed toward business growth, salon concept innovation, digital/PR strategies, and new formats like concept stores or hybrid retail + salon models. Meanwhile, technical excellence remained a cornerstone, with workshows and demos highlighting topics such as morpho-visagisme and K18 techniques.

The overall content mix is gradually shifting from pure artistry and trend displays to branding, differentiation, and concept storytelling, reflecting how salons are increasingly competing not only on cut and color, but also on experience and identity.

Implications for Professional Hair Care Brands

MCB Paris 2025 signaled evolving priorities in the professional hair care space. From these observations, several imperatives emerge for brands and salon professionals:

- Show more than product: Storytelling, diagnostics, and immersive experiences drive engagement.

- Lean into niche specialization: Curl, extensions, and textured hair are key growth areas, while crossover appeal remains important.

- Invest in influencer and digital partnerships early: Building buzz before the show amplifies impact.

- Optimize trade show presence: Smarter booth designs, modular builds, and shared displays help manage costs without compromising on visibility.

- Watch adjacent segments: The return of barber/franchise models, such as Blackbox, highlights growing opportunities in grooming and lifestyle-oriented offerings beyond traditional hair care.

For an in-depth analysis of the professional hair care market, including brands, product categories, and channels across over 30+ markets, explore Kline’s Professional Hair Care Global Series—featuring 2025 mid-year updates on 11 markets.