Two bits would be a bargain based on the average prices that salons are now charging for men’s services. Once perceived as a space exclusive to women, independent salons are finding that offering services and products for men can help bolster their bottom line. In fact, services that Kline PRO USA identifies as exclusive to men brought in nearly 8% of all service revenue in the first half of 2019. This number is on par with figures from the full year 2018.

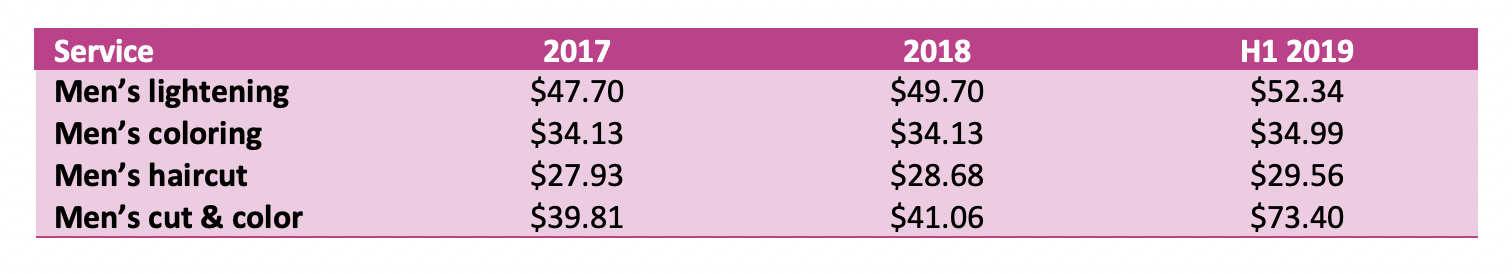

Men’s haircut and coloring services had a solid performance in 2018 with an increase of 3% in revenues, while the number of these services performed remained flat. This growth in revenue indicates that men are willing to pay a bit more for the services than they did the year before. Being able to increase prices helps salons offset the decline in the frequency of these services, as shown by Kline PRO data for the first half.

Salons are striking it rich, however, with shaving and beard services. Remarkable double-digit growth has been seen in both the service count and the associated revenue so far this year. Salons have either added these services to their menu, or stylists are suggesting a beard trim or shave to their existing clients as profitable add-ons. Moreover, part of this increase is also mirrored in the overall beauty and personal care market, where beard care products make the biggest impact, increasing at 35% in 2018, according to our recently published Male Grooming: U.S. Market Analysis and Opportunities.

While adding a shave or beard service has been successful for salons, getting men to purchase a hair product from the salon has been less so. Overall salon retail was down 8.3% in Q1 this year as compared to Q1 a year ago, but sales for men’s products declined even further at -14.8%. Some brands that managed to increase revenue during this period over last year include Paul Mitchell, Reuzel, and Zenagen, all recording double-digit growth rates.

Hair styling products and sprays account for the majority of revenue in the men’s segment at an almost 80% share. Among the top five brands that are creating value in this category are Paul Mitchell’s Mitch, Redken Brews, Reuzel, Layrite, and American Crew.

By contrast, in the beauty and personal care market, products tailored to men’s needs continue to increase share, albeit at a slower pace. Our consumer survey,with over 500 respondents, indicates that more than 60% of the men feel that taking care of their appearance is essential. Furthermore, about 80% of respondents have purchased hair care products or toiletries in the past six months, and over 60% have purchased skin care products in particular.

Products designed with men in mind will continue to rise and, along with them, so will the number of barbershops. To complete our coverage of this trending segment, we will renew our Barbershops: Global Market Brief study, which will survey barbershops across key countries to find out which products and services are most popular, which brands are making an impact, and what are the latest developments in the segment.